Happy New Year from the entire team at Axis MF!

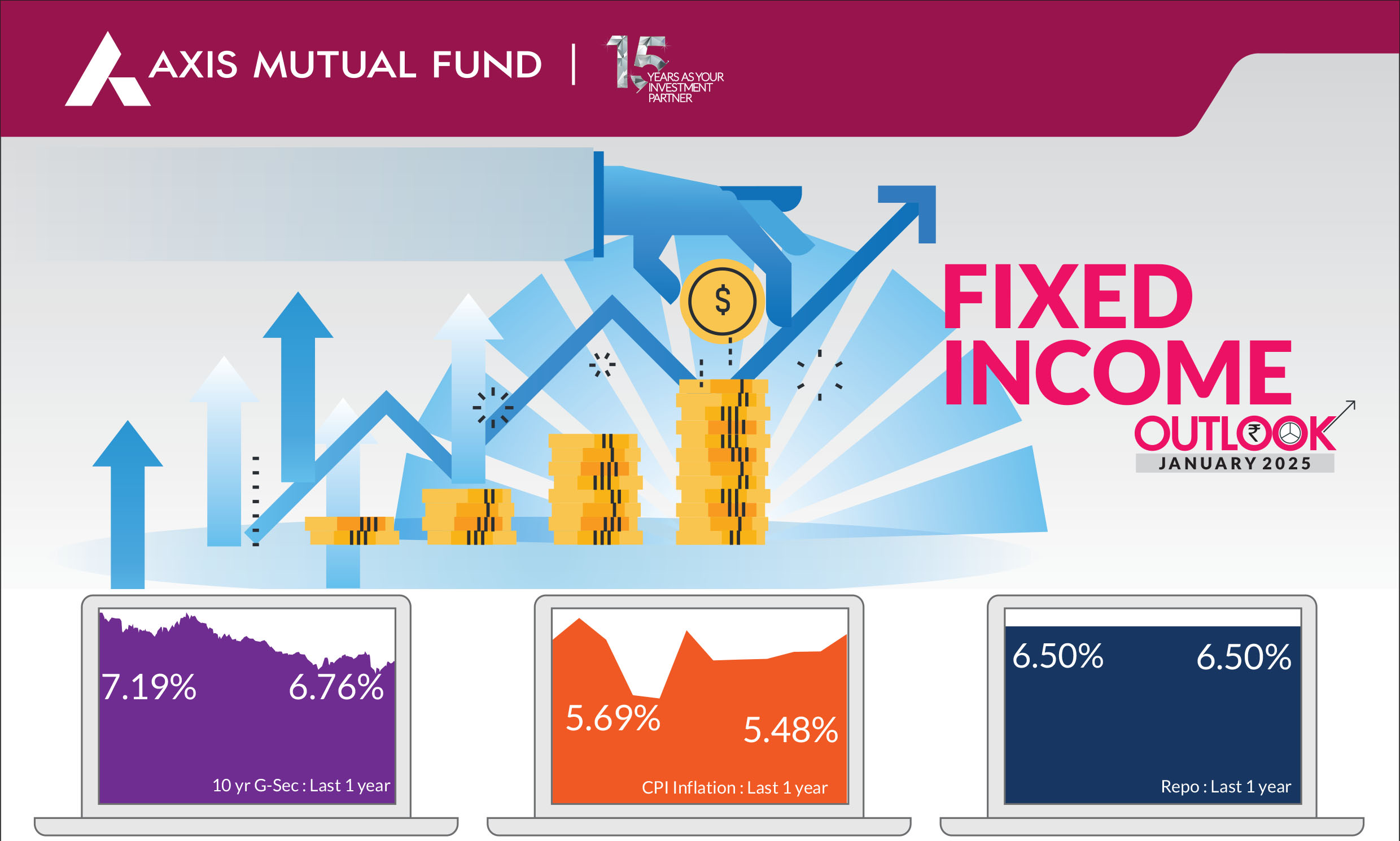

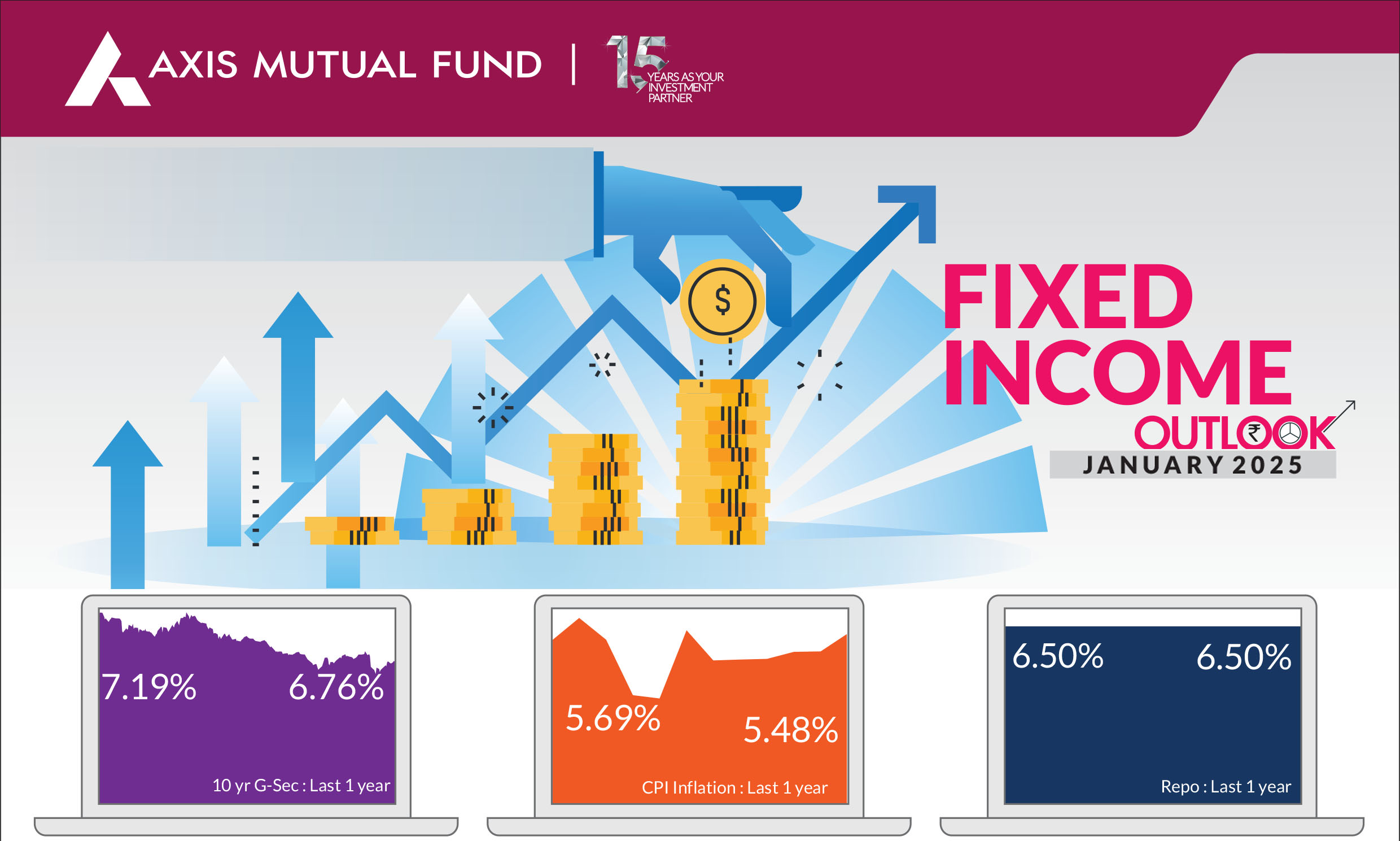

Overall, yields ended lower globally in lieu of rate cuts. In the US, the yields on the 10 year

Treasuries ended 31 bps lower while in India, yields on 10 year government bonds fell 43 bps

in anticipation of action by the Reserve Bank of India (RBI). Heading in 2025, we anticipate

several key themes to unfold: (a) US President Elect's America First policies to lead to stronger

growth (b) slowing growth in the rest of the world, (c) weakness in China on account of tariffs

measures imposed by the US (d) lower growth in India leading to rate cuts, and (e) tight

liquidity conditions in India for most of the year unless the central bank intervenes or India

benefits from forex inflows. To address these themes, we believe the central bank will cut

rates by 50 basis points and that the RBI will employ additional liquidity tools such as OMO

purchases, swap facilities, and VRR. Despite

strong growth, we expect US inflation to settle at

2.5-2.8% and the Us Federal Reserve (Fed) to

lower rates by 50-75 bps in 2025.

► Commodities: 2024 was favorable for precious metals, with gold reaching record highs. We anticipate global oil prices to remain low, and although industrial metals began the year strongly, their rally eventually faded. Looking forward, we expect commodities to remain subdued. Additionally, actions taken by China and escalating geopolitical conflicts could influence commodity prices.

