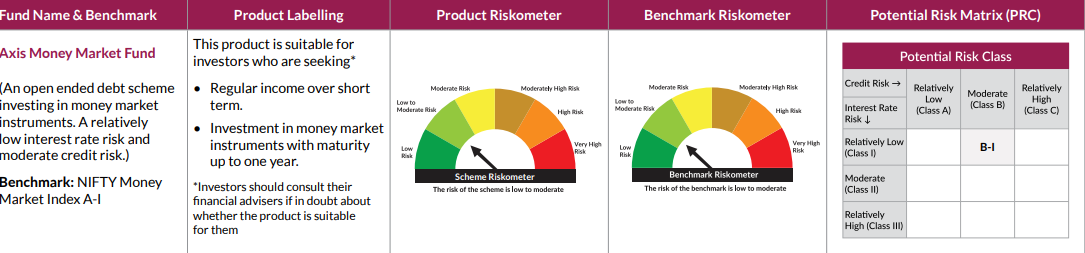

Axis Money Market Fund

Scheme Type: Debt

Investment Objective

Benefits of

Fund offers high liquidity as it does not have any exit load and it invests in high quality papers. Targets a portfolio average maturity of 2-6 months

Emphasis on 100% AAA rated papers from the carefully crafted universe of money market instruments.

Attempts to offer better risk reward opportunity over other traditional alternatives in short term space

Fund Manager

Entry Load

Exit Load

- Regular income over short term.

- Investment in money market instruments with maturity up to one year

- Lumpsum Investment :₹ 100

- Additional Investment :₹ 100

Goal Planning

Access all the goal features and benefits at No Cost.

Choose your goal

Issuers

IDCW

IDCW (₹ Per Unit) | NAV Per Unit |

| Record Date | Option | Individuals/HUF | Others | Cum IDCW | Ex IDCW |

| Jan 27, 2026 | Monthly Dividend | 3.907 | 3.906 | 1009.470 | 1005.564 |

| Dec 26, 2025 | Monthly Dividend | 4.589 | 4.588 | 1010.153 | 1005.564 |

| Nov 25, 2025 | Monthly Dividend | 4.969 | 4.968 | 1010.532 | 1005.564 |

| Dec 26, 2025 | Quarterly Dividend | 10.000 | 10.000 | 1171.962 | 1161.962 |

| Sep 25, 2025 | Quarterly Dividend | 10.000 | 10.000 | 1164.225 | 1154.225 |

| Jun 25, 2025 | Quarterly Dividend | 10.000 | 10.000 | 1156.986 | 1146.986 |

| Mar 25, 2025 | Annual Dividend | 40.000 | 40.000 | 1262.203 | 1222.203 |

| Mar 26, 2024 | Annual Dividend | 40.000 | 40.000 | 1211.973 | 1171.973 |

| Mar 27, 2023 | Annual Dividend | 40.000 | 40.000 | 1166.469 | 1126.469 |

FAQs on Axis Money Market Fund

Axis Money Market Fund is an open-ended debt mutual fund scheme that invests primarily in money market instruments with maturities up to one year. It aims to generate regular income while maintaining relatively low-interest rate risk and moderate credit risk. The fund targets high-quality short-term securities mainly rated A1+. It is suitable for investors seeking a relatively low-risk investment option for short-term money parking, typically with an investment horizon of 3 to 12 months.

The fund invests in a diversified portfolio of money market instruments such as treasury bills, commercial papers, certificates of deposit, and repurchase agreements. It actively manages the portfolio by assessing macroeconomic factors, credit risk, and liquidity to optimize returns. The fund may also use derivatives like interest rate swaps for hedging or portfolio balancing. Investors can subscribe or redeem units at NAV-based prices on any business day, with redemption proceeds typically dispatched within three working days.

