► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect lower interest rates in the last quarter of FY25.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-2-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

Happy New Year from the entire team at Axis MF!

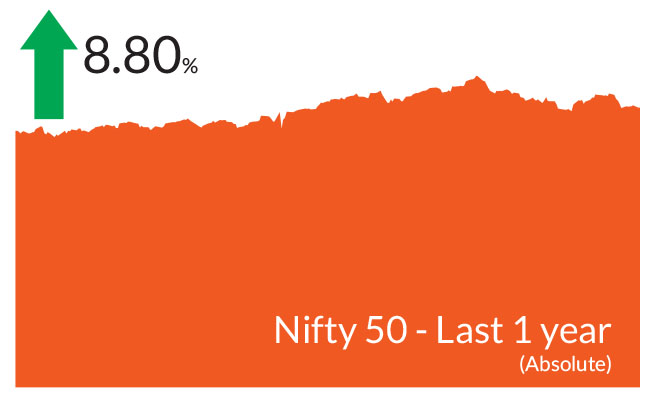

In December, equities initially showed gains, recovering some losses, but failed to maintain the momentum and ended lower. The BSE Sensex and Nifty 50 closed 2% down, while the NSE Midcap 100 rose by 1.4% and the NSE Smallcap 100 advanced 0.6%.

2024 remained promising for most of the year against a backdrop of general elections and union budget. However, the journey wasn't without its challenges. Elevated valuations, indices hitting lifetime highs, disappointing earnings growth, and persistent geopolitical tensions cast a shadow on the markets, causing a dip in October and November. Despite these challenges, the year ended on a high note. Equities rallied setting new records month after month. The Sensex soared past the 85,000 mark, while the Nifty 50 crossed 26,000. By year's end, the BSE Sensex had climbed 8.9%, the Nifty 9.6%, the Nifty Midcap 100 an impressive 23.4%, and the Nifty Smallcap 100 surged 23.9%.

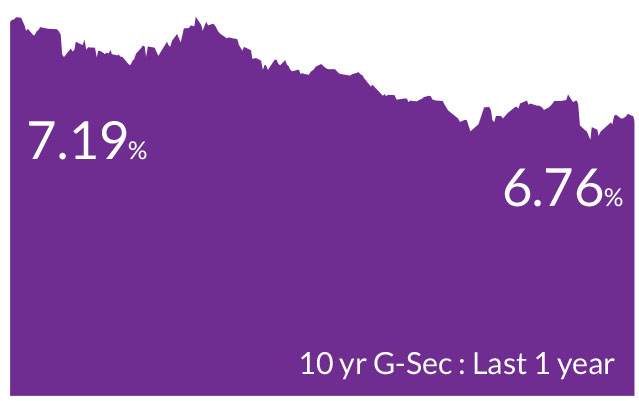

Overall, yields ended lower globally in lieu of rate cuts. In the US, the yields on the 10 year Treasuries ended 31 bps lower while in India, yields on 10 year government bonds fell 43 bps in anticipation of action by the Reserve Bank of India (RBI). Heading in 2025, we anticipate several key themes to unfold: (a) US President Elect's America First policies to lead to stronger growth (b) slowing growth in the rest of the world, (c) weakness in China on account of tariffs measures imposed by the US (d) lower growth in India leading to rate cuts, and (e) tight liquidity conditions in India for most of the year unless the central bank intervenes or India benefits from forex inflows. To address these themes, we believe the central bank will cut rates by 50 basis points and that the RBI will employ additional liquidity tools such as OMO purchases, swap facilities, and VRR. Despite strong growth, we expect US inflation to settle at 2.5-2.8% and the Us Federal Reserve (Fed) to lower rates by 50-75 bps in 2025.

In December, equities initially showed gains, recovering some losses, but failed to maintain the momentum and ended lower. The BSE Sensex and Nifty 50 closed 2% down, while the NSE Midcap 100 rose by 1.4% and the NSE Smallcap 100 advanced 0.6%.

2024 remained promising for most of the year against a backdrop of general elections and union budget. However, the journey wasn't without its challenges. Elevated valuations, indices hitting lifetime highs, disappointing earnings growth, and persistent geopolitical tensions cast a shadow on the markets, causing a dip in October and November. Despite these challenges, the year ended on a high note. Equities rallied setting new records month after month. The Sensex soared past the 85,000 mark, while the Nifty 50 crossed 26,000. By year's end, the BSE Sensex had climbed 8.9%, the Nifty 9.6%, the Nifty Midcap 100 an impressive 23.4%, and the Nifty Smallcap 100 surged 23.9%.

Overall, yields ended lower globally in lieu of rate cuts. In the US, the yields on the 10 year Treasuries ended 31 bps lower while in India, yields on 10 year government bonds fell 43 bps in anticipation of action by the Reserve Bank of India (RBI). Heading in 2025, we anticipate several key themes to unfold: (a) US President Elect's America First policies to lead to stronger growth (b) slowing growth in the rest of the world, (c) weakness in China on account of tariffs measures imposed by the US (d) lower growth in India leading to rate cuts, and (e) tight liquidity conditions in India for most of the year unless the central bank intervenes or India benefits from forex inflows. To address these themes, we believe the central bank will cut rates by 50 basis points and that the RBI will employ additional liquidity tools such as OMO purchases, swap facilities, and VRR. Despite strong growth, we expect US inflation to settle at 2.5-2.8% and the Us Federal Reserve (Fed) to lower rates by 50-75 bps in 2025.

