•

Expect lower interest rates in

the second half of FY25.

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year maturity and 1-

3-year maturity assets are

best strategies to invest in the

current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

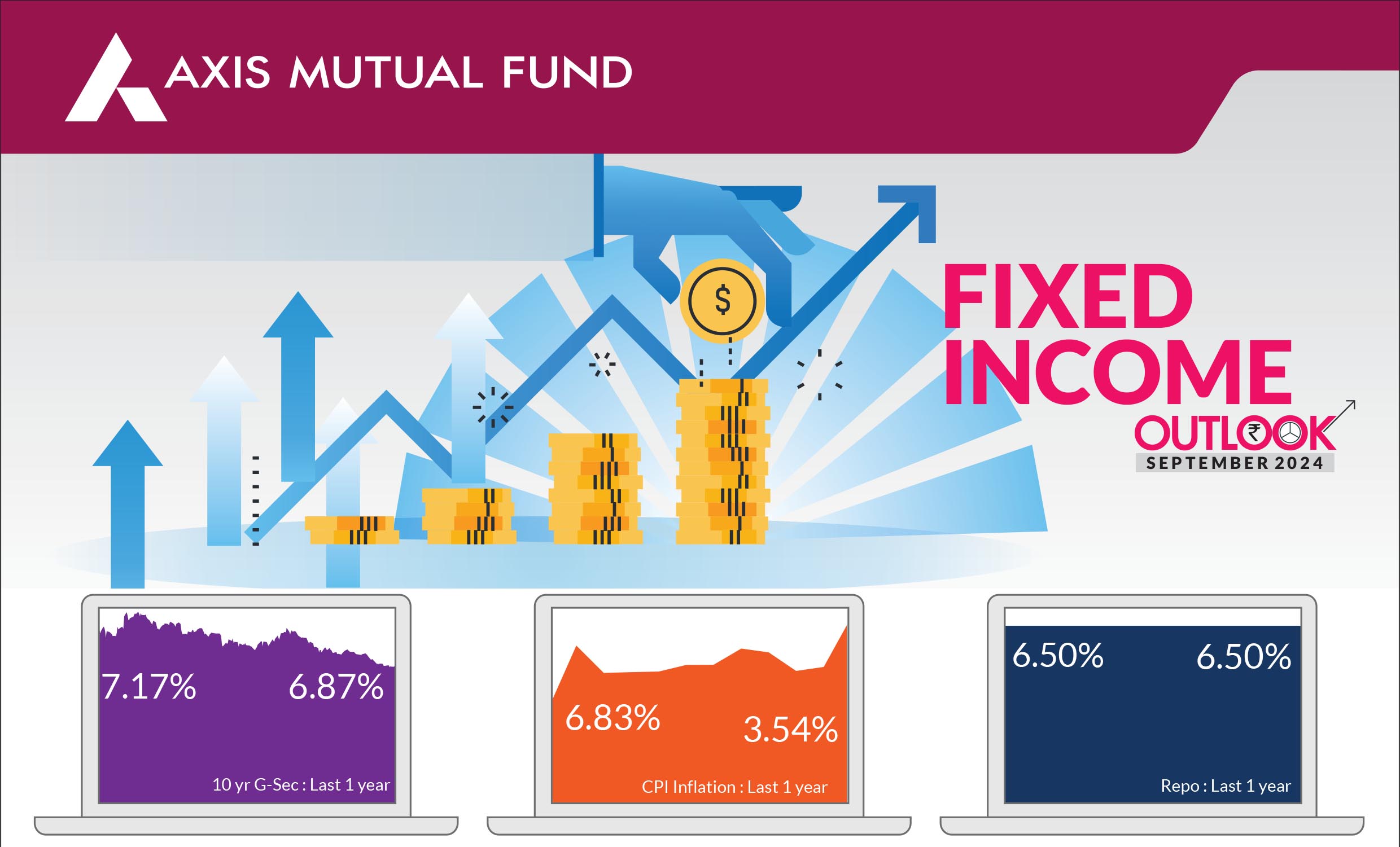

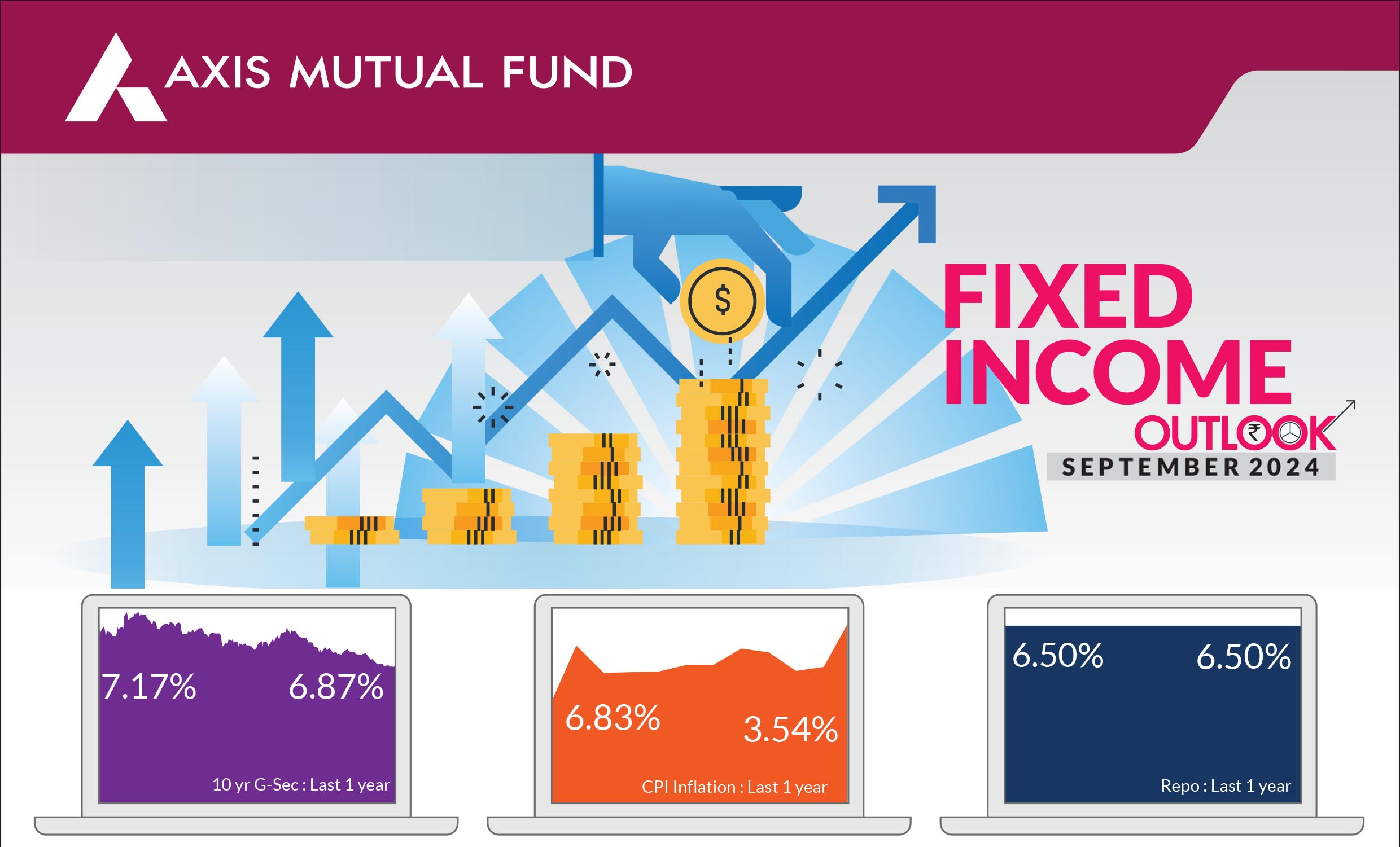

Overall, the month was favourable for Indian Bonds buoyed by a significant rise in US unemployment data, which led to fears of a slowdown and increased recession risks in the US. Expectations of lower inflation and rate cuts in the US from September led to a rally of 6 bps in the 10-year bond yields, ending at 6.87% while the swaps yields ended lower by 20 bps over the month. Foreign Portfolio Investors (FPI) flows was positive in August and stood at US$2.1 bn over the month. Year to date, cumulative debt inflows amounted to US$13.1bn. US bond yields priced in aggressive rate cuts and ended 13 bps lower at 3.90%.

►Global interest rates heading lower :

At

the annual Jackson Hole symposium in last

week of August, Fed Chair Jerome Powell

said "the time has come for policy to

adjust," thereby boosting debt and equities

alike globally. Fed futures are now pricing

in 100 bps cut till Dec 2024 and a total of

225 bps by end of 2025. In Europe, slowing

wage growth will prompt the European

Central Bank to further lower interest rates while in the UK, the Bank of England

lowered rates by 25 bps to 5%. Meanwhile, the Reserve Bank of India (RBI) held

interest rates steady but maintained a cautious outlook. In contrast, the Bank of

Japan surprisingly hiked the policy rate from a range of 0.0-0.1% to 0.25% at its

July monetary policy meeting to curb the yen's fall against the US dollar.

► GDP growth softens due to base effects :

As widely expected, GDP growth

moderated to 6.7% yoy in June 2024, compared to 7.8% in the previous quarter

due to base effects. Growth for the quarter was led by a recovery in private

consumption which rose to a seven-quarter high of 7.4% YoY, while gross fixed

capital formation came in at 7.5% yoy, above the previous quarter's level.

