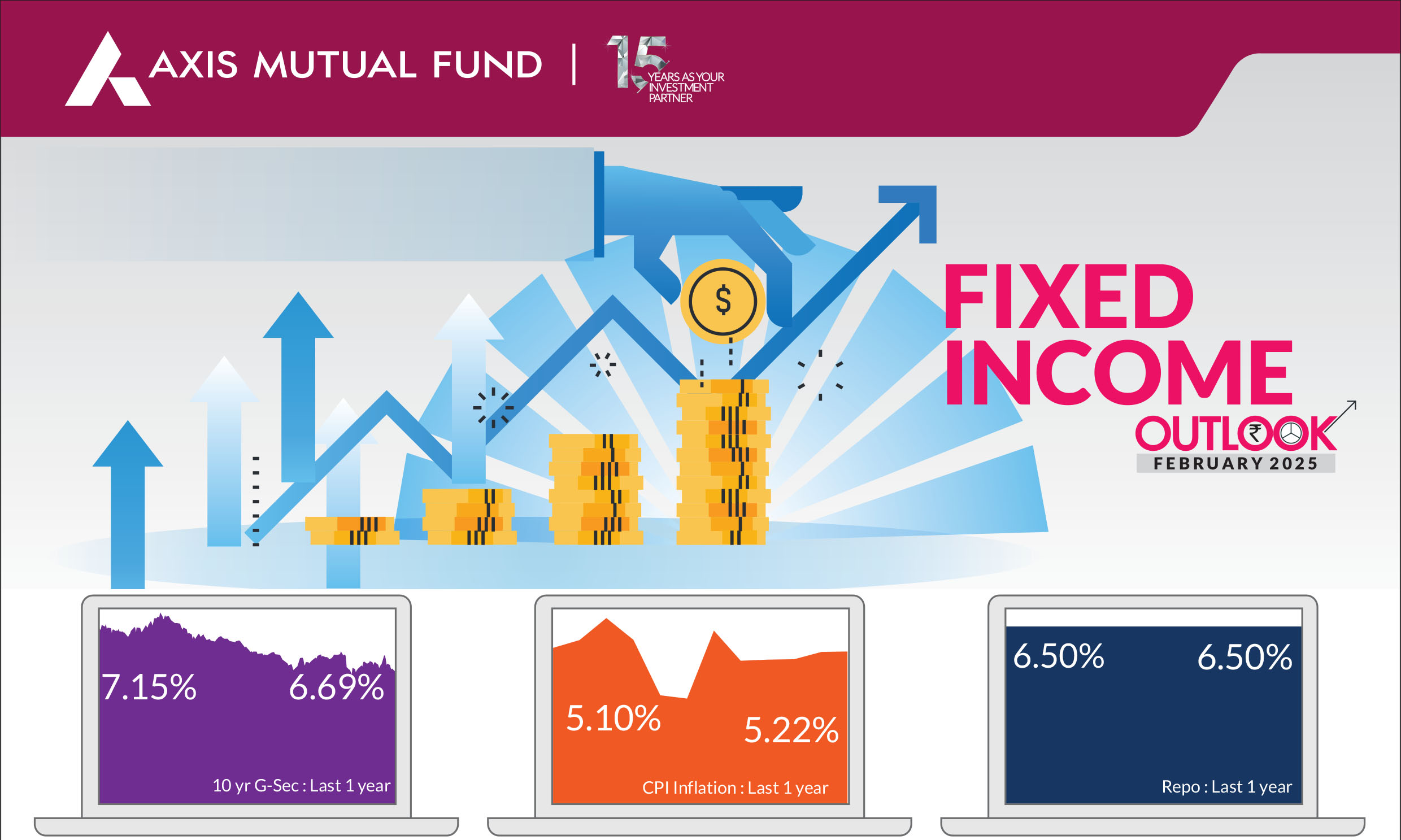

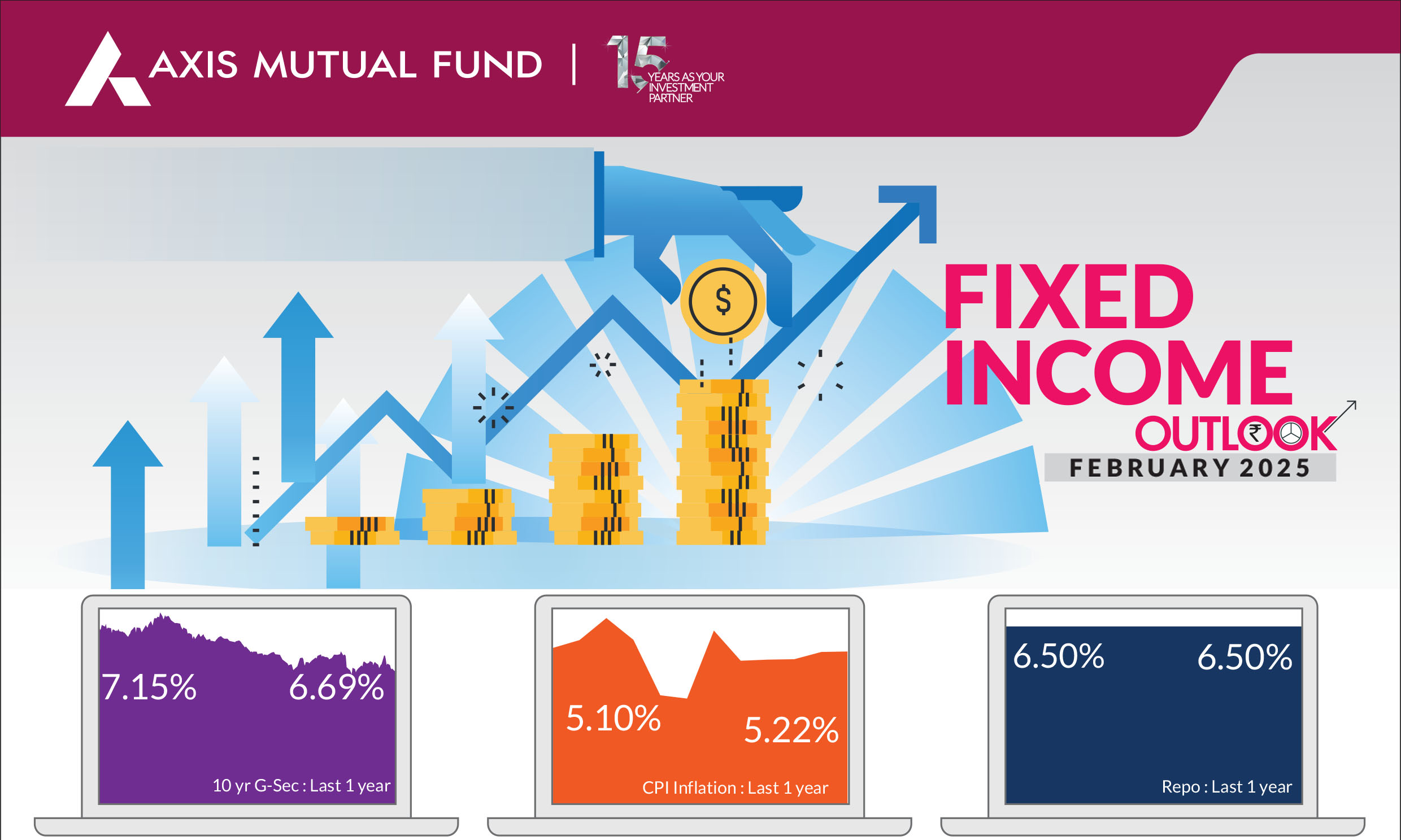

Despite market volatility, yields remained relatively unchanged overall in January. The US President's late January actions on immigration and tariffs caused significant fluctuations in both equities and bonds. In the first two weeks of January, 10-year Treasury yields increased by about 20 basis points due to Trump's return to office, which raised investors' expectations for increased fiscal spending and persistent inflation. However, US government bonds later rallied, initially due to a weaker-than-expected December inflation report and subsequently following a sell-off in AI technology stocks. As a result, 10-year US Treasury yields ended the month flat at 4.5%, while 10-year government bond yields fell by 7 basis points.

1) Union Budget on the path to fiscal consolidation : The government stayed on the path of fiscal consolidation with a budgeted estimate of 4.4% of GDP. This has come partly at the cost of capex. The government increased gross borrowing to Rs 14.82 trillion from the market to fund the deficit, compared to Rs 14.01 trillion in the current financial year. The net market borrowing stands at Rs 11.54 trillion, marginally lower from Rs 11.63 trillion in the current financial year. Both gross and net borrowings are on expected lines. The fiscal consolidation is also positive for India's sovereign rating.

Earlier, towards the end of the month, the RBI announced measures to boost liquidity in the system. These included Rs 60,000-crore Open Market Operations (OMO) purchase auctions of Government securities, a 56-day Variable Repo Rate (VRR) auction of 50,000 crore, and a $5-billion USD/rupee buy/sell swap auction for a six-month tenure. These measures could lead to liquidity infusion of about Rs 1.50 lakh crore in the banking system in a phased manner, beginning January 30 and ending on February 20 with OMO purchase auction. To ease liquidity tightness in the banking system, the RBI started conducting daily Variable Rate Repo (VRR) auctions with effect from January 16. These auctions will be conducted until further notice.

