► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Rate cycle on a pause for the next few policies.

► Yield upside limited; investors should add short term bonds with every rise in yields.

► Short term 2-5-year corporate bonds and tactical mix of 8-10 yr Gsecs and are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Yield upside limited; investors should add short term bonds with every rise in yields.

► Short term 2-5-year corporate bonds and tactical mix of 8-10 yr Gsecs and are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

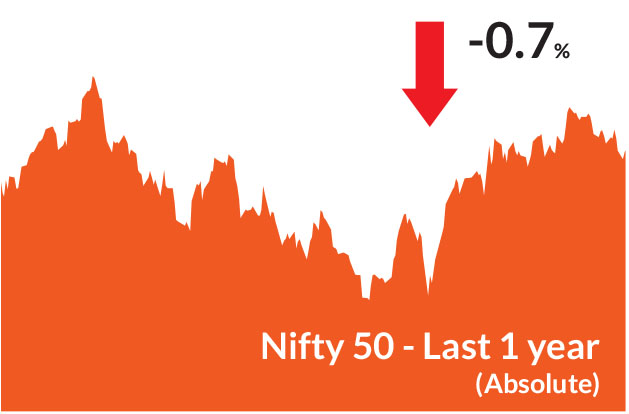

Indian equities witnessed a pullback in July 2025, reversing some of the

gains seen in June. The BSE Sensex and Nifty 50 ended the month lower

by of 2.90% and 2.93%, respectively, as investor sentiment weakened

due to escalating geopolitical tensions and the announcement of 25%

reciprocal new US tariffs on Indian goods. In contrast to June's broadbased

rally, mid and small-cap indices underperformed, with the NSE

Midcap 100 declining by 3.92% and NSE Smallcap 100 falling sharply by

5.81%, reflecting heightened caution among investors. Sectoral

performance in July was broadly negative, with all sectors ending in the

red except healthcare and FMCG, which benefited from defensive

demand and stable earnings. Globally, US equities remained buoyant,

continuing their upward trend from May and June, supported by robust

earnings and easing inflation concerns.

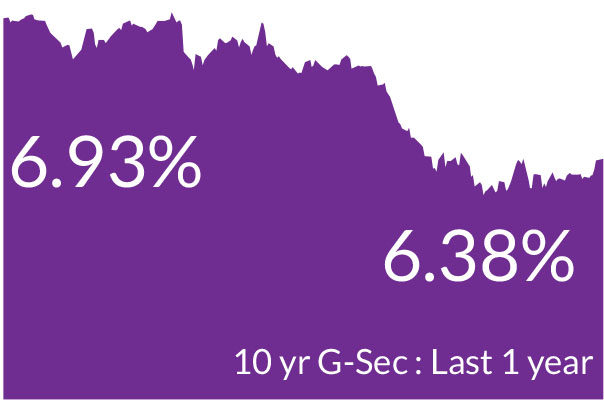

The month saw bond yields rise in the US ahead of the monetary policy outcome of the US Federal Reserve (Fed). Overall, 10 year Treasuries ended 14 bps higher at 4.37%. In India, the 10-year government bond yields ended 6 basis points higher at 6.38% given abundant banking liquidity and receding inflation.

The RBI highlighted that average daily liquidity has remained above Rs 3 lac crore since the June policy review. The upcoming phased CRR reductions, beginning in September, are expected to further augment this surplus.

Inflation falls further : Headline inflation fell to 2.1% in June from 2.8% in May, led by a faster than expected moderation in food prices especially vegetables. The IMD's forecast of an above-normal monsoon is likely to support the crop harvests, which, in addition to the healthy buffer stocks, is likely to ensure that food prices remain benign. We expect headline inflation to remain near 3% by the end of 2025 driven by benign food prices and due to favourable outlook for crop production.

Crude oil prices rose 7.3% over the month. The US has imposed a tariff of 25% (and additional 25%) on Indian exports to the US. A penalty has also been levied due to India's energy and defense imports from Russia. While the final numbers could change, these developments may exert upward pressure on inflation to some extent.

The month saw bond yields rise in the US ahead of the monetary policy outcome of the US Federal Reserve (Fed). Overall, 10 year Treasuries ended 14 bps higher at 4.37%. In India, the 10-year government bond yields ended 6 basis points higher at 6.38% given abundant banking liquidity and receding inflation.

Key Market Events

RBI keeps rates steady, banking liquidity in surplus : The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) maintained a neutral stance, keeping interest rates unchanged amid ample liquidity and ongoing transmission of the 100 basis points of cumulative easing implemented thus far. The central bank acknowledged that while global uncertainties have moderated, supply chain disruptions persist, and the imposition of tariffs on India could marginally temper growth.The RBI highlighted that average daily liquidity has remained above Rs 3 lac crore since the June policy review. The upcoming phased CRR reductions, beginning in September, are expected to further augment this surplus.

