•

Rate cycle on a pause for the

next few policies.

• Yield upside limited; investors

should add short term bonds

with every rise in yields.

•

Short term 2-5-year corporate bonds

and tactical mix of 8-10 yr Gsecs and

are best strategies to invest in the

current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

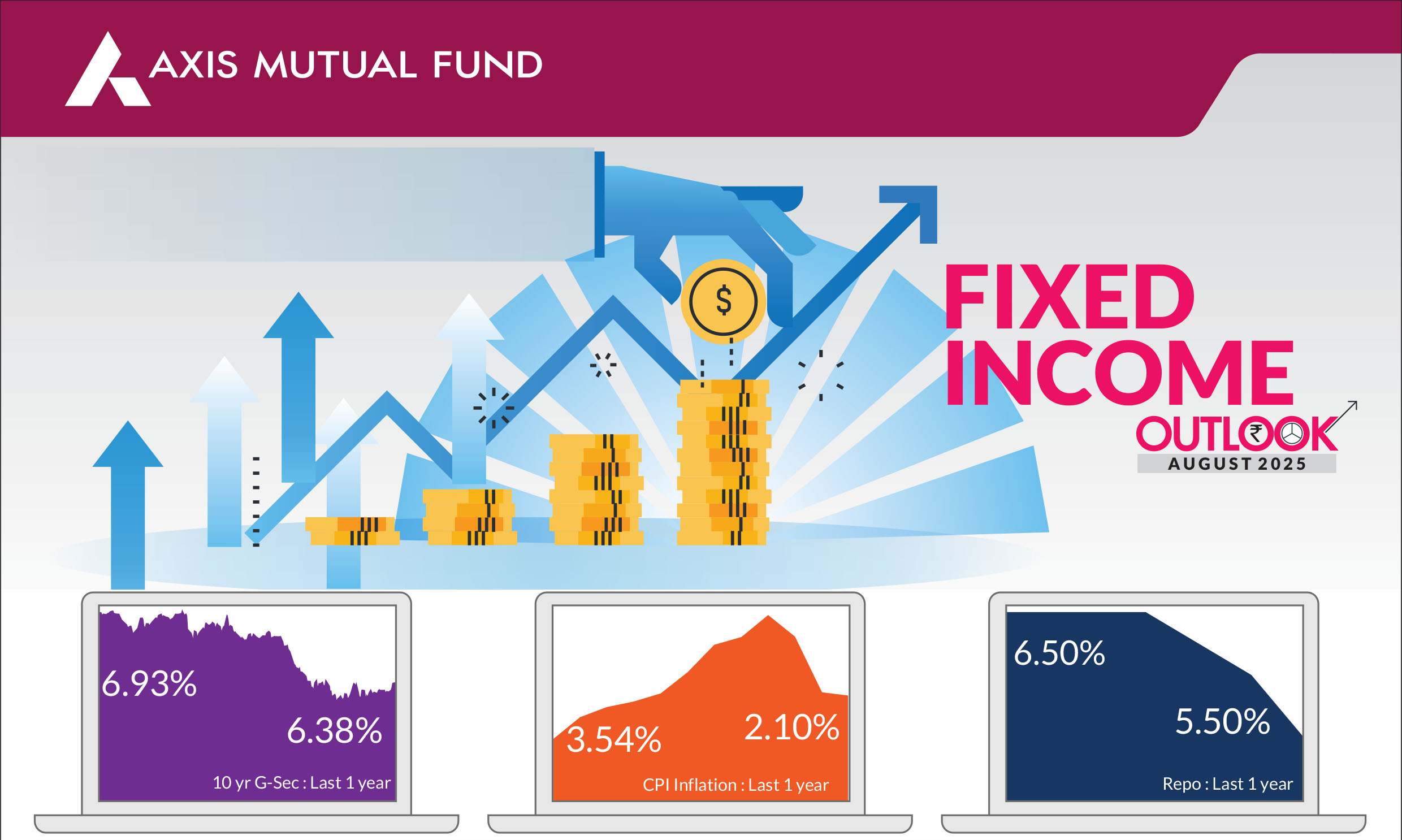

