► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Start of a shallow rate cycle post February cuts.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

Globally, January was a month of anticipation as the new US President

assumed office on January 20, 2025. Markets and investors were

keenly observing the new administration's policies, especially

concerning potential tariffs and immigration/deportation measures.

Key highlights of the month included: (a) FY25 real GDP growth

estimated at 6.4%, down from 8.2% in FY24, (b) Chinese startup

DeepSeek's release of a cost-effective AI model, sparking concerns

about heightened competition in the tech sector, (c) the central bank's

announcement of several measures to enhance liquidity in the banking

system, (d) the US Fed maintaining the policy rate, and (e) Q3FY25

earnings broadly aligning with our modest expectations.

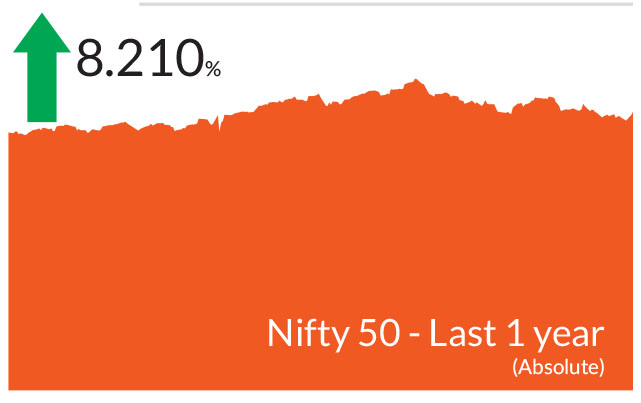

Overall, Indian equities ended January lower, this being the fourth consecutive month of negative returns. The BSE Sensex and Nifty 50 closed 0.8% and 0.6% lower, while the NSE Midcap 100 fell by 6.1% and the NSE Smallcap 100 declined 9.9%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in 2025, with outflows to the tune of U$ 9bn. In contrast, DIIs bought equities worth US$ 10bn.

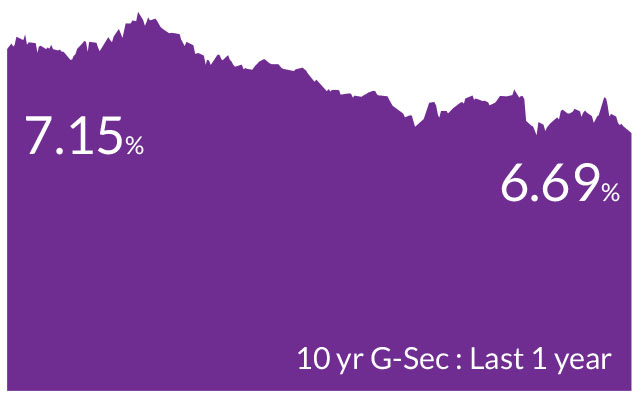

Despite market volatility, yields remained relatively unchanged overall in January. The US President's late January actions on immigration and tariffs caused significant fluctuations in both equities and bonds. In the first two weeks of January, 10-year Treasury yields increased by about 20 basis points due to Trump's return to office, which raised investors' expectations for increased fiscal spending and persistent inflation. However, US government bonds later rallied, initially due to a weakerthan- expected December inflation report and subsequently following a sell-off in AI technology stocks. As a result, 10-year US Treasury yields ended the month flat at 4.5%, while 10-year government bond yields fell by 7 basis points.

2) RBI lowers interest rates and infuses liquidity : In its monetary policy meeting in February, the Reserve Bank of India (RBI) ushered in a softer interest rate regime by lowering repo rate by 25 bps. Additionally, considering the concerns of banks needing to allocate additional funds to meet the Liquidity Coverage Ratio (LCR) requirements, the RBI postponed the implementation of the revised LCR norms until March 2026. This decision allows banks ample time to comply without experiencing liquidity disruptions.

