Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

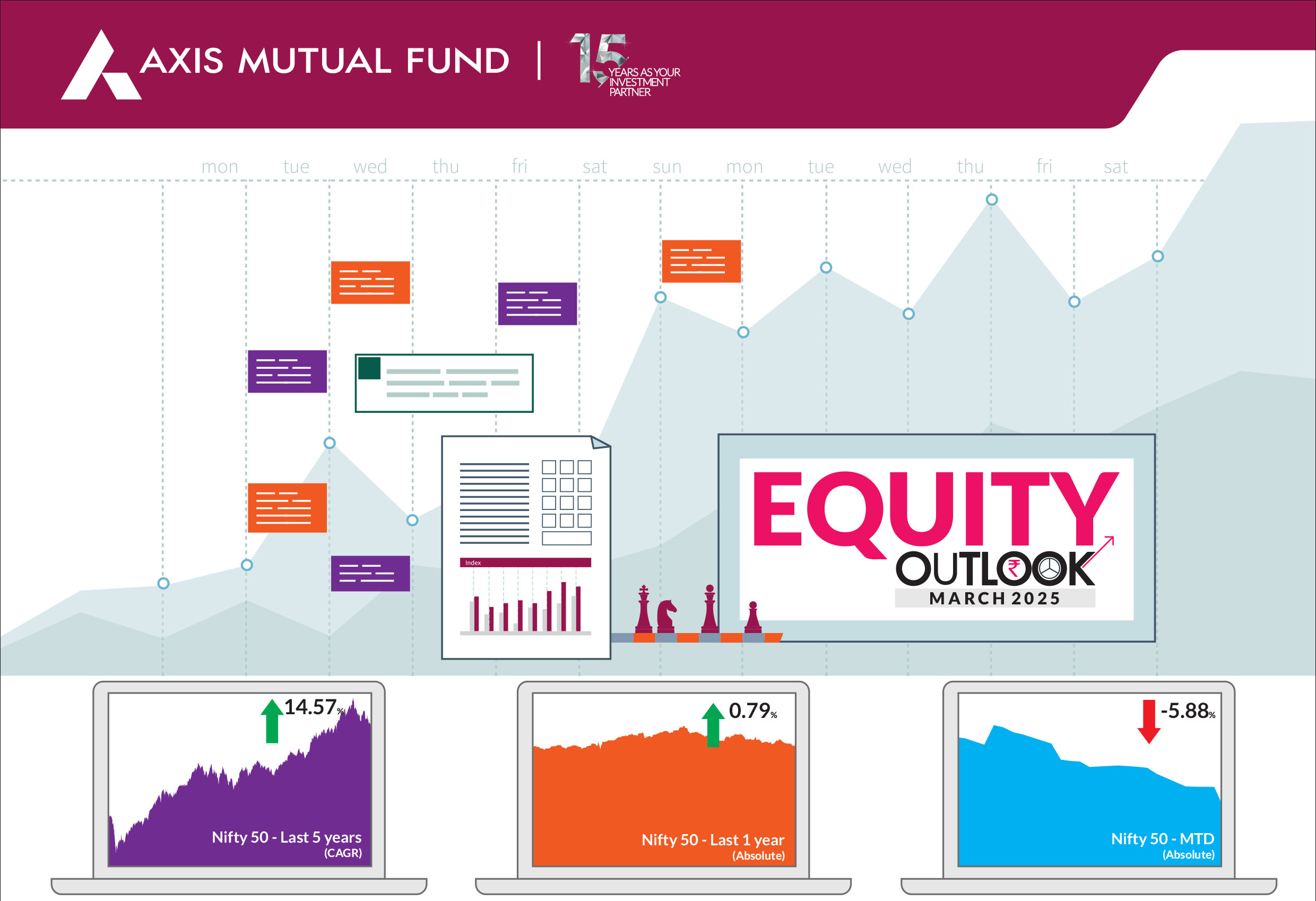

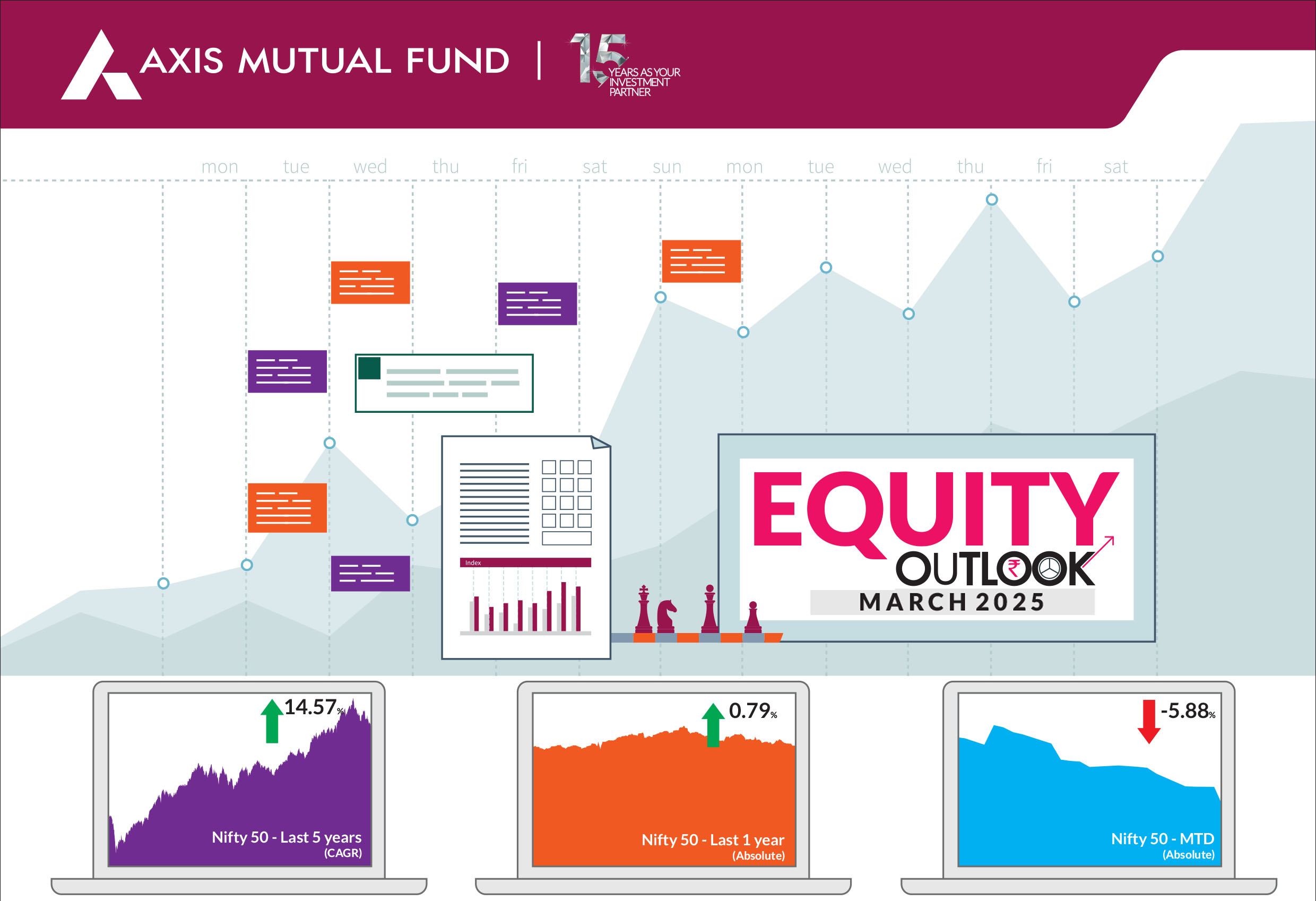

February was a month of anticipating the direction on policies by the new US President. In his first month back in office, the President announced several tariffs - a 25% tariff on goods imported from Mexico and Canada (delayed by one month), a 10% tariff on Chinese goods in addition to the existing 25% on some items, and a 25% tariff on all aluminium and steel imports. Additionally, he has instructed his administration to develop plans for reciprocal tariffs matching those imposed by other countries on U.S. goods. While, despite these measures globally equities have advanced year to date, in India the situation has been quite different. Overall, Indian equities ended February lower, this being the fifth consecutive month of negative returns. The BSE Sensex and Nifty 50 closed 5.6% and 5.9% lower, while the NSE Midcap 100 fell by 10.8% and the NSE Smallcap 100 declined 13.1%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in 2025, with outflows to the tune of U$ 4bn. In contrast, DIIs bought equities worth US$ 6bn. With this the total outflows by FPIs in FY25 stand at US$14 bn while the total inflows by DIIs add upto US$ 54 bn. |

