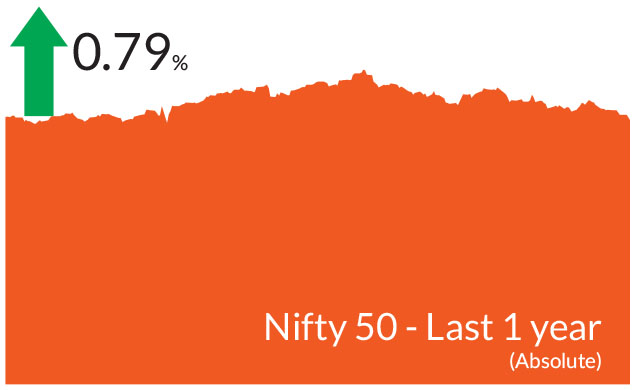

► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

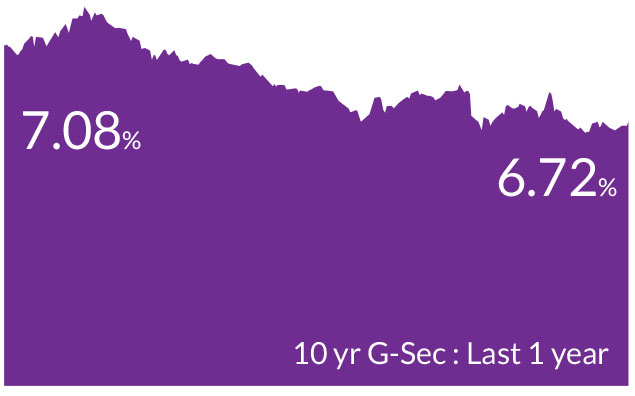

► Start of a shallow rate cycle post February cuts.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

February was a month of anticipating the direction on policies by the

new US President. In his first month back in office, the President

announced several tariffs - a 25% tariff on goods imported from Mexico

and Canada (delayed by one month), a 10% tariff on Chinese goods in

addition to the existing 25% on some items, and a 25% tariff on all

aluminium and steel imports. Additionally, he instructed his

administration to develop plans for reciprocal tariffs matching those

imposed by other countries on U.S. goods. While, despite these

measures globally equities have advanced year to date, in India the

situation has been quite different.

US Treasury yields fell in February after the tariff announcement by the US President on its top trading partners, China, Mexico and Canada led to nervousness in markets. Yields on 10-year US Treasuries fell 33 basis points over the month ending at 4.21% while equities also declined. This decline from above 4.8% was driven by a deteriorating outlook for US growth, as a series of data indicated weak consumer and business sentiment. In India, February was a month of key events - union budget, monetary policy and liquidity measures which led to infusion of Rs 3 lac crores in the banking system. The 10-year government bond yields rose by 3 basis points.

Inflation falls further : Headline inflation fell to 4.3% in January from 5.2% in December 2023, led by a faster than expected moderation in food prices especially vegetables with the onset of winter months. Core inflation continues to remain below 4% for over 12 months. We anticipate headline inflation to decrease further to 3.8% by end of the year due to good rabi and kharif crop harvests and lower vegetable prices.

Third quarter GDP growth improves : GDP growth improved to 6.2% YoY in Q3FY25 vs 5.6% in Q2FY25 (revised up from 5.4%). The uptick in GDP was led primarily by strength in both private consumption (supported by a buoyant rural economy) and government consumption (pickup in government spending). private consumption grew 6.9% YoY; 100bps pickup from the previous quarter. Moreover, FY25 advance estimate puts annual consumption growth at 7.6%, implying Q4FY25 private consumption growth at 9.9%YY. Government consumption rose to a five quarter high of 8.3% YoY. GVA growth at 6.2% was led by broad-based growth across sectors after a disappointing 2QFY25 performance.

Rupee depreciates but stabilizing slowly : The rupee continued to depreciate, declining 1% against the US dollar largely on account of the US Dollar strengthening and FPI outflows. However, the depreciation has been slower and we believe the rupee could be stabilizing near these levels.

US treasury yields decline in February : February saw yields lower to the tune of 35-40 bps. The two factors that led to the rally in treasuries were slowing growth and macros in the US balance sheet reduction by the US Federal Reserve. The central bank has been reducing supply every month to the tune of US$ 40 bn and this could end in June.

US Treasury yields fell in February after the tariff announcement by the US President on its top trading partners, China, Mexico and Canada led to nervousness in markets. Yields on 10-year US Treasuries fell 33 basis points over the month ending at 4.21% while equities also declined. This decline from above 4.8% was driven by a deteriorating outlook for US growth, as a series of data indicated weak consumer and business sentiment. In India, February was a month of key events - union budget, monetary policy and liquidity measures which led to infusion of Rs 3 lac crores in the banking system. The 10-year government bond yields rose by 3 basis points.

