Axis Gold Fund

Scheme Type: FOF-Domestic

Investment Objective

Benefits of

Invest in Gold ETF without the hassles of storage or concerns on quality

Low cost of holding

Transparent pricing based on international gold price movements

Invest in any amount subject to minimum investment requirements

No transaction charges on buying and selling* as compared to physical gold

Invest in Gold through systematic investments in as little as Rs.1,000

No demat account required

Fund Manager

Entry Load

Exit Load

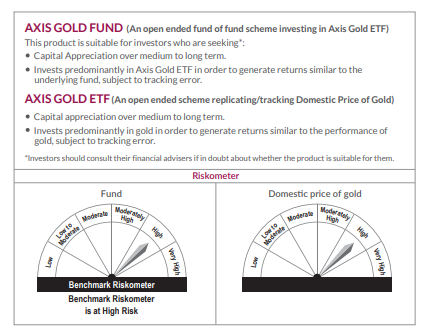

- Capital appreciation over medium to long term.

- Investment predominantly in Axis Gold ETF in order to generate returns similar to the underlying fund, subject to tracking error

- Lumpsum Investment :₹ 100

- Additional Investment :₹ 100

Units of Axis Gold ETF

Money Market Instruments

Goal Planning

Access all the goal features and benefits at No Cost.

Choose your goal

Issuers

Investment Packs

FAQs on Axis Gold Fund

A Gold Fund is a type of mutual fund that invests directly or indirectly in gold. These funds can invest in physical gold, or gold related instruments. They offer investors a way to gain exposure to gold without having to physically own it.

Axis Gold Fund is an open-ended fund of fund scheme investing in Axis Gold ETF. The objective is to generate returns that closely correspond to returns generated by Axis Gold ETF.

Gold Funds can be either actively or passively managed. However, the Axis Gold Fund is passively managed as it invests in the units of Axis Gold ETF and aims to replicate its performance. Axis Gold ETF, tracks the domestic price of gold.

Investing in Axis Gold Fund offers several benefits:

- Convenience: Invest in gold without the hassles of storage or concerns about quality.

- Low Cost: Lower holding costs compared to physical gold.

- Transparent Pricing: Prices are based on international gold price movements.

- Flexibility: Invest any amount, starting from the minimum investment requirement of Rs. 100.

The choice between NIFTY 50 and Gold Fund depends on your investment goals and risk tolerance:

- NIFTY 50: Offers higher returns but comes with higher risk and volatility. It is suitable for investors looking for capital appreciation and willing to take on more risk.

- Gold Fund: Provides potentially stability and generally acts as a hedge against inflation and economic uncertainties. It is suitable for investors prioritizing capital preservation and lower risk

You can invest in Gold Funds through various methods:

- Mutual Funds: Purchase shares of a mutual fund that invests in gold.

- ETFs: Buy shares of a gold ETF on the stock exchange.

- Financial Institutions: Some banks and financial institutions offer gold funds.

The minimum investment required for Axis Gold Fund is ₹100, and the minimum additional investment is also ₹100. The minimum SIP (Systematic Investment Plan) investment for a monthly frequency is ₹100.

Yes, Axis Gold Fund allows for Systematic Transfer Plan (STP), Systematic Investment Plan (SIP), and Systematic Withdrawal Plan (SWP)

Axis Gold Fund does not have an entry load, but it does have an exit load of 1% if redeemed within 15 days from the date of allotment.

Anyone looking for capital appreciation over the medium to long term and willing to invest in gold ETFs can invest in the Axis Gold Fund. It is suitable for investors seeking to generate returns similar to the underlying fund, subject to tracking error

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Investors will be bearing the recurring expenses of the scheme in addition to the expenses of other schemes in which Fund of Funds scheme makes investment

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.