Axis Ultra Short Duration Fund

Scheme Type: Debt

Investment Objective

Benefits of

Better carry : Elevated short term spreads offer historically higher yields in the front end of the curve. The fund aims for a low duration with low volatility and relatively higher carry over a 3-6 month period

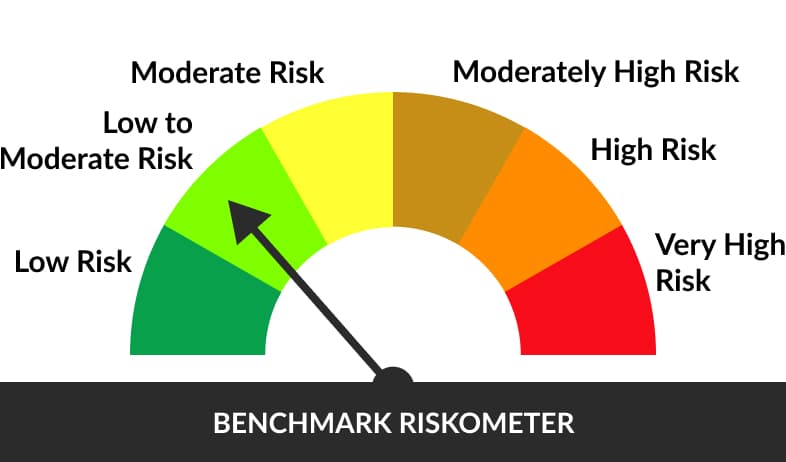

Lowered risk : Aims for higher yield with significantly lower risk

Superior risk reward : Attempts to offer better risk reward opportunity over other traditional alternatives in short term space

Robust cash management : Efficient cash management vehicle with limited impact from interest rate changes (due to low duration risk)

Efficient way to park money : Suitable to park money for short term ( 3-6 months)

Suitable for Systematic Transfer Plan (STP) : Can be invested for STPs in Equity Funds.

Fund Manager

Entry Load

Exit Load

- Regular income over short term.

- Investment in Debt and Money Market instruments such that Macaulay duration of the portfolio is between 3 months - 6 months.

- Lumpsum Investment :₹ 100

- Additional Investment :₹ 100

Goal Planning

Access all the goal features and benefits at No Cost.

Choose your goal

Issuers

IDCW

IDCW (₹ Per Unit) | NAV Per Unit |

| Record Date | Option | Individuals/HUF | Others | Cum IDCW | Ex IDCW |

| Dec 26, 2025 | Monthly Dividend | 0.056 | 0.056 | 10.072 | 10.017 |

| Nov 25, 2025 | Monthly Dividend | 0.054 | 0.054 | 10.079 | 10.024 |

| Oct 27, 2025 | Monthly Dividend | 0.062 | 0.062 | 10.089 | 10.027 |

Investment Packs