► Rest of the world: A lot depends on the US policies that could impact countries to varying degrees. In Europe and the UK, we expect the focus to remain on growth and the central banks to follow further monetary policy easing. In contrast, headline inflation in Japan is expected to remain higher allowing the central bank of Japan to raise policy rates during the course of 2025.

Macro Outlook for India

We believe that fixed income markets will be in a sweet spot on account of various drivers as outlined below:Growth: The three negative impulses for slower growth are (a) slowing credit growth, (b) fiscal consolidation (c) exports could be hit due to tariffs imposed by the US. However, we believe that growth could be in the range of 6.8% in FY25 and 6.4% in FY26. It is important to note here that the growth is coming off a high base and will still be positive and not expected to fall materially.

Inflation: Headline inflation has risen in the short term but is expected to stay around 4.5% next year, while core inflation has remained below 4% for over a year. We anticipate headline inflation to decrease further due to good rabi and kharif crop harvests and lower vegetable prices. Core inflation might see a slight increase due to rupee depreciation, but weaker commodities and slower growth are unlikely to cause major inflation surprises.

Currency: Rupee has been a stellar performer for the last few years. However, it can see some near term depreciation on fears of (a) tariffs imposed by the US (b) strong US dollar (c) weak growth and (d) FPI outflows. Having said that, the rupee has done reasonably well compared to other emerging market countries and we do not expect significant depreciation hereon.

Banking Liquidity: We expect liquidity to remain in a tight range particularly in the first half of the year unless the central bank intervenes by way of OMO purchases or uses tools such as VRR/CRR. High seasonal growth in currency in circulation and continuous forex outflows would lead to banking liquidity to remain in deficit for most of the first half of 2025.

Fiscal Position: Despite the possibility of some tax measures to spur consumption we believe the government will adhere to its path of fiscal consolidation of 4.9% of GDP in FY25 and 4.5% in FY26. While slow growth can lead to some risks to revenue budgets, we do believe that government would like to continue to adhere to fiscal consolidation and do not see any major deviations in fiscal deficit for rating upgrades.

Favourable demand supply dynamics: Bond markets will continue to have favourable demand supply dynamics due to (a) fiscal consolidation to 4.9% and 4.5% thereof (b) real money AUM growth. (Real Money AAUM is defined as Insurance, pension fund and provident fund AAUM). Additionally, the dynamics would become more favourable due to the proposed change in Liquidity Coverage Ratio guidelines or the possibility of inclusion in Bloomberg indices that could result in probable fresh inflows of US$20-25 billion.

Based on these themes, we believe that from February, every policy meeting will be an opportunity for a rate cut based on the below

1) By the next policy meeting, the central bank would have clarity on inflation and growth numbers to some extent

2) The Union Budget would be rolled out and if government continues on the path of fiscal consolidation, which we believe it would, monetary easing will be the likely outcome

3) The new President of the US would be sworn in on January 20, 2025, and by the time of our policy meeting, all the currency movements and market reactions would be priced in.

As growth at 6-6.5% continues to remain strong, we believe this cycle could be shallow and do not anticipate more than 50 bps of rate cuts in the next 6-12 months.

Risks to our view: The risks to our view at this point are as below

1) Currency and liquidity are the near-term problems. We remain slightly expensive on REER basis and hence can see some currency depreciation.

2) US political theme and Inflationary policies of the incoming government which can lead to a stronger US dollar.

3) China rebound can impact India in a vicious cycle of lower flows, weak growth and high inflation.

Strategy : We have been maintaining a higher duration across all our funds and guiding the rally in bonds since March 2024. We have already witnessed a more than 50 bps of rally in yields in 10-year bonds since the beginning of the year but positive demand-supply dynamics for government bonds and expected rate cuts will continue to keep bond markets happy, and we can expect another 20-25 bps of rally in the next 3-6 months. We believe that banking liquidity would be addressed somewhat in the Jan- March 2025 quarter due to CRR cuts but the RBI will have to do more to manage banking liquidity. Due to favourable demand supply dynamics, we continue to have a higher bias towards government bonds in our duration funds. Accordingly, from a strategy perspective, we have maintained an overweight duration stance within the respective scheme mandates with a higher allocation to Government bonds.

What should investors do?

• Investors should continue to hold duration across their portfolios.

• Incremental gains in long bonds would largely be post rate cuts.

• Directionally see yields for 10 year Gsec closer to 6.5% in next 6 months.

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.