Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

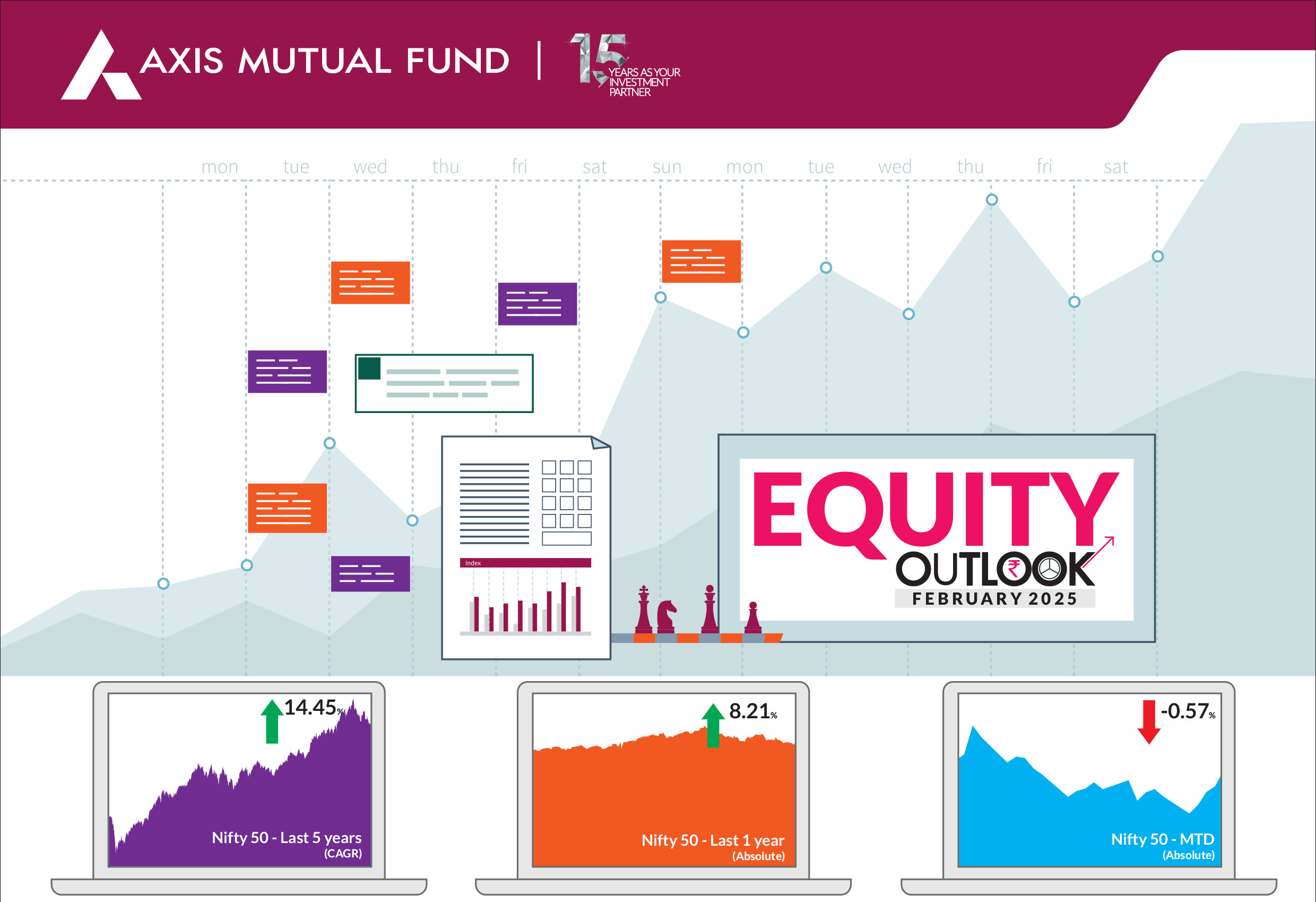

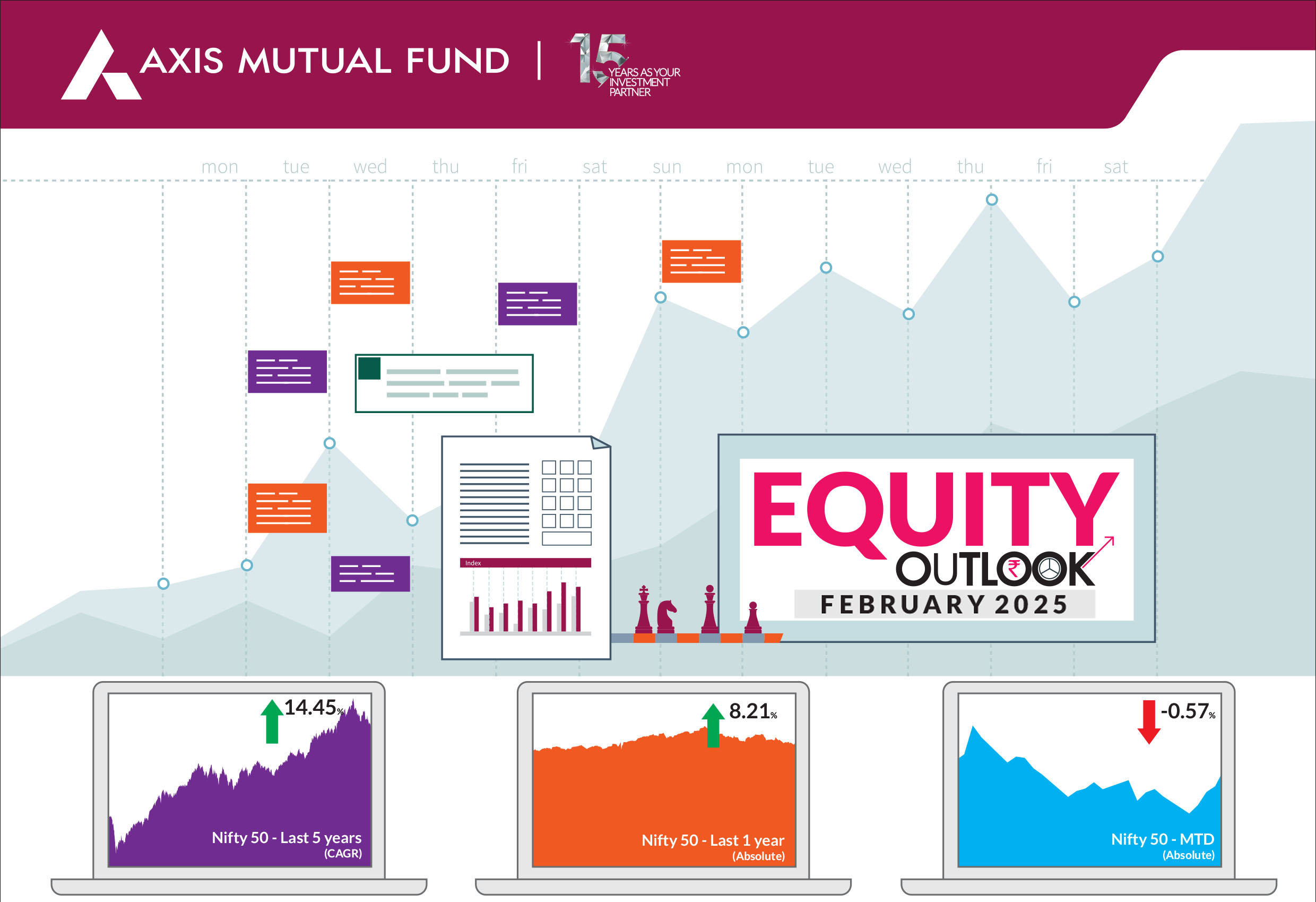

Globally, January was a month of anticipation as the new US President assumed office on January 20, 2025. Markets and investors were keenly observing the new administration's policies, especially concerning potential tariffs and immigration/deportation measures. Key highlights of the month included: (a) FY25 real GDP growth estimated at 6.4%, down from 8.2% in FY24, (b) Chinese startup DeepSeek's release of a cost-effective AI model, sparking concerns about heightened competition in the tech sector, (c) the central bank's announcement of several measures to enhance liquidity in the banking system, (d) the US Fed maintaining the policy rate, and (e) Q3FY25 earnings broadly aligning with our modest expectations. Overall, Indian equities ended January lower, this being the fourth consecutive month of negative returns. The BSE Sensex and Nifty 50 closed 0.8% and 0.6% lower, while the NSE Midcap 100 fell by 6.1% and the NSE Smallcap 100 declined 9.9%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in 2025, with outflows to the tune of U$ 9bn. In contrast, DIIs bought equities worth US$ 10bn. |

|

In an effort to boost disposable income in the hands of the salaried class, the government has cut income tax rates. This will help boost savings, increase consumption and thereby enhance growth. Consumption has been a pain point for the government so far and with the impending slowdown globally, the government has pulled all stops at improving consumption by lowering the income tax rates. Higher