Fund Overview

Axis Banking & PSU Debt Fund

Scheme Type: Debt

Fund Manager:

Mr. Aditya Pagaria + 1

Invest Now

NAV

NA

CAGR

AUM as on 31 Jan 2026(in Cr.)

₹ 13,093.52

Updated as on: January 31, 2026

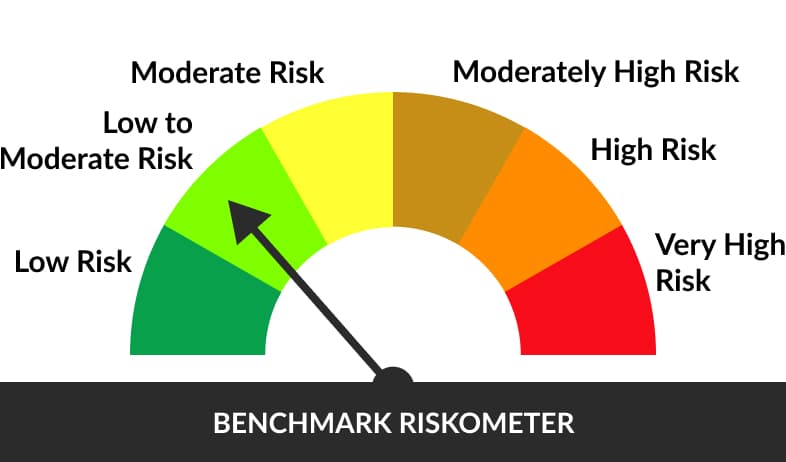

Risk

Moderate

An open ended debt scheme predominantly investing in debt instruments of Banks, Public Sector Undertakings & Public Financial Institutions

Investment Objective

To generate stable returns by investing predominantly in debt & money market instruments issued by Banks, Public Sector Units (PSUs) & Public Financial Institutions (PFIs).The scheme shall endeavor to generate optimum returns with low credit risk.

Benefits of

An open ended debt scheme that invests primarily in debt & money market instruments.

Endeavours to invest in debt instruments issued by banking companies, public financial institutions and other high quality public sector undertakings (PSUs).

The fund is ideal for investors with an investment horizon of 12 months or more and is an alternative to traditional fixed savings instruments.

Potential Risk Class

A Potential Risk Class matrix consists of parameters based on maximum interest rate risk (measured by Macaulay Duration (MD) of the scheme) and maximum credit risk (measured by Credit Risk Value (CRV) of the scheme).

Fund Manager

Mr. Aditya Pagaria

Managing this fund since 13th Aug 2016

18

Years

Work Experience

See all schemes managed by Aditya Pagaria

Mr. Hardik Shah

Managing this fund since 03th Jul 2023

17

Years

Work Experience

See all schemes managed by Hardik Shah

Entry Load

NA

Exit Load

Nil

Debt Quants

Average Maturity@*

2.75 years

Modified Duration@*

2.16 years

Mac D

2.3 years

Portfolio Yield (Yield to Maturity&) - Monthly

7.08%

Disclaimer: * For instruments with put/call option, the put/call date has been taken as the maturity date. & The yield to maturity given above is based on the portfolio of funds as on date given above. This should not be taken as an indication of the returns that maybe generated by the fund and the securities bought by the fund may or may not be held till their respective maturities. The calculation is based on the invested corpus of the debt portfolio. In case of semi annual YTM, it will be annualised

Updated as on:

This product is suitable for investors who are seeking*

- Regular income over short to medium term.

- Investment in debt and money market instruments issued by Banks, PFIs & PSUs.

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them

Axis Banking & PSU Debt Fund

The risk of the scheme is Moderate

Nifty Banking & PSU Debt Index A-II

The risk of the benchmark is Low to Moderate

Minimum Investment Amount

- Lumpsum Investment :₹ 5000

- Additional Investment :₹ 1000

Goal Planning

Big or small, everyone has goals that they want to accomplish. There are some goals you’re able to fulfil and others that you’re not. With proper planning a lot of this can be managed.

Savings, on their own are not enough. And most people who invest, do so in an ad-hoc manner. When the markets look promising, they follow the trend and invest like others do. When the volatility sets in, they worry over their investments and take uninformed decisions.

Access all the goal features and benefits at No Cost.

Choose your goal

Let your money work for your goals.

Vacation

Child Education

Emergency Funds

Wealth Builder

Retirement

Create Your Own Goal

Issuers

Top 10 Issuers

% Of Net Assets

Small Industries Dev Bank of India

10.99

National Bank For Agriculture and Rural Development

10.58

REC Limited

9.66

Indian Railway Finance Corporation Limited

6.11

Export Import Bank of India

6.07

Power Finance Corporation Limited

5.38

National Housing Bank

4.25

Power Grid Corporation of India Limited

3.15

HDFC Bank Limited

2.68

7.18% GOI (MD 14/08/2033)

2.59

IDCW

IDCW (₹ Per Unit) | NAV Per Unit |

| Record Date | Option | Individuals/HUF | Others | Cum IDCW | Ex IDCW |

| Jan 27, 2026 | Monthly Dividend | ||||

| Dec 26, 2025 | Monthly Dividend | 1.119 | 1.119 | 1033.930 | 1032.810 |

| Nov 25, 2025 | Monthly Dividend | 5.539 | 5.539 | 1038.349 | 1032.810 |

Disclaimer: Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future. Face value of units is Rs. 1000. IDCW means Income Distribution cum Capital Withdrawal.

IDCW History

Select Plan

Select Timeframe

21-11-2025

21-02-2026