Key Market Events

RBI lowers interest rates and infuses liquidity : The central bank auctioned threeyear dollar/rupee buy/sell swaps worth $10 billion and this witnessed strong demand amid persistently tight liquidity deficit in the system. Earlier in the month, the Reserve Bank of India (RBI) ushered in a softer interest rate regime by lowering repo rate by 25 bps. Additionally, considering the concerns of banks needing to allocate additional funds to meet the Liquidity Coverage Ratio (LCR) requirements, the RBI postponed the implementation of the revised LCR norms until March 2026. This decision allows banks ample time to comply without experiencing liquidity disruptions.Inflation falls further : Headline inflation fell to 4.3% in January from 5.2% in December 2023, led by a faster than expected moderation in food prices especially vegetables with the onset of winter months. Core inflation continues to remain below 4% for over 12 months. We anticipate headline inflation to decrease further to 3.8% by end of the year due to good rabi and kharif crop harvests and lower vegetable prices.

Third quarter GDP growth improves : GDP growth improved to 6.2% YoY in Q3FY25 vs 5.6% in Q2FY25 (revised up from 5.4%). The uptick in GDP was led primarily by strength in both private consumption (supported by a buoyant rural economy) and government consumption (pickup in government spending). private consumption grew 6.9% YoY; 100bps pickup from the previous quarter. Moreover, FY25 advance estimate puts annual consumption growth at 7.6%, implying Q4FY25 private consumption growth at 9.9%YY. Government consumption rose to a five quarter high of 8.3% YoY. GVA growth at 6.2% was led by broad-based growth across sectors after a disappointing 2QFY25 performance.

Rupee depreciates but stabilizing slowly : The rupee continued to depreciate, declining 1% against the US dollar largely on account of the US Dollar strengthening and FPI outflows. However, the depreciation has been slower and we believe the rupee could be stabilizing near these levels.

US treasury yields decline in February : February saw yields lower to the tune of 35-40 bps. The two factors that led to the rally in treasuries were slowing growth and macros in the US balance sheet reduction by the US Federal Reserve. The central bank has been reducing supply every month to the tune of US$ 40 bn and this could end in June.

Equity Market View:

In terms of sectors, we maintain a bias towards quick commerce, travel/tourism, select automobiles and capital market beneficiaries while having exposure to other segments (retail, jewellery, modern retail) within consumer discretionary. Information technology, healthcare, renewable capex and power transmission/distribution companies, defense are the other themes we favour. While the budget was flat on capex, we do believe select capex and PSU companies will perform well during the course of the year.While no one can predict how long this decline will last or where the bottom might be, it is important to outline a few factors for investors, especially given the significant noise that accompanies market downturns. Staying invested in the long run and during periods of market declines is crucial. To set the context, in early 2020, markets fell notably, and many investors were caught waiting on the sidelines. Many investors started investing when the runup was steep. It is pertinent to note that notional gains and losses are a part of investing cycle. Investors should likely use these declines as an opportunity to build portfolios based on an asset allocation approach.

If one views India's long term growth story, the fundamentals are supported by: 1) strong macro stability, characterized by improving terms of trade, a declining primary deficit, and declining inflation 2) annual earnings growth in the mid- to high-teens over the next 3-5 years, driven by an emerging private capital expenditure cycle, the releveraging of corporate balance sheets, and a structural increase in discretionary consumption.

Debt Market View:

Earlier in the month, the RBI lowered interest rates ushering in a softer interest rate regime and announced a few liquidity measures. We expect an overall shallow interest rate cut cycle of 25-50 bps in next 6- 12 months with 25 bps coming up in the April monetary policy meeting and a long pause thereafter. We also expect further proactive liquidity measures by RBI to anchor the overnight rates to the policy rates. The central bank is cognizant of the fact that growth is slowing while liquidity is weakening. The latest GDP data while better than expectations is still lower and growth may remain subdued in the near term. Inflation is expected to further head lower thereby allowing the central bank to lower rates. As already mentioned in the previous outlook, the Budget was in line with expectations and the borrowing numbers too were aligned with expectations.Slowing credit growth and fiscal consolidation are negative impulses for slower growth. We had opined that growth in the third and fourth quarter would be below 6.5%, and growth did come below 6.5%. Having said that the GDP numbers are better than expected by the markets. Headline inflation surprised positively and we believe core headline and core inflation will head down in coming months.

In the US, we believe rate cuts could be to the tune of 50-75 basis points. Growth is indeed slowing down as seen by the weaker data such as GDP growth, lower inflation and other macros. The tariff measures implemented by the US on its top trading partners will hurt growth over the medium term. However, we believe that the US President has been slow in his actions and interest rate expectations are being built up again.

Source: Bloomberg, Axis MF Research.