This fund is ideal for investors seeking a liquid and short-term investment option. It suits those who want to park funds temporarily, earn better returns than traditional savings accounts or fixed deposits, and maintain liquidity. It is also appropriate for investors seeking an efficient cash management vehicle with limited exposure to interest rate risk and moderate credit risk. It is suitable for investors seeking a relatively low-risk investment option for short-term money parking, typically with an investment horizon of 3 to 12 months.

Investors can invest in the Axis Money Market Fund through lump sum or systematic investment plans (SIPs). The fund is available for subscription and redemption on all business days at NAV-based prices. Investments can be made online via the Axis Mutual Fund website, financial platforms, or through authorized distributors.

A money market fund is a mutual fund that invests in short-term, high-quality debt instruments such as treasury bills, commercial papers, certificates of deposit, and repurchase agreements. It aims to provide high liquidity with relatively low risk, making it a suitable option for investors looking to park money temporarily or manage cash efficiently.

Money market funds pool investors’ money to buy a diversified portfolio of short-term debt securities. They issue redeemable units and allow investors to withdraw money, usually without exit load. Returns are generated from interest income on the underlying instruments and are influenced by prevailing market interest rates. These funds aim to preserve capital while providing modest income.

Money market funds invest in low-risk, short-term debt securities such as treasury bills, commercial papers, bankers' acceptances, certificates of deposit, repurchase agreements, and other money market instruments with maturities typically less than one year.

- High liquidity with easy access to funds

- Relatively Low risk due to investment in high-quality short-term instruments

- Potentially better returns than traditional savings accounts

- Efficient cash management tool for short-term parking of funds

- No exit load and flexible investment options

Money market funds are a subset of mutual funds focusing exclusively on short-term, low-risk debt instruments, whereas mutual funds can invest in a wide range of asset classes including equities, bonds, and hybrid instruments. Money market funds prioritize capital preservation and liquidity, while other mutual funds may aim for higher returns with varying risk levels

Money market funds may be suitable for conservative investors seeking liquidity and short-term investment options. They are suitable for parking funds temporarily or managing cash but are not ideal for long-term wealth creation due to limited capital appreciation.

Money market mutual funds are generally considered to have lower risk compared to many other debt or equity funds, as they invest in high-quality, short-term debt instruments. However, they are subject to market risks, including credit risk and interest rate risk

Risks include credit risk (default by issuers), interest rate risk (changes in interest rates affecting yields), and liquidity risk (difficulty in selling securities quickly). Though generally low, these risks can impact returns and capital preservation

Returns typically range around prevailing short-term interest rates, often better than savings accounts but lower than long-term debt or equity funds.

These funds are best suited for short-term investment horizons, typically between 3 to 12 months, aligning with their investment in short-duration instruments.

Maximize returns by investing during periods of higher interest rates, maintaining investments for the recommended short-term horizon, and choosing funds with high credit quality and efficient management.

For investors seeking the best money market mutual funds in India in 2025, it is advisable to consider funds that demonstrate consistent performance, high assets under management (AUM), competitive expense ratios, and strong credit quality in their portfolios.

| Feature | Money Market Fund | Liquid Fund |

| Investment Duration | Typically up to 1 year | Very short term, usually up to 91 days |

| Portfolio Instruments | Money market instruments (up to 1 year) | Short-term debt and money market papers |

| Risk Level | Low to moderate | Low to moderate |

| Liquidity | High | Very high |

| Returns | Slightly higher than liquid funds | Slightly lower, more stable |

Money market funds generally invest in high-quality, short-term debt instruments and are subject to market risks, including credit risk and interest rate risk. No investment is entirely risk-free, and returns are not guaranteed

This article represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Views and opinions contained herein are for information purposes only and should not be construed as investment advice/ recommendation to any party or solicitation to buy, sale or hold any security or to adopt any investment strategy. It does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Axis MF/AMC is not guaranteeing/assuring any returns on investments. The recipient should exercise due caution and/ or seek professional advice before making any decision or entering into any financial obligation based on information, statement or opinion which is expressed herein.

The Sponsor - Axis Bank Ltd. is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.