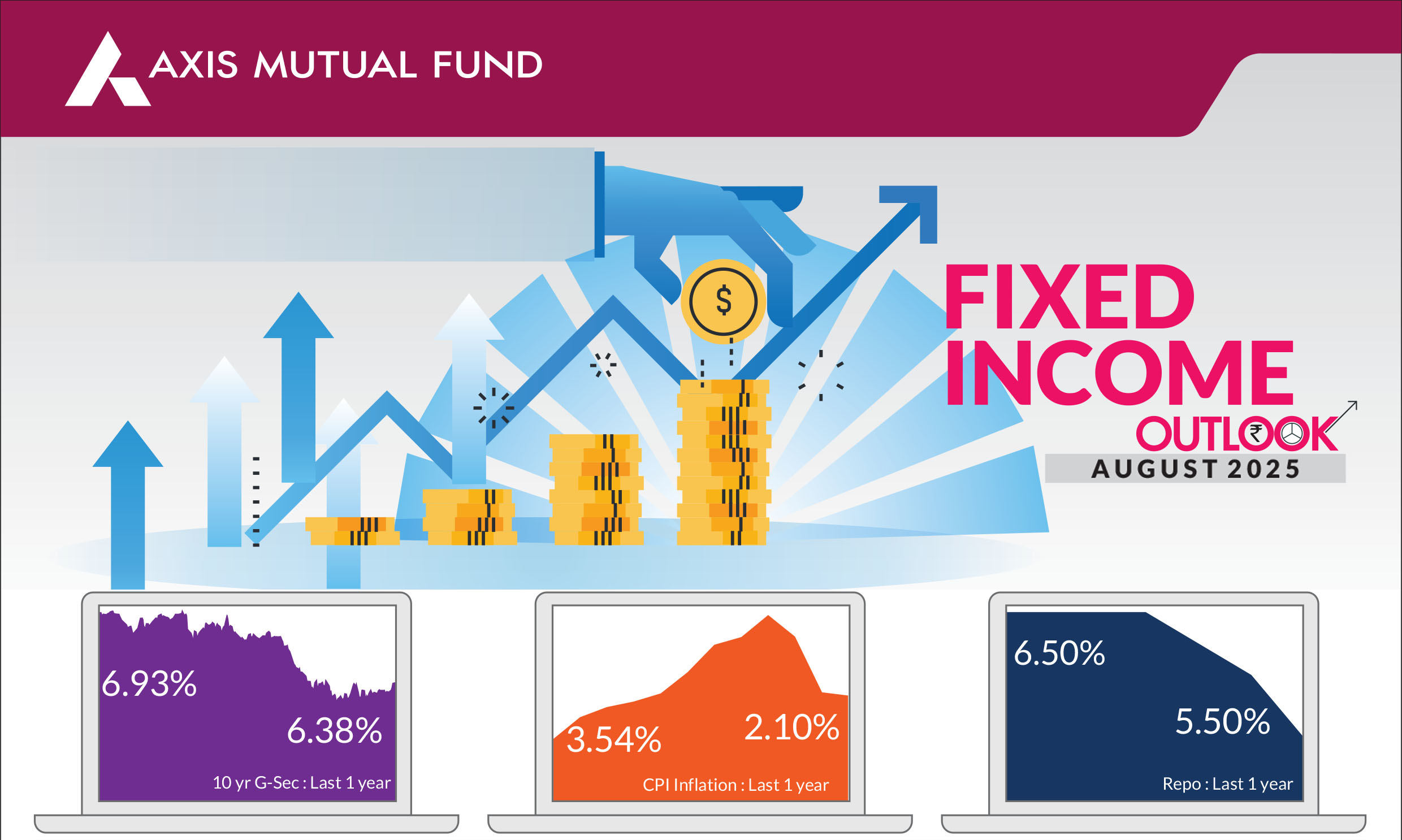

The month saw bond yields rise in the US ahead of the monetary policy outcome of the US Federal Reserve (Fed). Overall, 10 year Treasuries ended 14 bps higher at 4.37%. In India, the 10-year government bond yields ended 6 basis points higher at 6.38% given abundant banking liquidity and receding inflation.