disposable income effect should drive pickup in demand particularly discretionary, savings and even credit (loans). We believe that consumer discretionary in particular will benefit from the aspirational needs of the salaried class. Hence segments such as auto, retailing, travel and tourism, hospitality and real estate could be the beneficiaries. Pick-up in demand should also be a catalyst for improved capital spending by the private sector. The regulatory burden that was quite high will now come down given that the government has mandated a "High-Level Committee for Regulatory Reforms" that will enhance the ease of doing business. The earnings season so far has been tepid as we had believed it would be. So far only a handful of domestic oriented sectors, such as capital markets, consumer durables, healthcare and real estate, reported strong growth in revenues and PAT. The prolonged weak demand environment continues to impact volume growth of FMCG/durables. Furthermore, the profitability of automobile and consumer companies remains under pressure. The banking sector has delivered well on asset quality and profitability, despite weakening credit demand, and real estate companies reported a strong growth in pre-sales. the outsourcing companies reported a decent growth with most IT services companies reporting a gradual uptick in revenues. The elevated global uncertainty in the aftermath of US tariffs on Canada, China and Mexico may also delay the expected recovery in global IT spending and thereby weigh on present high valuations of the sector. We believe that markets are gravitating towards companies with clear earnings growth visibility and a lower likelihood of significant earnings downgrades. Accordingly we believe the themes in 2025 are likely to be split into two halves and the market to become more stock-specific. We anticipate that highvaluation sectors may consolidate in the near term if they lack new earnings growth drivers. Nonetheless, we continue to find opportunities across the market. Near-term market volatility is expected to continue, driven by both global and domestic uncertainties. However, on a macro level, lower inflation, improved core sector growth, and increased consumption due to lower taxes will support market optimism. In its February monetary policy, the RBI lowered interest rate by 25 bps underscoring its commitment to supporting growth, enhancing liquidity, and maintaining flexible inflation targeting. Valuations are off their highs and seem better placed than before particularly for large caps. For eg, the Nifty 50 is trading at 18.8x one year forward earnings, vs the peak of 21.3 seen in September 2024. The mid and smallcaps are still trading above their long term averages. Post the budget our sector view remain the same; we had a bias towards quick commerce, travel/tourism, automobiles and capital market beneficiaries while having exposure to others segments (retail, jewellery, modern retail) within consumer discretionary. Information technology, healthcare, renewable capex and power transmission/distribution companies, defense are the other themes we favour. While the budget was flat on capex, we do believe select capex and PSU companies will perform well during the course of the year. |

Source: Bloomberg, Axis MF Research.