Axis Multicap Fund

Scheme Type: Equity

Investment Objective

Benefits of

Balanced exposure to large, mid, and small-cap segments*.

Designed to capture the full growth lifecycle of companies — from emerging to established leaders.

Minimum 25% allocation to each market cap for structural diversification.

Flexibility in the remaining 25% to capitalize on evolving opportunities

Combines stability, growth, and alpha potential under one portfolio.

Fund Manager

Entry Load

Exit Load

redeemed/switched out after 12 months from the date of allotment: Nil

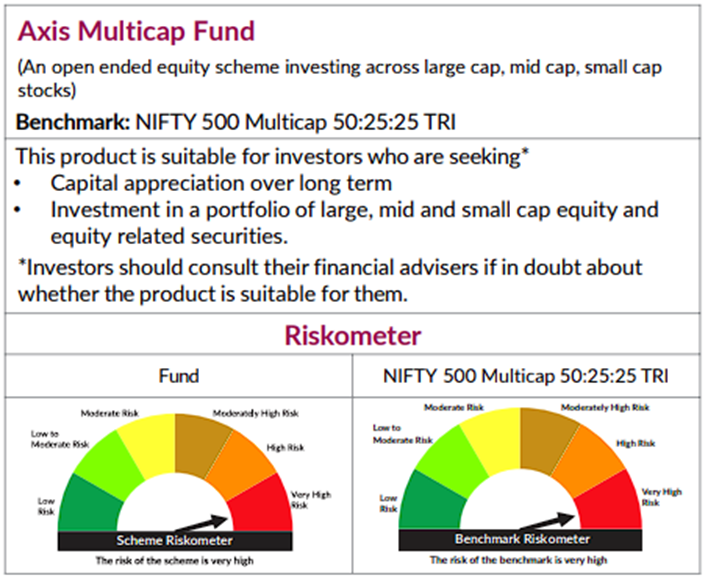

- Capital appreciation over long term

- Investment in a portfolio of large, mid and small cap equity and equity related securities.

- Lumpsum Investment :₹ 100

- Additional Investment :₹ 100

Goal Planning

Access all the goal features and benefits at No Cost.

Choose your goal

Top 5 sectors

Issuers

FAQs on Axis Multicap Fund

Axis Multicap Fund is an open-ended equity scheme investing across large, mid, and small-cap stocks. It aims to deliver long-term capital appreciation through a diversified and actively managed portfolio, offering a balanced blend of stability and growth potential.

To generate long-term capital appreciation by investing in a diversified portfolio of equity and equity-related instruments across market capitalizations, offering exposure to a wide spectrum of growth opportunities in the Indian economy.

- Minimum 25% each in large, mid, and small-cap stocks.

- Remaining 25% flexibly allocated based on market conditions.

- Exposure to leaders, emerging midcaps, and high-growth small caps.

- Dynamic allocation managed actively to respond to valuation and sector trends.

- Diversified exposure across all market segments.

- Balances volatility with large-cap stability and mid/small-cap growth.

- Captures company growth from early to mature stages.

- Actively managed to adapt to changing market dynamics.

- Suitable for investors seeking broad-based participation in India’s equity story.

- Capture opportunities across different company sizes and growth phases.

- Maintain balanced allocation to market caps.

- Identify high-conviction businesses with sustainable earnings.

- Focus on fundamentals, quality management, and scalability.

- Aim for improved risk-reward profile through active rebalancing.

The above framework is broadly indicative and the fund manager may change the framework depending on the market conditions.

- Stable leaders with market dominance.

- Midcaps transitioning to organized sectors.

- Small caps with scalable models and leadership potential.

- Consistent earnings and financial prudence.

- Strong corporate governance and execution.

India’s markets offer multi-dimensional opportunities across market caps.

Sectors like Capital Goods, Manufacturing, Auto Ancillaries, and Financials are attractive.

Bottom-up stock-picking helps identify resilient and scalable businesses.

Focus remains on quality mid and small caps that can become future large caps.

The strategy balances cyclical participation with structural growth themes.

Sector mentioned above are for the purpose of disclosure of the portfolio of the Schemes and should not be construed as recommendation.

Investors who:

- Seek diversification across market caps in one fund.

- Prefer a blend of stability and growth.

- Have a medium to long-term horizon (5+ years).

- Are comfortable with higher risk for higher potential returns.

- Exposure to mid and small caps introduces higher volatility.

- Market fluctuations and economic factors may impact returns.

Mitigation: Diversification, disciplined allocation, and active management.

A minimum of 5 years is recommended to benefit from the full market-cap cycle and compounding potential.

Yes. SIPs allow gradual exposure across market caps, benefit from rupee-cost averaging, and support long-term wealth creation.

- Vs. Large-Cap Funds: Includes mid and small caps for higher growth.

- Vs. Mid/Small-Cap Funds: Adds stability via large-cap allocation.

- Vs. Flexi-Cap Funds: Maintains minimum 25% exposure to each segment.

- Vs. Thematic Funds: Offers broad-based exposure, not sector-restricted.

- Diversified allocation across growth and stability segments.

- Continuous rebalancing for risk-adjusted returns.

- Portfolio built on fundamental strength and earnings visibility.

- Financials & BFSI – credit growth and deepening

- Capital Goods & Industrials – capex cycle

- Auto Ancillaries & Manufacturing – policy-driven expansion

- Technology & Services – digital transformation

- Consumer & Healthcare – domestic demand growth.

The sector mentioned herein are for general assessment purpose only and not a complete disclosure of evert material fact. It should not be constructed as investment advice to any party.

- Captures growth across company lifecycles.

- Offers a balanced risk-reward profile via diversification.

- Generates alpha through disciplined stock selection.

- Delivers long-term compounding across market phases.

* Market caps are defined as per SEBI regulations as below: a. Large Cap: 1st -100th company in terms of full market capitalization. b. Mid Cap: 101st -250th company in terms of full market capitalization. c. Small Cap: 251st company onwards in terms of full market capitalization.

Past performance may or may not sustain in future.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.