RBI keeps rates steady, banking liquidity in surplus :

The Monetary Policy Committee

(MPC) of the Reserve Bank of India (RBI) maintained a neutral stance, keeping interest

rates unchanged amid ample liquidity and ongoing transmission of the 100 basis points of

cumulative easing implemented thus far. The central bank acknowledged that while global

uncertainties have moderated, supply chain

disruptions persist, and the imposition of tariffs

on India could marginally temper growth.

The RBI highlighted that average daily liquidity

has remained above Rs 3 lac crore since the

June policy review. The upcoming phased CRR

reductions, beginning in September, are

expected to further augment this surplus.

Inflation falls further : Headline inflation fell to 2.1% in June from 2.8% in May, led by a faster than expected moderation in food prices especially vegetables. The IMD's forecast of an above-normal monsoon is likely to support the crop harvests, which, in addition to the healthy buffer stocks, is likely to ensure that food prices remain benign. We expect headline inflation to remain near 3% by the end of 2025 driven by benign food prices and due to favourable outlook for crop production.

Crude oil prices rose 7.3% over the month. The US has imposed a tariff of 25% (and additional 25%) on Indian exports to the US. A penalty has also been levied due to India's energy and defense imports from Russia. While the final numbers could change, these developments may exert upward pressure on inflation to some extent.

Inflation falls further : Headline inflation fell to 2.1% in June from 2.8% in May, led by a faster than expected moderation in food prices especially vegetables. The IMD's forecast of an above-normal monsoon is likely to support the crop harvests, which, in addition to the healthy buffer stocks, is likely to ensure that food prices remain benign. We expect headline inflation to remain near 3% by the end of 2025 driven by benign food prices and due to favourable outlook for crop production.

Crude oil prices rose 7.3% over the month. The US has imposed a tariff of 25% (and additional 25%) on Indian exports to the US. A penalty has also been levied due to India's energy and defense imports from Russia. While the final numbers could change, these developments may exert upward pressure on inflation to some extent.

Macro data mixed :

High frequency indicators remained mixed. PMIs remained in an

expansionary zone with both manufacturing and services PMIs rising in June. GST

collections slowed while credit growth improved marginally. External demand too showed

a pickup in June, led by services exports, while goods exports were largely flat on a YoY

basis.

Rupee depreciates in July : The rupee depreciated against the US dollar weighed down by the announcement of 25% tariff against India and a penalty for buying Russian crude. Subsequently, this figure now stands revised at 50% after another additional tariff of 25%. The dollar outperformed most currencies, with the DXY rising 3.3%.

US treasury yields move higher : The yields on US Treasuries rose higher tracking the interest rate expectations ahead of monetary policy. The FOMC maintained target range for fed fund rate at 4.25-4.5% and highlighted a cautious approach while focusing on dual mandate on inflation and employment. The Fed chair emphasized that the Fed is "being pulled in two directions," balancing the need to control inflation with the goal of sustaining employment.

Rupee depreciates in July : The rupee depreciated against the US dollar weighed down by the announcement of 25% tariff against India and a penalty for buying Russian crude. Subsequently, this figure now stands revised at 50% after another additional tariff of 25%. The dollar outperformed most currencies, with the DXY rising 3.3%.

