RBI Monetary Policy – As Expected - Key Announcements & Our View

The Monetary Policy Committee decided to keep rates unchanged whilst maintaining its ‘accommodative’ stance on expected lines. The governor’s speech echoed the budget, as policy action reiterated that the government and the RBI are working in consort to kick start the economic growth engine.

The MPC voted unanimously to leave the policy repo rate unchanged at 4 per cent. It also decided to continue with the accommodative stance of monetary policy as long as necessary – at least through the current financial year and into the next year – to revive growth on a durable basis and mitigate the impact of COVID-19, while ensuring that inflation remains within the target going forward.

The markets took the policy as a signal for post Covid normalization. Accordingly, we saw another round of sell-off across the curve. The G-Sec curve saw a consistent 10bps sell off after the policy. The benchmark 10 Year G-Sec is hovering close to 6.17% levels at the time of writing this note.

Key Announcements

- Restoration of Cash Reserve Ratio (CRR) in two phases beginning March 2021.

The RBI has decided to gradually restore the CRR in two phases in a non-disruptive manner. Banks would now be required to maintain the CRR at 3.5% of NDTL effective from the reporting fortnight beginning March 27, 2021 and 4.0% of NDTL effective from fortnight beginning May 22, 2021

- On Tap T-LTRO scheme: – Inclusion of NBFCs

Recognizing the work done by NBFC’s in providing last mile credit funding, the RBI has decided to provide funds from banks under the T-LTRO on Tap scheme to NBFCs for incremental lending to sectors identified as part of the T-LTRO Program

- Extension for banks to hold higher HTM assets

To ensure banks are able to participate in upcoming G-Sec auctions, the RBI has extended the dispensation which permit banks to hold higher HTM assets as part of their SLR holdings.

- Opening up GILT markets to Retail Investors

In an attempt to deepen the governments securities market and create demand for G-Secs, the RBI has opened up the G-Sec markets to retail participation. Retail investors can directly open accounts with the RBI and access G-Sec markets.

Our View

In the shadow of the recently concluded budget presentation, the RBI policy delivered on expected lines. Reaffirming the health of the economy and growth prospects, the goal of policy was to reassure the markets. The continued accommodative stance and the ‘calendarized’ approach to ending easy monetary policy can be looked at calming market nerves as the RBI gets ready to auction sizable government paper over the next 2 months. The Union Budget 2021 envisaged additional market borrowings of Rs 80,000 Cr before March 31st 2021). (Click here to read our take on the budget).

The inflation estimates at the higher end of the have given more impetus for RBI to normalize rates in due course. The CRR normalization could help open other avenues of liquidity e.g. FX intervention and OMO’s should the RBI need to redirect liquidity.

The G-Sec curve has already seen a ~40 bps sell-off since the budget as markets factored budget announcements and the proposed borrowing calendar for FY22. We believe we are ‘well and truly’ in a rising rate environment and investor portfolios should look to pivot accordingly. Across our schemes today, portfolio positioning looks to play the ‘reinvestment theme’ and barbell strategies. We have consciously reduced portfolio maturities across our products in line with our view. Select long bond strategies continue to offer opportunities for investors looking to lock in long term rates.

|

Product |

Macaulay Duration |

Current Positioning |

|

Axis Money Market Fund |

88 Days |

Actively Managed money market strategy |

|

Axis Banking & PSU Fund |

1.4 Years |

100% AAA roll down strategy ideal for investors looking to lock-in rates for 15-18 months |

|

Axis Strategic Bond Fund |

2.1 Years |

50% AAA % 50% AA portfolio currently running a barbell strategy |

|

Axis Dynamic Bond Fund |

6.6 Years |

100% AAA fund with a 9 year Corporate Bond Strategy |

Allocation and strategy is based on the current market conditions and is subject to changes depending on the fund manager’s view of the markets. Data as on 31st January 2021

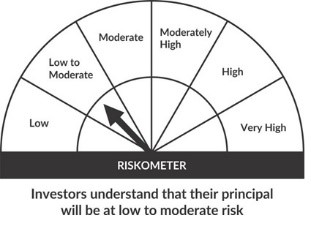

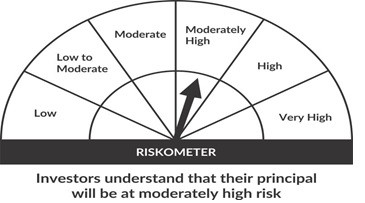

Product Labelling

|

Fund Name |

Riskometer |

Product Labelling |

|

Axis Banking & PSU Fund |

|

This product is suitable for investors who are seeking*

|

|

Axis Money Market Fund |

|

This product is suitable for investors who are seeking*

|

|

Axis Dynamic Bond Fund |

This product is suitable for investors who are seeking*

|

|

|

Axis Strategic Bond Fund |

|

This product is suitable for investors who are seeking*

|

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer

Source of Data: RBI Governor’ statement, & RBI Monetary Policy Statement dated 5th February 2021, Axis MF Research

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Are you ready to plan and start your investment journey with Axis?