Earlier, towards the end of the month, the RBI announced measures to boost liquidity in the system. These included Rs 60,000-crore Open Market Operations (OMO) purchase auctions of Government securities, a 56-day Variable Repo Rate (VRR) auction of 50,000 crore, and a $5-billion USD/rupee buy/sell swap auction for a six-month tenure. These measures could lead to liquidity infusion of about Rs 1.50 lakh crore in the banking system in a phased manner, beginning January 30 and ending on February 20 with OMO purchase auction. To ease liquidity tightness in the banking system, the RBI started conducting daily Variable Rate Repo (VRR) auctions with effect from January 16. These auctions will be conducted until further notice.

3) Inflation heading lower : Headline inflation fell in December to 5.22%, but still higher than the levels seen in mid 2024. Core inflation continues to remain below 4% for over 12 months. We anticipate headline inflation to decrease further to 4.5% by June and to 3.8% by end of the year due to good rabi and kharif crop harvests and lower vegetable prices. Slowing credit growth and fiscal consolidation are negative impulses for slower growth and we expect Q3 and Q4 GDP to be below 6.5%.

4) Rupee sees orderly depreciation : Recently, we have seen rupee depreciation of nearly 3- 4% in the last quarter largely on account of the US Dollar strengthening, forex and FPI outflows and expected slowdown in India's GDP. However, our macro indicators remain healthy and despite recent depreciation, the rupee seems to be expensive on REER basis by 3-4%. We believe that the external situation (BoP and CAD), FX reserves and macro indicators continue to remain stable and the rupee needs some orderly depreciation. Hence, we do not expect any action from the RBI to stem this depreciation. India still has roughly eight months of import cover.

Overall, Indian equities ended January lower, this being the fourth consecutive month of negative returns. The BSE Sensex and Nifty 50 closed 0.8% and 0.6% lower, while the NSE Midcap 100 fell by 6.1% and the NSE Smallcap 100 declined 9.9%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in 2025, with outflows to the tune of U$ 9bn. In contrast, DIIs bought equities worth US$ 10bn.

Despite market volatility, yields remained relatively unchanged overall in January. The US President's late January actions on immigration and tariffs caused significant fluctuations in both equities and bonds. In the first two weeks of January, 10-year Treasury yields increased by about 20 basis points due to Trump's return to office, which raised investors' expectations for increased fiscal spending and persistent inflation. However, US government bonds later rallied, initially due to a weakerthan- expected December inflation report and subsequently following a sell-off in AI technology stocks. As a result, 10-year US Treasury yields ended the month flat at 4.5%, while 10-year government bond yields fell by 7 basis points.

Key Market Events

1) Union Budget on the path to fiscal consolidation : The government stayed on the path of fiscal consolidation with a budgeted estimate of 4.4% of GDP. This has come partly at the cost of capex. The government increased gross borrowing to Rs 14.82 trillion from the market to fund the deficit, compared to Rs 14.01 trillion in the current financial year. The net market borrowing stands at Rs 11.54 trillion, marginally lower from Rs 11.63 trillion in the current financial year. Both gross and net borrowings are on expected lines. The fiscal consolidation is also positive for India's sovereign rating.2) RBI lowers interest rates and infuses liquidity : In its monetary policy meeting in February, the Reserve Bank of India (RBI) ushered in a softer interest rate regime by lowering repo rate by 25 bps. Additionally, considering the concerns of banks needing to allocate additional funds to meet the Liquidity Coverage Ratio (LCR) requirements, the RBI postponed the implementation of the revised LCR norms until March 2026. This decision allows banks ample time to comply without experiencing liquidity disruptions.

Earlier, towards the end of the month, the RBI announced measures to boost liquidity in the system. These included Rs 60,000-crore Open Market Operations (OMO) purchase auctions of Government securities, a 56-day Variable Repo Rate (VRR) auction of 50,000 crore, and a $5-billion USD/rupee buy/sell swap auction for a six-month tenure. These measures could lead to liquidity infusion of about Rs 1.50 lakh crore in the banking system in a phased manner, beginning January 30 and ending on February 20 with OMO purchase auction. To ease liquidity tightness in the banking system, the RBI started conducting daily Variable Rate Repo (VRR) auctions with effect from January 16. These auctions will be conducted until further notice.

