Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

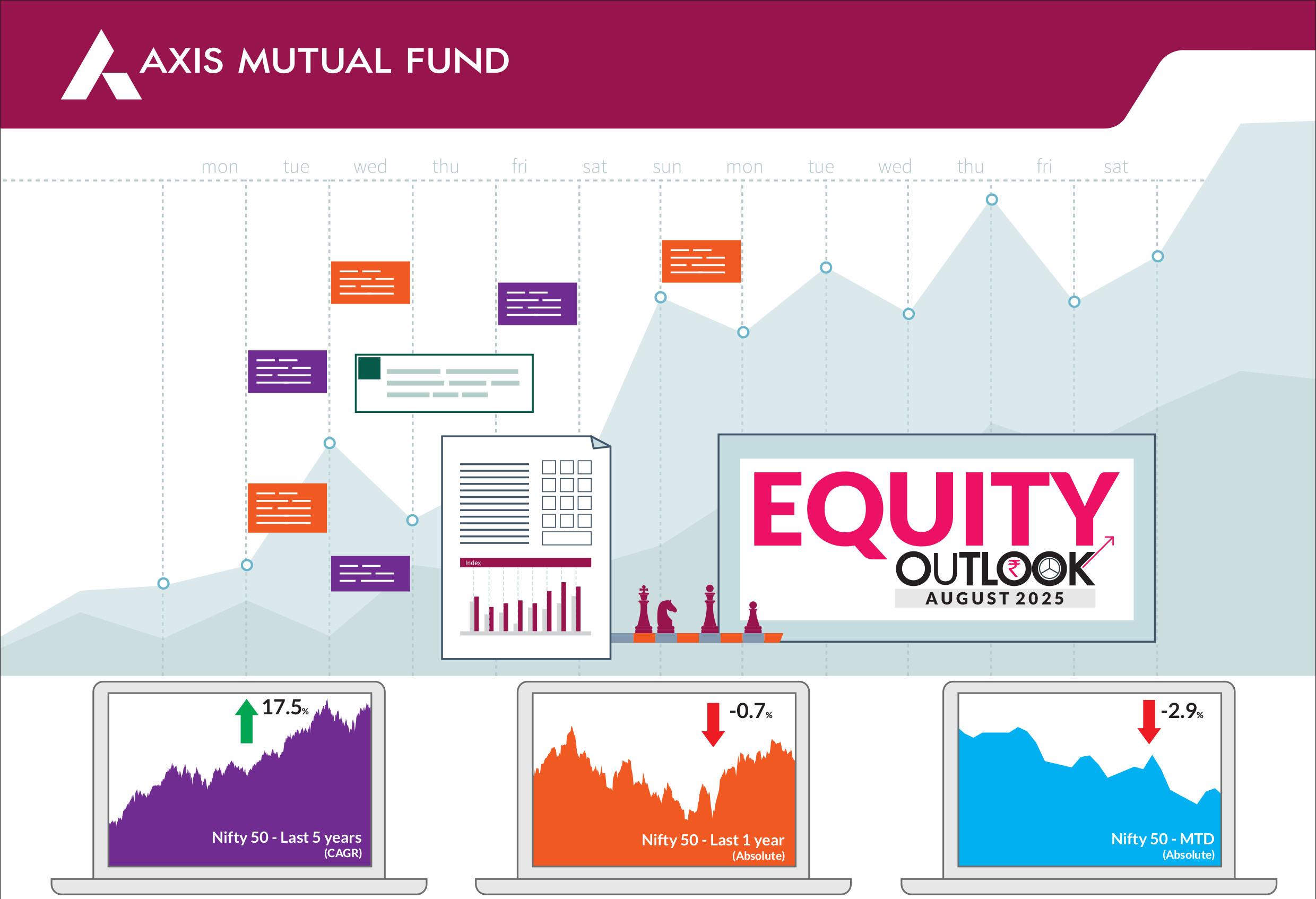

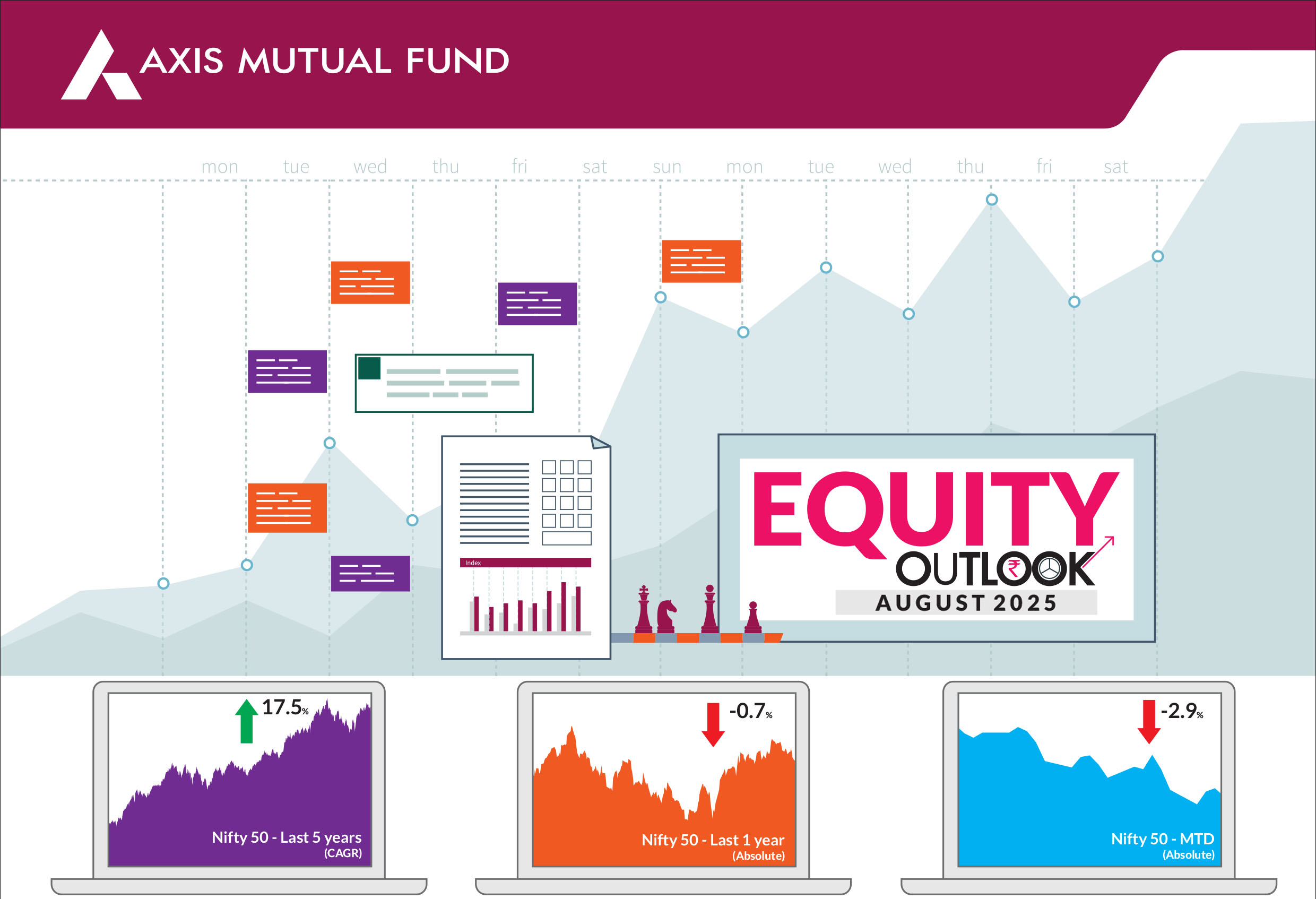

Indian equities witnessed a pullback in July 2025, reversing some of the gains seen in June. The BSE Sensex and Nifty 50 ended the month with notable declines of 2.90% and 2.93%, respectively, as investor sentiment weakened due to escalating geopolitical tensions and the announcement of 25% reciprocal new US tariffs on Indian goods. In contrast to June's broad-based rally, mid and small-cap indices underperformed, with the NSE Midcap 100 declining by 3.92% and NSE Smallcap 100 falling sharply by 5.81%, reflecting heightened caution among investors. Sectoral performance in July was broadly negative, with all sectors ending in the red except healthcare and FMCG, which benefited from defensive demand and stable earnings. Globally, US equities remained buoyant, continuing their upward trend from May and June, supported by robust earnings and easing inflation concerns. Meanwhile, Foreign Portfolio Investors (FPIs) turned net sellers in July, pulling out US$2.1 billion after three months of steady inflows. Domestic flows remain supportive, driven by strong SIP inflows and steady mutual fund deployment. - Domestic Institutional Investors (DIIs) remained supportive with US$6.32 billion in equity purchases. On the macro front, June headline inflation eased to 2.1% from 2.8% in May on the back of moderating vegetables prices while Manufacturing and Services PMI numbers came in higher. |

While these developments may exert pressure on India's goods exports to the US, the impact could be partially mitigated by redirecting trade flows to alternative markets. Additionally, the recent depreciation of the Indian rupee-if sustained-may help offset the tariff burden and enhance the