•

Start of a shallow rate cycle

post February cuts.

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year maturity and 1-

2-year maturity assets are best

strategies to invest in the

current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

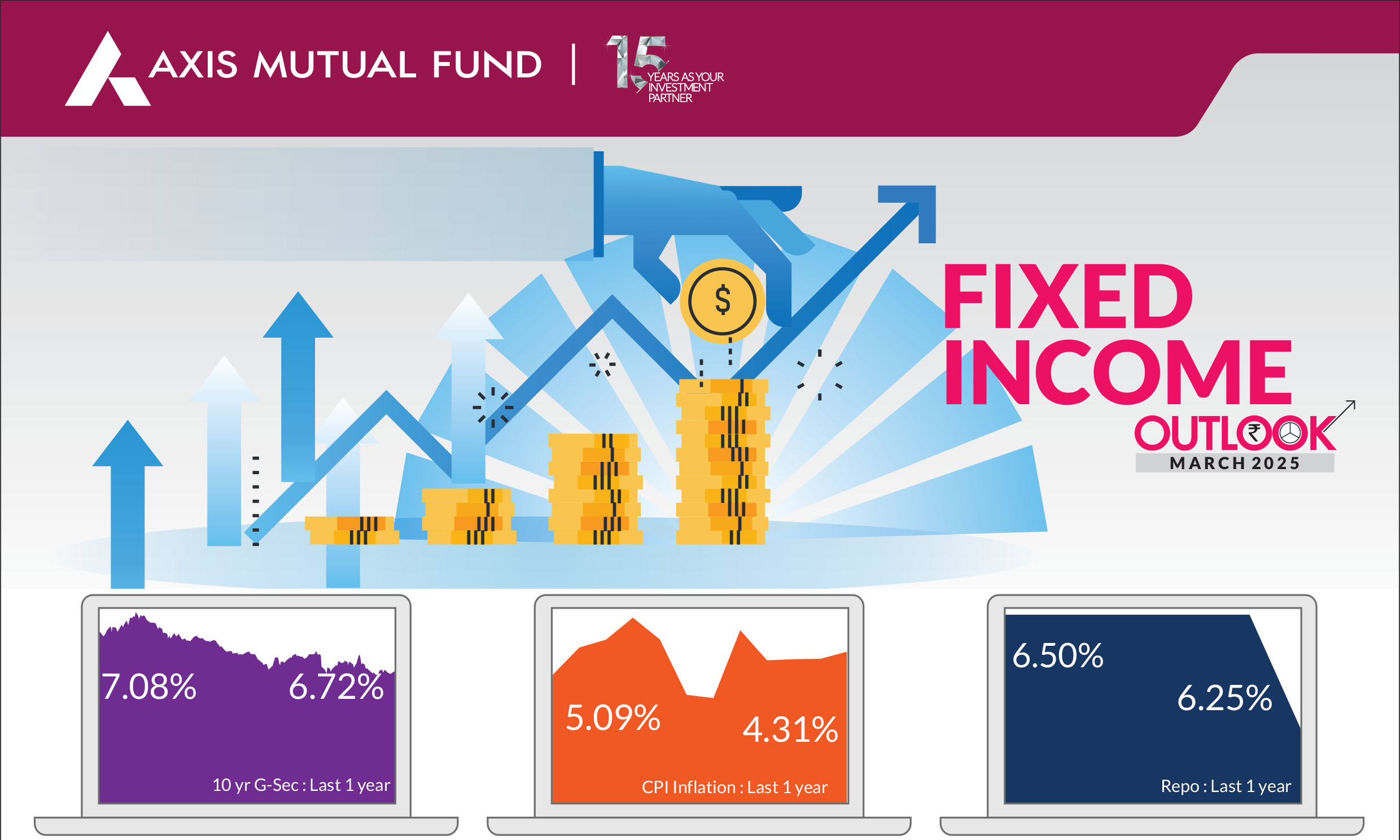

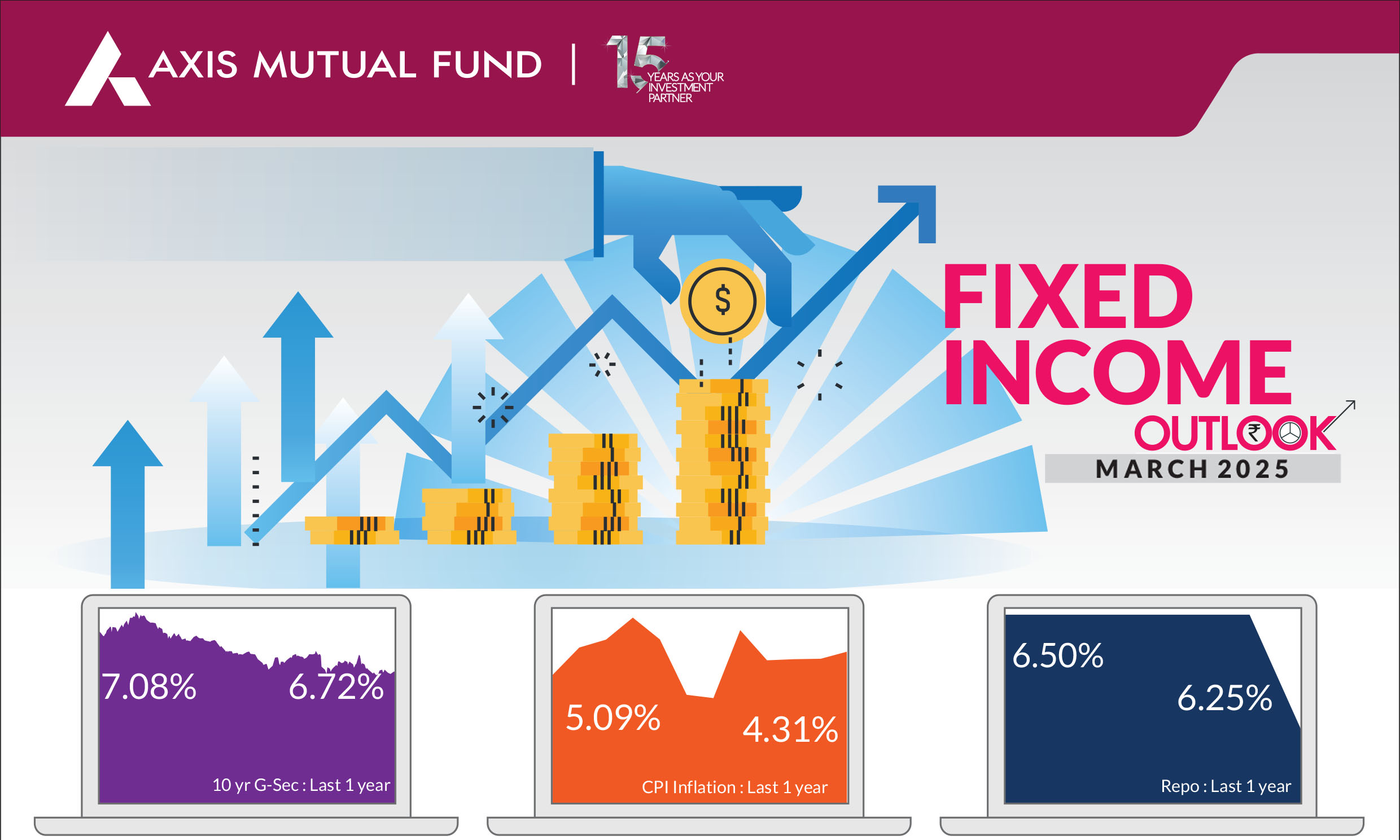

US Treasury yields fell in February after the tariff announcement by the US President on its top trading partners, China, Mexico and Canada led to nervousness in markets. Yields on 10-year US Treasuries fell 33 basis points over the month ending at 4.21% while equities also declined. This decline from above 4.8% was driven by a deteriorating outlook for US growth, as a series of data indicated weak consumer and business sentiment. In India, February was a month of key events - union budget, monetary policy and liquidity measures which led to infusion of Rs 3 lac crores in the banking system. The 10-year government bond yields rose by 3 basis points.

RBI lowers interest rates and infuses

liquidity :

The central bank auctioned threeyear

dollar/rupee buy/sell swaps worth $10

billion and this witnessed strong demand

amid persistently tight liquidity deficit in the

system. Earlier in the month, the Reserve

Bank of India (RBI) ushered in a softer

interest rate regime by lowering repo rate by

25 bps. Additionally, considering the

concerns of banks needing to allocate additional funds to meet the Liquidity Coverage

Ratio (LCR) requirements, the RBI postponed the implementation of the revised LCR

norms until March 2026. This decision allows banks ample time to comply without

experiencing liquidity disruptions.

Inflation falls further :

Headline inflation fell to 4.3% in January from 5.2% in December

2023, led by a faster than expected moderation in food prices especially vegetables

with the onset of winter months. Core inflation continues to remain below 4% for over

12 months. We anticipate headline inflation to decrease further to 3.8% by end of the

year due to good rabi and kharif crop harvests and lower vegetable prices.