|

This market correction has brought Nifty valuations closer to their one-year forward PE average. Following the underperformance, the India premium has also adjusted and is now much closer to the average compared to other emerging markets. Despite positive triggers such as tax cuts in the union budget, central bank easing measures (including rate cuts, liquidity boosts, and regulatory relaxations), and increased government spending, market sentiment remains subdued. However, we believe economic activity is already rebounding from the lows of September 2024. Improving data points, along with reasonable valuations, particularly in large-cap stocks, are expected to somewhat enhance market sentiment. High growth sectors like Power capital goods, Electronics Manufacturing services, Import substitution themes, Quick commerce, Fintech, capital market related companies, travel and tourism, retail, Hospitals, chemicals and real estate have got re-rated substantially compared to precovid levels. While low growth sectors like lenders, Insurance, FMCG, consumer durables, large cap IT, Pharma, Metals, Agri, Construction, Oil and Gas have not re-rated substantially, in fact some of them have de-rated. In this market, the high growth sectors and companies have well appreciated and consequently substantially re-rated, wherein we carry valuation risk. On the other hand, the companies which have not been substantially re-rated tend to carry growth risk, as growth has been weak in them. Close to two thirds of rise in small and midcap names since March 23 was valuation re-rating and earnings growth contributed to only one third of the increase. While valuations are beginning to make sense in pockets, they still remain elevated relative to historic context and one has to anyways assess this in relation to future prospects. As is with markets, they are not unidirectional and tend to go through bouts of volatility. This correction is both noisy and there are some red flags. We cannot control external factors like tariffs and their impact on countries including India and geopolitical uncertainty. The risks that we can control are ensuring our portfolio construction is geared towards capturing growth tailwinds in various sectors - both structural and opportunistic and building a portfolio that is best placed to weather uncontrollable risks at any point in time. The key triggers to watch out for are the bottoming of rupee depreciation and its implications on liquidity /lending rates and valuations. A revival in retail credit growth and tax cuts can help spur consumption. Near-term market volatility is expected to continue, driven by both global and domestic uncertainties. In the current scenario, we believe that earnings growth is unlikely to support valuation expansion in near term. Meanwhile, GDP growth improved to 6.2% YoY in Q3FY25 vs 5.6% in Q2FY25 (revised up from 5.4%). The uptick in GDP was led primarily by strength in both private consumption (supported by a buoyant rural economy) and government consumption (pickup in government spending). As such, while private consumption grew 6.9% YoY; government consumption rose to a five quarter high of 8.3% YoY. In terms of sectors, we maintain a bias towards quick commerce, travel/tourism, select automobiles and capital market beneficiaries while having exposure to other segments (retail, jewellery, modern retail) within consumer discretionary. Information technology, healthcare , renewable capex and power transmission/distribution companies, defense are the other themes we favour. While the budget was flat on capex, we do believe select capex and PSU companies will perform well during the course of the year. While no one can predict how long this decline will last or where the bottom might be, it is important to outline a few factors for investors, especially given the significant noise that accompanies market downturns. Staying invested in the long run and during periods of market declines is crucial. To set the context, in early 2020, markets fell notably, and many investors were caught waiting on the sidelines. Many investors started investing when the runup was steep. It is pertinent to note that notional gains and losses are a part of investing cycle. Investors should likely use these declines as an opportunity to build portfolios based on an asset allocation approach. If one views India's long term growth story, the fundamentals are supported by: 1) strong macro stability, characterized by improving terms of trade, a declining primary deficit, and declining inflation 2) annual earnings growth in the mid- to high-teens over the next 3-5 years, driven by an emerging private capital expenditure cycle, the re-leveraging of corporate balance sheets, and a structural increase in discretionary consumption. |

Source: Bloomberg, Axis MF Research.