competitiveness of Indian exports globally. The earnings season started on a relatively tamer note. The current quarter marks the fourth consecutive quarter of muted mid-single-digit topline growth contributed by benign volumes. What also stands out is the correction in margins which have remained largely unchanged through FY25. Mid/small caps continue to outperform large caps with double-digit revenue growth and EBITDA/PAT growth of 16%/28% & 10%/17% vs large caps of 4%/8%. Consensus Nifty earnings (aggregate) have been cut by 200bps for FY26 with ~9% growth & 11% (unchanged) for FY27E. At a sectoral level, the EPS cuts have been broad-based, with only Telecom seeing significant EPS upgrades. The cuts are the highest in Staples, Real Estate, and Utilities. |

IT companies see mixed revenue trends, though with currency support and lower wage costs, earnings mostly upgraded by 2-3%. Large private banks delivered mixed results, with asset quality concerns in few banks, alongside uneven NIM trends. Capital market companies report mostly beats / earnings raise while Insurance companies saw in line/positive June quarter. Consumer staples have seen sequential improvement in volume growth, EBITDA growth remains weak, owing to high input costs. Consumer discretionary and retail so far have seen decent results. Autos results were in line with divergence in EBITDA growth. Pharmaceuticals saw mixed trends while cement witnessed earnings upgrade post strong beats in June quarter and improved pricing environment for the upcoming quarter. Meanwhile, valuations remain expensive on an absolute basis and trading well above long-term averages. The mid-cap valuation premium over the Nifty at 31% remains high vs the long-term average of 18%. Small-caps premium at 26% is now off the decade-high of 31% seen in early June but