Third quarter GDP growth improves : GDP growth improved to 6.2% YoY in Q3FY25 vs 5.6% in Q2FY25 (revised up from 5.4%). The uptick in GDP was led primarily by strength in both private consumption (supported by a buoyant rural economy) and government consumption (pickup in government spending). private consumption grew 6.9% YoY; 100bps pickup from the previous quarter. Moreover, FY25 advance estimate puts annual consumption growth at 7.6%, implying Q4FY25 private consumption growth at 9.9%YY. Government consumption rose to a five quarter high of 8.3% YoY. GVA growth at 6.2% was led by broad-based growth across sectors after a disappointing 2QFY25 performance.

Rupee depreciates but stabilizing slowly : The rupee continued to depreciate, declining 1% against the US dollar largely on account of the US Dollar strengthening and FPI outflows. However, the depreciation has been slower and we believe the rupee could be stabilizing near these levels.

US treasury yields decline in February : February saw yields lower to the tune of 35-40 bps. The two factors that led to the rally in treasuries were slowing growth and macros in the US balance sheet reduction by the US Federal Reserve. The central bank has been reducing supply every month to the tune of US$ 40 bn and this could end in June.

Third quarter GDP growth improves : GDP growth improved to 6.2% YoY in Q3FY25 vs 5.6% in Q2FY25 (revised up from 5.4%). The uptick in GDP was led primarily by strength in both private consumption (supported by a buoyant rural economy) and government consumption (pickup in government spending). private consumption grew 6.9% YoY; 100bps pickup from the previous quarter. Moreover, FY25 advance estimate puts annual consumption growth at 7.6%, implying Q4FY25 private consumption growth at 9.9%YY. Government consumption rose to a five quarter high of 8.3% YoY. GVA growth at 6.2% was led by broad-based growth across sectors after a disappointing 2QFY25 performance.

Rupee depreciates but stabilizing slowly : The rupee continued to depreciate, declining 1% against the US dollar largely on account of the US Dollar strengthening and FPI outflows. However, the depreciation has been slower and we believe the rupee could be stabilizing near these levels.

US treasury yields decline in February : February saw yields lower to the tune of 35-40 bps. The two factors that led to the rally in treasuries were slowing growth and macros in the US balance sheet reduction by the US Federal Reserve. The central bank has been reducing supply every month to the tune of US$ 40 bn and this could end in June.

Market view

Earlier in the month, the RBI lowered interest rates ushering in a softer interest rate regime and announced a few liquidity measures. We expect an overall shallow interest rate cut cycle of 25-50 bps in next 6-12 months with 25 bps coming up in the April monetary policy meeting and a long pause thereafter. We also expect further proactive liquidity measures by RBI to anchor the overnight rates to the policy rates. The central bank is cognizant of the fact that growth is slowing while liquidity is weakening. The latest GDP data while better than expectations is still lower and growth may remain subdued in the near term. Inflation is expected to further head lower thereby allowing the central bank to lower rates. As already mentioned in the previous outlook, the Budget was in line with expectations and the borrowing numbers too were aligned with expectations.Slowing credit growth and fiscal consolidation are negative impulses for slower growth. We had opined that growth in the third and fourth quarter would be below 6.5%, and growth did come below 6.5%. Having said that the GDP numbers are better than expected by the markets. Headline inflation surprised positively and we believe core headline and core inflation will head down in coming months.

In the US, we believe rate cuts could be to the tune of 50-75 basis points. Growth is indeed slowing down as seen by the weaker data such as GDP growth, lower inflation and other macros. The tariff measures implemented by the US on its top trading partners will hurt growth over the medium term. However, we believe that the US President has been slow in his actions and interest rate expectations are being built up again.

Risks to our view: The risks to our view at this point are as below

1) Currency and liquidity are the near-term problems.

2) Inflationary policies of the US government which can lead to a stronger US dollar.

3) China rebound can impact India in a vicious cycle of lower flows, weak growth and high inflation.

Strategy - We have been maintaining a higher duration across all our funds and guiding the rally in bonds since March 2024. We have already witnessed a more than 50 bps of rally in yields in 10-year bonds since early 2024 but positive demand-supply dynamics for government bonds and expected rate cuts will continue to keep bond markets happy, and we can expect another 20-25 bps of rally in the next 3-6 months. Despite the liquidity measures by the RBI, we expect more of liquidity measures as system liquidity still needs to be addressed. Due to favourable demand supply dynamics and OMOs, we continue to have a higher bias towards government bonds in our duration funds.

Accordingly, from a strategy perspective, we have maintained an overweight duration stance within the respective scheme mandates with a higher allocation to Government bonds.

What should investors do?

• Investors should continue to hold duration across their portfolios.

• Incremental gains in long bonds following rate cuts.

• Directionally see yields for 10 year Gsec closer to 6.5% in next 6 months

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.