Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

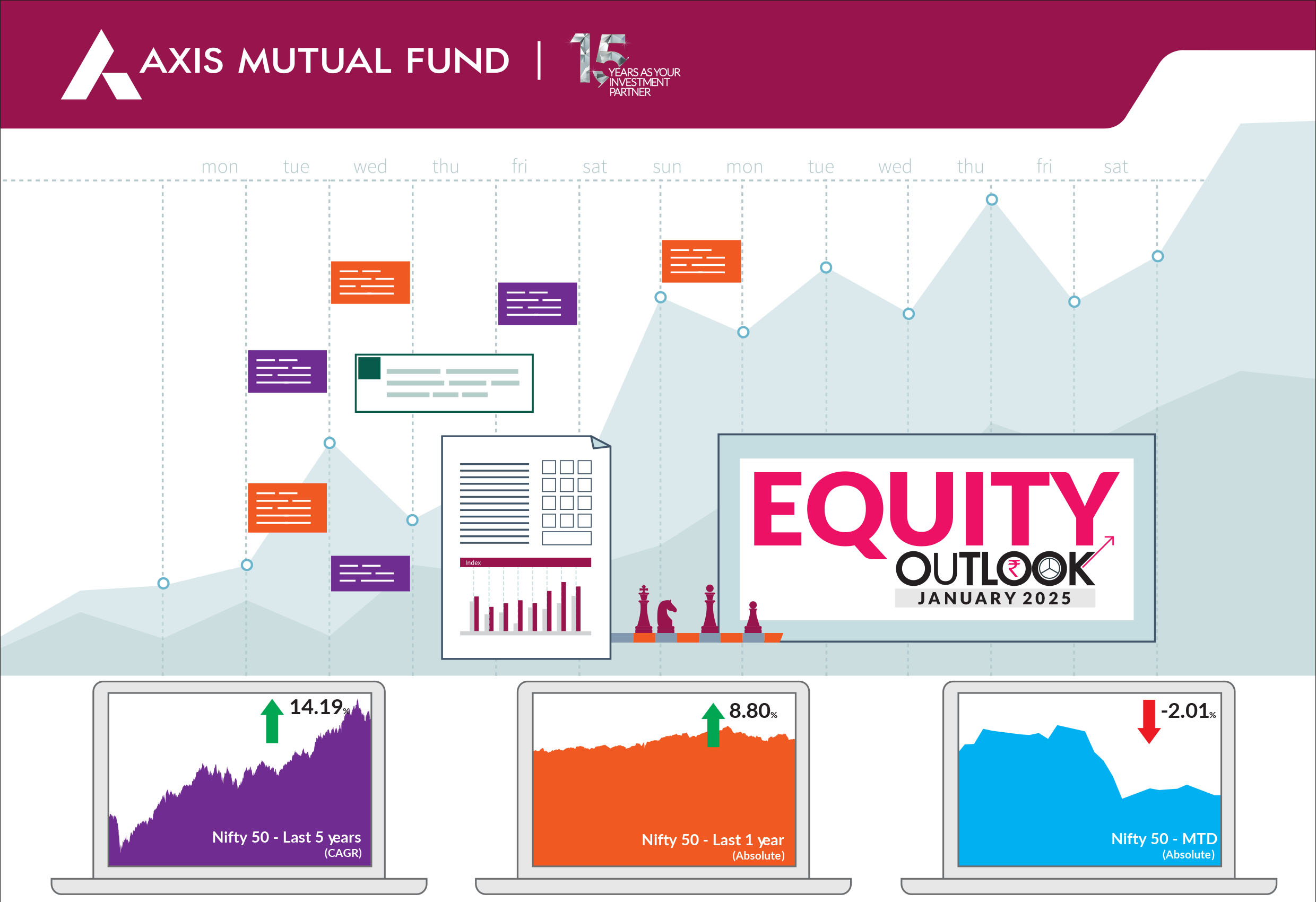

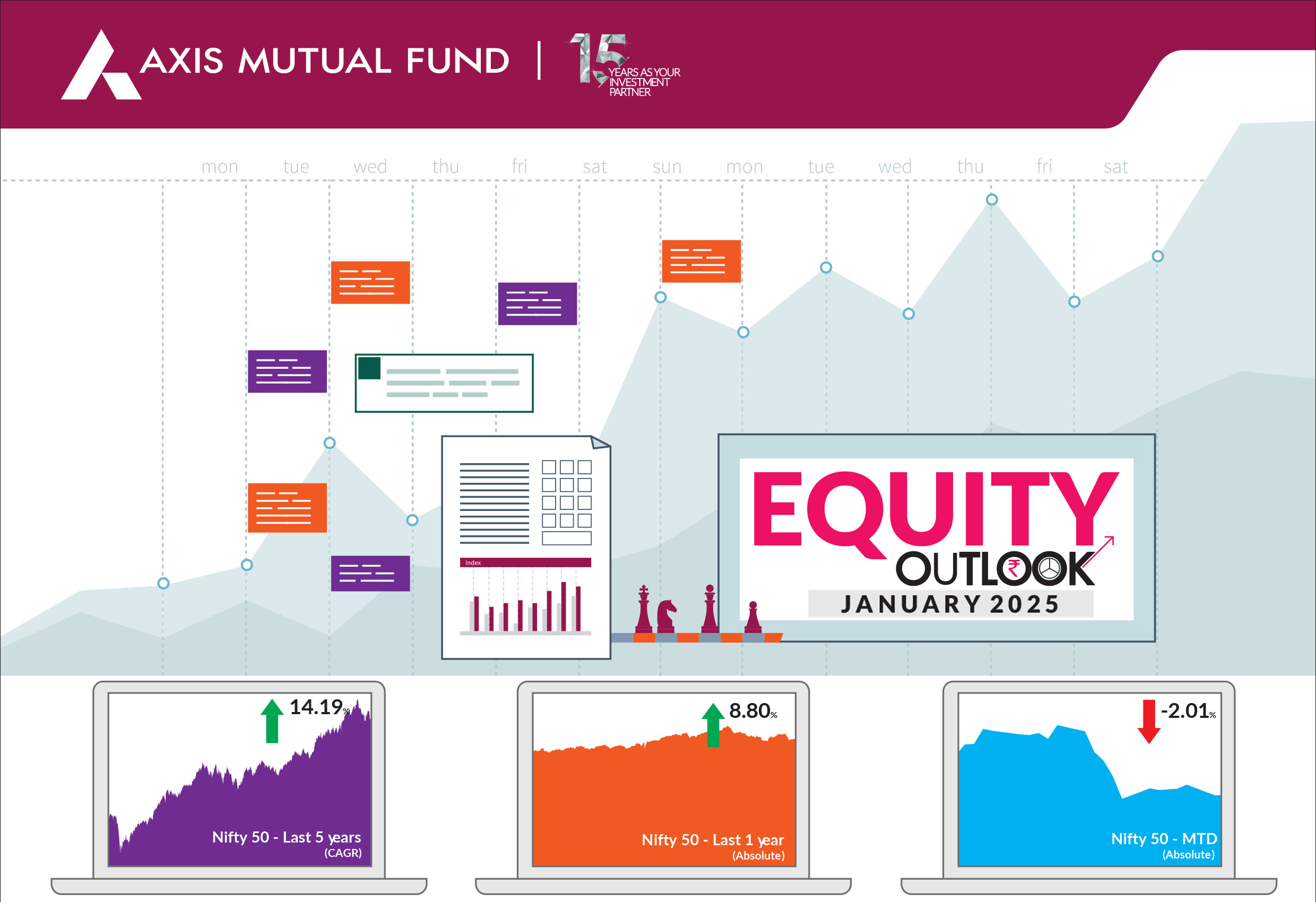

Happy New Year from the entire team at Axis MF! In December, equities initially showed gains, recovering some losses, but failed to maintain the momentum and ended lower. The BSE Sensex and Nifty 50 closed 2% down, while the NSE Midcap 100 rose by 1.4% and the NSE Smallcap 100 advanced 0.6%. 2024 remained promising for most of the year against a backdrop of general elections and union budget. However, the journey wasn't without its challenges. Elevated valuations, indices hitting lifetime highs, disappointing earnings growth, and persistent geopolitical tensions cast a shadow on the markets, causing a dip in October and November. Despite these challenges, the year ended on a high note. Equities rallied setting new records month after month. The Sensex soared past the 85,000 mark, while the Nifty 50 crossed 26,000. By year's end, the BSE Sensex had climbed 8.9%, the Nifty 9.6%, the Nifty Midcap 100 an impressive 23.4%, and the Nifty Smallcap 100 surged 23.9%. |

|

We believe that markets are gravitating towards companies with clear earnings growth visibility and a lower likelihood of significant earnings downgrades. Accordingly we believe the themes in 2025 are likely to be split into two halves. In India, 2024 was a year of optimism albeit for most of the year, but 2025 may bring more tempered expectations. We expect growth to remain moderate given the fiscal consolidation and slower credit growth. Many segments of the economy are showing signs of a slowdown given the higher base and this has translated into weaker corporate earnings. Companies have seen superior earning growth led by margin improvement, strong recovery post Covid, along with government spending and policy actions. We believe factors like margin improvement may not continue for long, however continuation of prudent capital allocation policy by government to boost both capex and consumption, may drive earnings recovery. The strength of the US dollar coupled with stimulus measures in China have led to foreign fund