3) Inflation heading lower : Headline inflation fell in December to 5.22%, but still higher than the levels seen in mid 2024. Core inflation continues to remain below 4% for over 12 months. We anticipate headline inflation to decrease further to 4.5% by June and to 3.8% by end of the year due to good rabi and kharif crop harvests and lower vegetable prices. Slowing credit growth and fiscal consolidation are negative impulses for slower growth and we expect Q3 and Q4 GDP to be below 6.5%.

4) Rupee sees orderly depreciation : Recently, we have seen rupee depreciation of nearly 3- 4% in the last quarter largely on account of the US Dollar strengthening, forex and FPI outflows and expected slowdown in India's GDP. However, our macro indicators remain healthy and despite recent depreciation, the rupee seems to be expensive on REER basis by 3-4%. We believe that the external situation (BoP and CAD), FX reserves and macro indicators continue to remain stable and the rupee needs some orderly depreciation. Hence, we do not expect any action from the RBI to stem this depreciation. India still has roughly eight months of import cover.

Equity Market View:

We believe that markets are gravitating towards companies with clear earnings growth visibility and a lower likelihood of significant earnings downgrades. Accordingly we believe the themes in 2025 are likely to be split into two halves and the market to become more stock-specific. We anticipate that high-valuation sectors may consolidate in the near term if they lack new earnings growth drivers. Nonetheless, we continue to find opportunities across the market. Near-term market volatility is expected to continue, driven by both global and domestic uncertainties. However, on a macro level, lower inflation, improved core sector growth, and increased consumption due to lower taxes will support market optimism. In its February monetary policy, the RBI lowered interest rate by 25 bps underscoring its commitment to supporting growth, enhancing liquidity, and maintaining flexible inflation targeting.Valuations are off their highs and seem better placed than before particularly for large caps. For eg, the Nifty 50 is trading at 18.8x one year forward earnings, vs the peak of 21.3 seen in September 2024. The mid and smallcaps are still trading above their long term averages.

Post the budget our sector view remain the same; we had a bias towards quick commerce, travel/tourism, automobiles and capital market beneficiaries while having exposure to others segments (retail, jewellery, modern retail) within consumer discretionary. Information technology, healthcare, renewable capex and power transmission/distribution companies, defense are the other themes we favour. While the budget was flat on capex, we do believe select capex and PSU companies will perform well during the course of the year.

Debt Market View:

As we had anticipated, the central bank lowered interest rates ushering in a softer interest rate regime. In our Acumen "Navigating Headwinds" we had anticipated the RBI to announce liquidity measures like VRR auctions, FX buy/sell swaps and/ or CRR cuts/ OMO purchases. While these were carried out by the governor (with the exception of CRR cuts) in late January, we had anticipated more measures which the governor has assured will be carried out when needed. Deferring the LCR norms until March 2026 is good for the short end of the money market curve. We expect an overall shallow interest rate cut cycle of 50-75 bps . We also expect further proactive liquidity measures by RBI to anchor the overnight rates to the policy rates.The budget announced by the Finance Minister was pro consumption and pro-people. The government showed its intent on fiscal consolidation. From a medium term perspective, we see the government is moving from the fiscal deficit target to the centre debt to GDP target. Currently center's debt is around 56% and this should be around 50 +/-1% in the next 5 years. We believe that the budget was both credible and realistic. Slowing growth and fiscal consolidation collectively paved the way for easing of the monetary policy.

Globally, January was a news heavy month and accordingly there was a lot of action in the bonds market. As expected, the US President after assuming office announced tariffs on China, Mexico and Canada. US also faces a significant risk of inflation in an already slowing economy as these three countries are amongst the top 5 where US imports from. We believe while these tariffs were the known certainty, it is the uncertainty stemming from economic growth and investment intentions that matter.

Source: Bloomberg, Axis MF Research.