Axis Short Duration Fund

Scheme Type: Debt

Investment Objective

Benefits of

Short duration funds invest in shorter duration debt and money market instruments which give the potential to generate relatively stable returns with comparatively lesser risk.

It is a short duration debt fund investing in high quality papers which allows participation in short Duration part of the curve which is a large and highly traded space.

One should target investments in this fund for minimum of 1 year.

Fund Manager

Entry Load

Exit Load

- Regular income while maintaining liquidity over short duration.

- Investment in debt and money market instruments

- Lumpsum Investment :₹ 100

- Additional Investment :₹ 100

Goal Planning

Access all the goal features and benefits at No Cost.

Choose your goal

Issuers

IDCW

IDCW (₹ Per Unit) | NAV Per Unit |

| Record Date | Option | Individuals/HUF | Others | Cum IDCW | Ex IDCW |

| Dec 26, 2025 | Monthly Dividend | 0.056 | 0.056 | 10.090 | 10.034 |

| Nov 25, 2025 | Monthly Dividend | 0.060 | 0.060 | 10.129 | 10.069 |

| Oct 27, 2025 | Monthly Dividend | 0.064 | 0.064 | 10.134 | 10.070 |

Investment Packs

FAQs on Axis Short Duration Fund

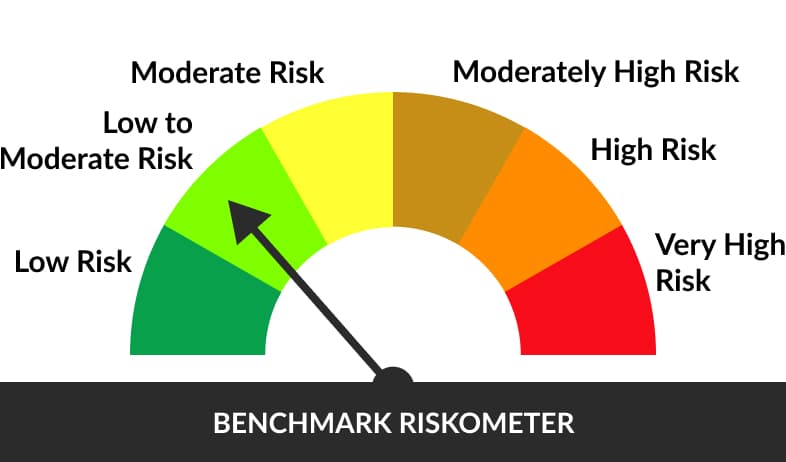

Axis Short Duration Fund is an open ended short duration debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 year to 3 years. The investment objective of this fund is to generate stable returns with a low risk strategy while maintaining liquidity through a portfolio comprising of debt and money market instruments. However, there can be no assurance that the investment objective of the scheme will be achieved.

A short duration debt fund might work well when the interest rates are high but may drop unexpectedly. Short duration debt funds may be a good investment option in a market where the interest rates are unpredictable. Since the average portfolio maturity is shorter than long term debt funds, fluctuations in the interest rates do not affect the performance of short duration debt funds. A short duration fund invests in a basket of debt instruments, thus offering diversification to investors. This fund can be a good option for someone looking to park their money for a short duration. Short duration funds have high liquidity which is why they are considered for building an emergency fund.

A short duration debt fund invests in a range of debt securities such as government securities, derivatives, corporate bonds, etc. To ensure that the portfolio maintains liquidity, these funds may also invest in money market instruments like commercial paper, treasury bills, certificates of deposits, etc. There are no norms that oblige these funds to invest in securities with high credit ratings. Hence short duration funds can invest in low credit quality debt instruments that may have the ability to generate better returns.

Axis Short Duration Fund invests in shorter duration debt and money market instruments which give the potential to generate relatively stable returns with comparatively lesser risk. It is a short duration debt fund investing in high quality papers that allows participation in the short duration part of the curve which is a large and highly traded space.

Axis Short Duration Fund is a debt mutual fund that invests in a portfolio of securities that mature over the short duration.