Government consumption remained weak as spending was restricted in view of

general elections. Net exports contributed positively, with growth in exports

surpassing imports. Meanwhile, GVA for the quarter rose to 6.8% vs 6.3% in the

previous quarter. GVA growth outpaced GDP growth as net indirect taxes

declined in the current quarter. In terms of sectors, manufacturing activity

slowed; construction and electricity, gas & water supply improved. Both services

and agricultural growth gained momentum. Within consumption, rural demand is

picking up, as suggested by 1) rural FMCG volumes 2) improvement in twowheeler

sales; 3) favourable monsoon trends and kharif sowing, 4) moderating

inflation; and 5) earnings commentary from FMCG firms.

► Inflationary pressures ease : Headline inflation declined from 5.1% in June to 3.5% in July, mainly driven by favorable base effects. Core inflation continued to remain low at~3.4%. Going forward, headline inflation for month of August too could remain at 3.5% due to a fall in vegetable prices. Geopolitical tensions, particularly in the Middle East have increased which led to volatility in crude prices; yet crude ended 2.4% lower. Weaker China macro data and fears of global growth slowdown led to lower commodity prices. We will be watchful of these developments and how they impact inflation which we believe may not be material.

► Banking liquidity in surplus : Banking liquidity continued to remain in surplus while the overnight funding rate stayed low which helped keep money market curve yields in check. We believe that once festive season starts from September, banking liquidity would turn in to deficit zone and we might see some volatility in money market yields due to pick up in credit growth and higher deposit supply.

► Inflationary pressures ease : Headline inflation declined from 5.1% in June to 3.5% in July, mainly driven by favorable base effects. Core inflation continued to remain low at~3.4%. Going forward, headline inflation for month of August too could remain at 3.5% due to a fall in vegetable prices. Geopolitical tensions, particularly in the Middle East have increased which led to volatility in crude prices; yet crude ended 2.4% lower. Weaker China macro data and fears of global growth slowdown led to lower commodity prices. We will be watchful of these developments and how they impact inflation which we believe may not be material.

► Banking liquidity in surplus : Banking liquidity continued to remain in surplus while the overnight funding rate stayed low which helped keep money market curve yields in check. We believe that once festive season starts from September, banking liquidity would turn in to deficit zone and we might see some volatility in money market yields due to pick up in credit growth and higher deposit supply.

Market view

Over the last two months, US yields have rallied by more than 60 bps due to expectations of rate cuts by the Fed. The Fed chair almost confirmed a September rate cut in his Jackson Hole meeting. The key questions are the extent and speed of these rate cuts. We anticipate that the US central bank would be cautious and guided by data. Hence we do not expect more than 75 bps cut till Dec 2024. US bond markets could likely continue to trade in a range of 3.65-4.10% following rate cuts but high US fiscal deficits will likely prevent a massive rally in US yieldsBack home, in its August policy meeting, the RBI maintained a status quo stance on rates with a cautious approach. The policy's impact on our bond markets was minimal. Our headline inflation figures were lower, and we believe a significant fall in vegetable prices will result in the August CPI to be ~3.5%. The CPI average for the second quarter will be substantially lower than RBI expectations (~4% v/s 4.4% RBI projections)

Our core view on bonds remains constructive driven by lower-than-expected inflation (in India) in the second quarter, Fed rate cuts and favourable demand supply dynamics for bonds. We believe that if the Fed reduces rates in September and monsoon is normal, there is a strong likelihood that the RBI will shift to a neutral policy stance in the October or December monetary policy meeting. Given the strong economic growth and rising geopolitical risks we expect the RBI to be cautious and not aggressive in cutting rates. We expect 50 bps of rate cut in this cycle in next 6-12 months. Consequently, we continue to maintain higher duration and larger allocation to government bonds across all our funds.

Risks to view

Market positioning is heavy (both traders and investors), which means everyone is positioned for rally in bonds. However, any unexpected geopolitical events that drive up oil and commodity prices, disrupting the disinflation process, could cause a short-term increase in yields and volatility in our bond markets.

Positioning & Strategy

From a strategy perspective, we have maintained an overweight duration stance within the respective scheme mandates with a higher allocation to Government bonds. Accordingly, investors should continue to hold duration across their portfolios. Investors would need to be patient for a further rally as actual rate cuts in India would be delayed to the second half of FY 25. They could use this opportunity to invest in Short to Medium term funds with tactical allocation to gilt funds against a backdrop of lower inflation, favorable demand supply dynamics for government bonds and continued flows from FPIs.

Source: Bloomberg, Axis MF Research.