3) Inflation heading lower : Headline inflation fell in December to 5.22%, but still higher than the levels seen in mid 2024. Core inflation continues to remain below 4% for over 12 months. We anticipate headline inflation to decrease further to 4.5% by June and to 3.8% by end of the year due to good rabi and kharif crop harvests and lower vegetable prices. Slowing credit growth and fiscal consolidation are negative impulses for slower growth and we expect Q3 and Q4 GDP to be below 6.5%.

4) Rupee sees orderly depreciation : Recently, we have seen rupee depreciation of nearly 3- 4% in the last quarter largely on account of the US Dollar strengthening, forex and FPI outflows and expected slowdown in India's GDP. However, our macro indicators remain healthy and despite recent depreciation, the rupee seems to be expensive on REER basis by 3-4%. We believe that the external situation (BoP and CAD), FX reserves and macro indicators continue to remain stable and the rupee needs some orderly depreciation. Hence, we do not expect any action from the RBI to stem this depreciation. India still has roughly eight months of import cover.

Global events:

1) US treasuries see volatility in January : In January, bond markets experienced significant volatility. This was driven by President Trump's proposed policies, including tax cuts, immigration restrictions, and tariffs, which raised expectations for higher US inflation and led to an increase in global yields. Meanwhile the Fed kept its interest rate unchanged. Upon taking office, the US President announced an additional 25% tariff on imported goods from Mexico and Canada, with energy imports from Canada facing a 10% tariff increase.

Additionally, a 10% tariff was imposed on imports from China. These tariffs are set to take effect on Tuesday, February 4th. In response, all three countries have announced retaliatory tariffs.

Prices of commodities such as gold and other metals increased due to Trump's tariff threats. Meanwhile, oil prices were boosted by the cold winter weather and US sanctions on Russia.

2) Hit by tariffs China retaliates : China has been much in focus since Trump won elections. In response to the tariffs imposed on it, China has retaliated with its own countermeasures. China's finance ministry put tariffs of 10-15% on imports of a range of US goods and several US companies have been also added to China's "unreliable entity" list, potentially restricting their ability to conduct business in the country.

The blanket 10% tariffs levied by the US are on top of the existing tariffs of up to 25% that Trump had imposed on Chinese goods during his first presidency. The additional 10% tariffs could reduce China's real GDP growth by roughly 50 basis points this year.

Macro Outlook for India

As we had anticipated, the central bank lowered interest rates ushering in a softer interest rate regime. In our Acumen "Navigating Headwinds" we had anticipated the RBI to announce liquidity measures like VRR auctions, FX buy/sell swaps and/ or CRR cuts/ OMO purchases. While these were carried out by the governor (with the exception of CRR cuts) in late January, we had anticipated more measures which the governor has assured will be carried out when needed. Deferring the LCR norms until March 2026 is good for the short end of the money market curve. We expect an overall shallow interest rate cut cycle of 50-75 bps. We also expect further proactive liquidity measures by RBI to anchor the overnight rates to the policy rates.The budget announced by the Finance Minister was pro consumption and pro-people. The government showed its intent on fiscal consolidation. From a medium term perspective, we see the government is moving from the fiscal deficit target to the centre debt to GDP target. Currently center's debt is around 56% and this should be around 50 +/-1% in the next 5 years. We believe that the budget was both credible and realistic. Slowing growth and fiscal consolidation collectively paved the way for easing of the monetary policy.

Globally, January was a news heavy month and accordingly there was a lot of action in the bonds market. As expected, the US President after assuming office announced tariffs on China, Mexico and Canada. US also faces a significant risk of inflation in an already slowing economy as these three countries are amongst the top 5 where US imports from. We believe while these tariffs were the known certainty, it is the uncertainty stemming from economic growth and investment intentions that matter.

Risks to our view: The risks to our view at this point are as below

1) Currency and liquidity are the near-term problems. We remain slightly expensive on REER basis and hence can see some currency depreciation.

2) US political theme and Inflationary policies of the incoming government which can lead to a stronger US dollar.

3) China rebound can impact India in a vicious cycle of lower flows, weak growth and high inflation.

Strategy : We have been maintaining a higher duration across all our funds and guiding the rally in bonds since March 2024. We have already witnessed a more than 50 bps of rally in yields in 10- year bonds since early 2024 but positive demand-supply dynamics for government bonds and expected rate cuts will continue to keep bond markets happy, and we can expect another 20-25 bps of rally in the next 3-6 months. Despite the liquidity measures by the RBI, we expect more of liquidity measures as system liquidity still needs to be addressed. As mentioned above, the RBI has assured of pro-active liquidity management. Due to favourable demand supply dynamics and OMOs, we continue to have a higher bias towards government bonds in our duration funds.

Accordingly, from a strategy perspective, we have maintained an overweight duration stance within the respective scheme mandates with a higher allocation to Government bonds.

What should investors do?

• Investors should continue to hold duration across their portfolios.

• Incremental gains in long bonds following rate cuts.

• Directionally see yields for 10 year Gsec closer to 6.5% in next 6 months

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.