outflows. However, these have been counterbalanced by the robust domestic fund inflows. Nonetheless, India remains one of the fastest-growing economies globally. The tariffs on China and other countries proposed by US President-elect could significantly impact global trade. However, during his first term, the tariffs on China benefited India, and this time, India might again be able to turn these trade restrictions into an opportunity. It is pertinent to note that we begin 2025 after the strong rallies of 2023 and 2024, and elevated valuations thereof. Key events have caused volatility and rallies in equities. While our economy has been on a strong footing so far, equities are off the all-time highs and have seen a correction in the last three months. Yet valuations remain elevated. Going forward market performance could be influenced by earnings growth and absolute valuations. Given near-term growth challenges, likely muted foreign institutional investor (FII) inflows, and subdued earnings expectations, significant valuation expansion seems unlikely. We expect 2025 to be a year of stock picking across market caps. The recent corrections in mid and small caps could present opportunities to increase exposure to select stocks. For the first half of 2025, key themes to watch include sectors such as Information Technology, Pharma, Quick Commerce, Capital Market beneficiaries, Travel/Tourism, Renewable Capex, Power Transmission & Distribution, EMS, Defense, and select Auto companies with new product launches on the horizon. However, many of these sectors currently have high valuations. By the second half of 2025, markets may shift focus to potential triggers in underperforming sectors such as Lenders, FMCG, and IT. Over the past three years, the capital goods sector has shown strong earnings growth, outperforming other sectors. After peaking in May 2024 and consolidating, it remains superior, especially as some consumption segments have weakened. Renewables, power transmission, defense orders, and electronics manufacturing drive demand. We expect select capex and PSU companies to perform well in 2025. |

Source: Bloomberg, Axis MF Research.