Inflation falls further : Headline inflation fell to 2.1% in June from 2.8% in May, led by a faster than expected moderation in food prices especially vegetables. The IMD's forecast of an above-normal monsoon is likely to support the crop harvests, which, in addition to the healthy buffer stocks, is likely to ensure that food prices remain benign. We expect headline inflation to remain near 3% by the end of 2025 driven by benign food prices and due to favourable outlook for crop production.

Crude oil prices rose 7.3% over the month. The US has imposed a tariff of 25% (and additional 25%) on Indian exports to the US. A penalty has also been levied due to India's energy and defense imports from Russia. While the final numbers could change, these developments may exert upward pressure on inflation to some extent.

Equity Market View:

The US has implemented a 25% tariff (and another additional 25% tariff) on Indian goods, alongside penalties related to India's procurement of arms and energy from Russia. In comparison, tariffs imposed on select ASEAN nations are relatively lower: Bangladesh at 35%, Vietnam at 20%, Indonesia at 19%, and the Philippines at 19%. Notably, any transshipment of goods from China via Vietnam will attract a significantly higher tariff of 40%. Trade agreements with other key partners have been finalized at varying tariff levels: the United Kingdom (10%), European Union (15%), Japan (15%), and South Korea (25%).While these developments may exert pressure on India's goods exports to the US, the impact could be partially mitigated by redirecting trade flows to alternative markets. Additionally, the recent depreciation of the Indian rupee-if sustained-may help offset the tariff burden and enhance the competitiveness of Indian exports globally.

The earnings season started on a relatively tamer note. The current quarter marks the fourth consecutive quarter of muted mid-singledigit topline growth contributed by benign volumes. What also stands out is the correction in margins which have remained largely unchanged through FY25. Mid/small caps continue to outperform large caps with double-digit revenue growth and EBITDA/PAT growth of 16%/28% & 10%/17% vs large caps of 4%/8%. Consensus Nifty earnings (aggregate) have been cut by 200bps for FY26 with ~9% growth & 11% (unchanged) for FY27E. At a sectoral level, the EPS cuts have been broad-based, with only Telecom seeing significant EPS upgrades. The cuts are the highest in Staples, Real Estate, and Utilities.

Meanwhile, valuations remain expensive on an absolute basis and trading well above long-term averages. The mid-cap valuation premium over the Nifty at 31% remains high vs the long-term average of 18%. Small-caps premium at 26% is now off the decade-high of 31% seen in early June but remains high vs historical standards. Overall, the valuations of sectors such as Energy, Pharma, Staples, and Industrials are the most expensive, while those of Utilities, Telecom, and Financials look attractive at current valuations and EPS estimates.

Overall, India continues to be a medium- to long-term growth opportunity, underpinned by its strong domestic consumption-driven economy. While recent tariff measures may introduce short-term headwinds, the structural fundamentals remain intact. In the near term, favorable macroeconomic indicators-such as a strong monsoon, healthy reservoir levels, and promising kharif crop sowing-are expected to support rural consumption. Additionally, the upcoming festive season is likely to stimulate broader demand across sectors, reinforcing consumption momentum.

Debt Market View:

The Fed continues to navigate the dual challenge of stubborn inflation and slowing growth. Despite holding rates steady in recent months, we expect two rate cuts in 2025. Indicators such as a softening labor market and tariff-related growth headwinds support this view. The cumulative easing could total 75-100 basis points, especially if trade tensions persist and fiscal policy remains tight.As expected by us, the central bank kept interest rates unchanged. Given the absence of significant economic vulnerabilities and considering the cumulative 100 basis points rate reduction already implemented, the RBI is well-positioned to maintain a neutral approach. With operative rates already eased by ~150 bps, any further cuts may be limited to just one more or two at best in case the growth surprises on downside. Moreover, the implications of elevated tariffs warrant careful evaluation, with key macroeconomic variables-such as currency dynamics, capital flows, and evolving trade relationships-requiring close monitoring. As rightly noted by the Governor, monetary policy transmission operates with a lag and must be allowed to fully play out.

In our view, we are at the fag end of the rate cut cycle and an additional 25 basis points rate cut would have had limited incremental impact under prevailing liquidity conditions. That said, we continue to believe that interest rates are likely to remain lower for an extended period.

We have gradually reduced duration in our portfolios since February 2025 transitioning from long duration strategies to accrual-based strategies.

We believe that the current year's demand-supply mismatch is worsening, with limited tactical support and rising issuance. This imbalance could increase pressure on yields, especially in long-duration segments.

We have been adding 2-5 year corporate bonds to the portfolio as we expect surplus banking liquidity, lower supply of corporate bonds/ CDs due to slowdown and delay in implementation of LCR guidelines and attractive spreads and valuations. Incrementally short bonds can outperform long bonds from risk-reward perspective due to a shallow rate cut cycle, lower OMO purchases in the second half of the year and a shift in focus to Govt Debt to GDP targets.

Source: Bloomberg, Axis MF Research.