Equity Market View:

After robust inflows of US$20.7 bn in 2023, Foreign Portfolio Investors (FPIs) adopted a cautious stance in 2024, riding a financial see-saw. As election season approached, they pulled back, resulting in a US$4 bn outflows. However, post-election optimism from June to September saw a resurgence, with inflows reaching US$14 bn. This optimism was short-lived, as October and November witnessed another retreat, with outflows totaling US$13.5 bn. Despite the volatility, FPI flows managed to stay just above water, ending the year with a modest net positive of US$124 mn. In contrast, Domestic Institutional Investors (DIIs) played the perfect counterbalance to the FPIs, consistently adding inflows each month. The October-November outflows from FPIs were countered by a substantial US$18 bn inflows from DIIs. By the end of the year, DIIs had amassed a total of ~US$63 bn in inflows.We believe that markets are gravitating towards companies with clear earnings growth visibility and a lower likelihood of significant earnings downgrades. Accordingly we believe the themes in 2025 are likely to be split into two halves.

It is pertinent to note that we begin 2025 after the strong rallies of 2023 and 2024, and elevated valuations thereof. Key events have caused volatility and rallies in equities. While our economy has been on a strong footing so far, equities are off the all-time highs and have seen a correction in the last three months. Yet valuations remain elevated. Going forward market performance could be influenced by earnings growth and absolute valuations. Given near-term growth challenges, likely muted foreign institutional investor (FII) inflows, and subdued earnings expectations, significant valuation expansion seems unlikely. We expect 2025 to be a year of stock picking across market caps. The recent corrections in mid and small caps could present opportunities to increase exposure to select stocks.

For the first half of 2025, key themes to watch include sectors such as Information Technology, Pharma, Quick Commerce, Capital Market beneficiaries, Travel/Tourism, Renewable Capex, Power Transmission & Distribution, EMS, Defense, and select Auto companies with new product launches on the horizon. However, many of these sectors currently have high valuations. By the second half of 2025, markets may shift focus to potential triggers in underperforming sectors such as Lenders, FMCG, and IT. Over the past three years, the capital goods sector has shown strong earnings growth, outperforming other sectors. After peaking in May 2024 and consolidating, it remains superior, especially as some consumption segments have weakened. Renewables, power transmission, defense orders, and electronics manufacturing drive demand. We expect select capex and PSU companies to perform well in 2025.

Debt Market View:

We believe that fixed income markets will be in a sweet spot on account of various drivers as outlined below:Growth: The three negative impulses for slower growth are (a) slowing credit growth, (b) fiscal consolidation (c) exports could be hit due to tariffs imposed by the US. However, we believe that growth could be in the range of 6.8% in FY25 and 6.4% in FY26. It is important to note here that the growth is coming off a high base and will still be positive and not expected to fall materially.

Inflation: Headline inflation has risen in the short term but is expected to stay around 4.5% next year, while core inflation has remained below 4% for over a year. We anticipate headline inflation to decrease further due to good rabi and kharif crop harvests and lower vegetable prices. Core inflation might see a slight increase due to rupee depreciation, but weaker commodities and slower growth are unlikely to cause major inflation surprises.

Currency: Rupee has been a stellar performer for the last few years. However, it can see some near term depreciation on fears of (a) tariffs imposed by the US (b) strong US dollar (c) weak growth and (d) FPI outflows. Having said that, the rupee has done reasonably well compared to other emerging market countries and we do not expect significant depreciation hereon.

Banking Liquidity: We expect liquidity to remain in a tight range particularly in the first half of the year unless the central bank intervenes by way of OMO purchases or uses tools such as VRR/CRR. High seasonal growth in currency in circulation and continuous forex outflows would lead to banking liquidity to remain in deficit for most of the first half of 2025.

Fiscal Position: Despite the possibility of some tax measures to spur consumption we believe the government will adhere to its path of fiscal consolidation of 4.9% of GDP in FY25 and 4.5% in FY26. While slow growth can lead to some risks to revenue budgets, we do believe that government would like to continue to adhere to fiscal consolidation and do not see any major deviations in fiscal deficit for rating upgrades.

Favourable demand supply dynamics: Bond markets will continue to have favourable demand supply dynamics due to (a) fiscal consolidation to 4.9% and 4.5% thereof (b) real money AUM growth. (Real Money AAUM is defined as Insurance, pension fund and provident fund AAUM). Additionally, the dynamics would become more favourable due to the proposed change in Liquidity Coverage Ratio guidelines or the possibility of inclusion in Bloomberg indices that could result in probable fresh inflows of US$20-25 billion.

Based on these themes, we believe that from February, every policy meeting will be an opportunity for a rate cut based on the below

1) By the next policy meeting, the central bank would have clarity on inflation and growth numbers to some extent

2) The Union Budget would be rolled out and if government continues on the path of fiscal consolidation, which we believe it would, monetary easing will be the likely outcome

3) The new President of the US would be sworn in on January 20, 2025, and by the time of our policy meeting, all the currency movements and market reactions would be priced in.

As growth at 6-6.5% continues to remain strong, we believe this cycle could be shallow and do not anticipate more than 50 bps of rate cuts in the next 6-12 months.

Source: Bloomberg, Axis MF Research.