remains high vs historical standards. Overall, the valuations of sectors such as Energy, Pharma, Staples, and Industrials are the most expensive, while those of Utilities, Telecom, and Financials look attractive at current valuations and EPS estimates. Against this backdrop, we are overweight the financial sector, particularly NBFCs. We also maintain an overweight position in the pharmaceutical segment, although we had been reducing our exposure in light of the uncertainty regarding tariffs and pricing issues in the US. We maintain an overweight in the consumer discretionary segment through retailers, hotels, travel and tourism. We believe that the discretionary segment is well positioned to benefit from strengthening domestic momentum and lower interest rates coupled with lower tax rates may likely provide consumption a fillip. Travel and hospitality have been holding well despite weather and geopolitical disruptions. We have reduced our overweight in automobiles in the last few months and remain underweight information technology. Renewable capex, manufacturers and power transmission/distribution companies, defense are the other themes we favour and we have increased our exposure to defense in the last few months. Overall, India continues to be a medium- to long-term growth opportunity, underpinned by its strong domestic consumption-driven economy. While recent tariff measures may introduce short-term headwinds, the structural fundamentals remain intact. In the near term, favorable macroeconomic indicators-such as a strong monsoon, healthy reservoir levels, and promising kharif crop sowing-are expected to support rural consumption. Additionally, the upcoming festive season is likely to stimulate broader demand across sectors, reinforcing consumption momentum. |

Source: Bloomberg, Axis MF Research.