US treasury yields move higher : The yields on US Treasuries rose higher tracking the interest rate expectations ahead of monetary policy. The FOMC maintained target range for fed fund rate at 4.25-4.5% and highlighted a cautious approach while focusing on dual mandate on inflation and employment. The Fed chair emphasized that the Fed is "being pulled in two directions," balancing the need to control inflation with the goal of sustaining employment.

Market view

The Fed continues to navigate the dual challenge of stubborn inflation and slowing growth. Despite holding rates steady in recent months, we expect two rate cuts in 2025. Indicators such as a softening labor market and tariff-related growth headwinds support this view. The cumulative easing could total 75-100 basis points, especially if trade tensions persist and fiscal policy remains tight.As expected by us, the central bank kept interest rates unchanged. Given the absence of significant economic vulnerabilities and considering the cumulative 100 basis points rate reduction already implemented, the RBI is well-positioned to maintain a neutral approach. With operative rates already eased by ~150 bps, any further cuts may be limited to just one more or two at best in case the growth surprises on downside. Moreover, the implications of elevated tariffs warrant careful evaluation, with key macroeconomic variables-such as currency dynamics, capital flows, and evolving trade relationships-requiring close monitoring. As rightly noted by the Governor, monetary policy transmission operates with a lag and must be allowed to fully play out.

In our view, we are at the fag end of the rate cut cycle and an additional 25 basis points rate cut would have had limited incremental impact under prevailing liquidity conditions. That said, we continue to believe that interest rates are likely to remain lower for an extended period.

Since the monetary policy in June policy, spreads on long bonds have widened significantly-from 30-40 bps to nearly 70 bps. Historical data shows that spreads tend to widen at the tail end of rate-cut cycles. The previous rate cut cycles saw spreads (between 10 year and 30 year Gsecs) widen by 58 and 77 basis points, respectively. In the current cycle (Dec 2024 - Jul 2025), spreads have already widened by 54 basis points, indicating a similar steepening trend.

The tactical tailwinds that worked in favour of duration have been fading. With Rs12 trillion injected via CRR cuts and other tools, and a current liquidity surplus of Rs 6 trillion, the need for OMOs is minimal. We do not expect any major OMOs until March 2026. FPI flows have dried up, with net outflows of Rs 27,643 crore over the last four months. Most JP Morgan and Bloomberg-related flows are already in, leaving little room for incremental demand.

In our recently released Acumen, "Is the rally over in Long Duration Bonds?" We have highlighted that the primary concern for long-duration bonds is no longer about spreads or yield levels-it lies in the deteriorating demand-supply dynamics, both structurally and tactically. While interest rates are likely to remain lower for an extended period, the structural rally in long bonds appears to have largely played out. That said, tactical opportunities offering 10-15 basis points may still emerge intermittently. For investors focused on yield and near-term capital appreciation, alternative strategies as explained above may present a more compelling risk-reward profile.

We believe that only those investors with long-term liabilities may still find value in long bonds, especially if they can withstand short-term volatility. Investors in mutual funds should consider shifting to short-duration or accrual strategies. The steepening yield curve favors 2-5-year corporate bonds, which offer better risk-adjusted returns.

Risks to our view: The risks to our view at this point are as below

1) Currency 2) Growth shocks globally and in India 3) Inclusion in Bloomberg indices

Strategy - We have gradually reduced duration in our portfolios since February 2025 transitioning from long duration strategies to accrual-based strategies.

We believe that the current year's demand-supply mismatch is worsening, with limited tactical support and rising issuance. This imbalance could increase pressure on yields, especially in long-duration segments.

We have been adding 2-5 year corporate bonds to the portfolio as we expect surplus banking liquidity, lower supply of corporate bonds/ CDs due to slowdown and delay in implementation of LCR guidelines and attractive spreads and valuations. Incrementally short bonds can outperform long bonds from risk-reward perspective due to a shallow rate cut cycle, lower OMO purchases in the second half of the year and a shift in focus to Govt Debt to GDP targets.

What should investors do?

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.