Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

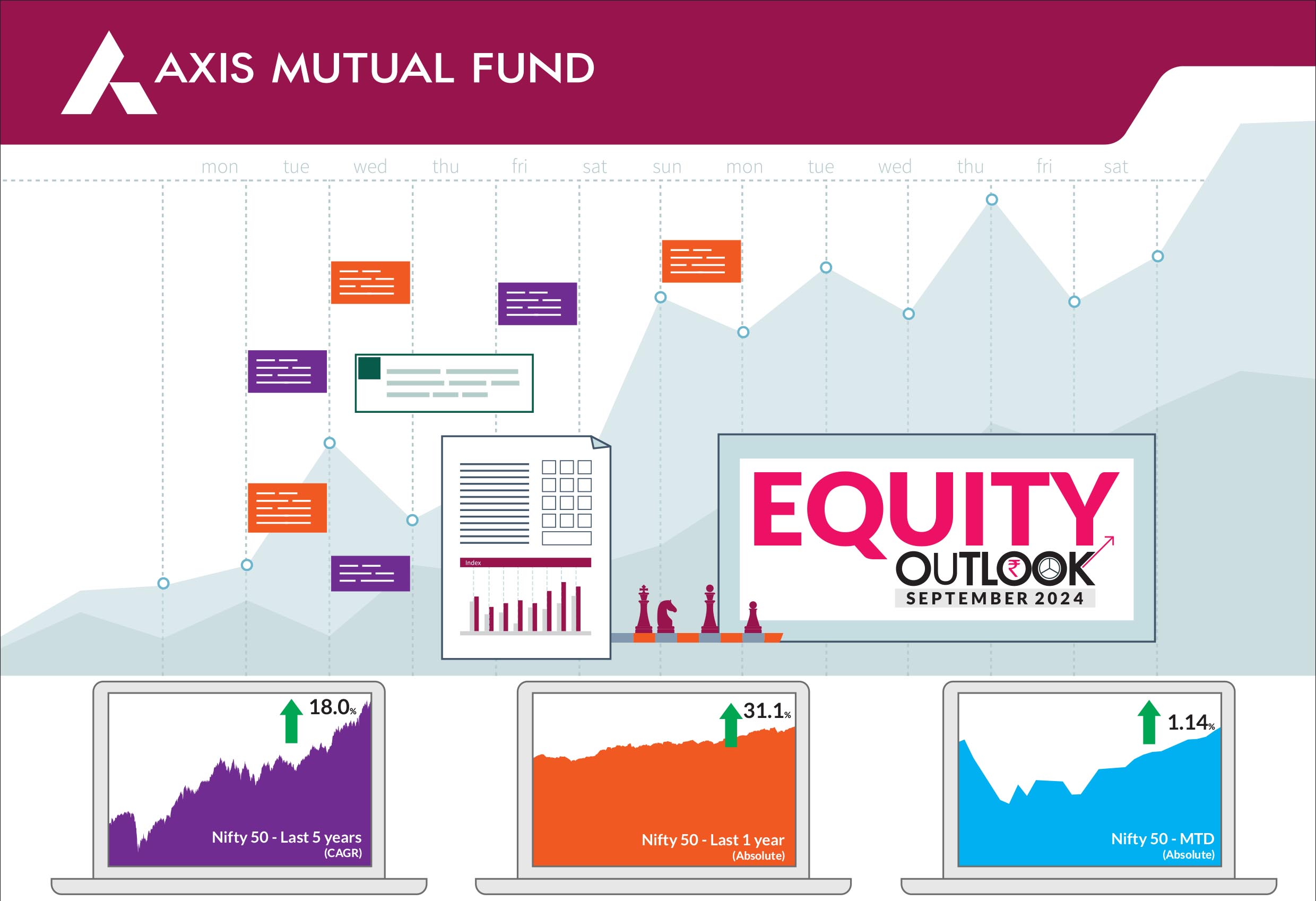

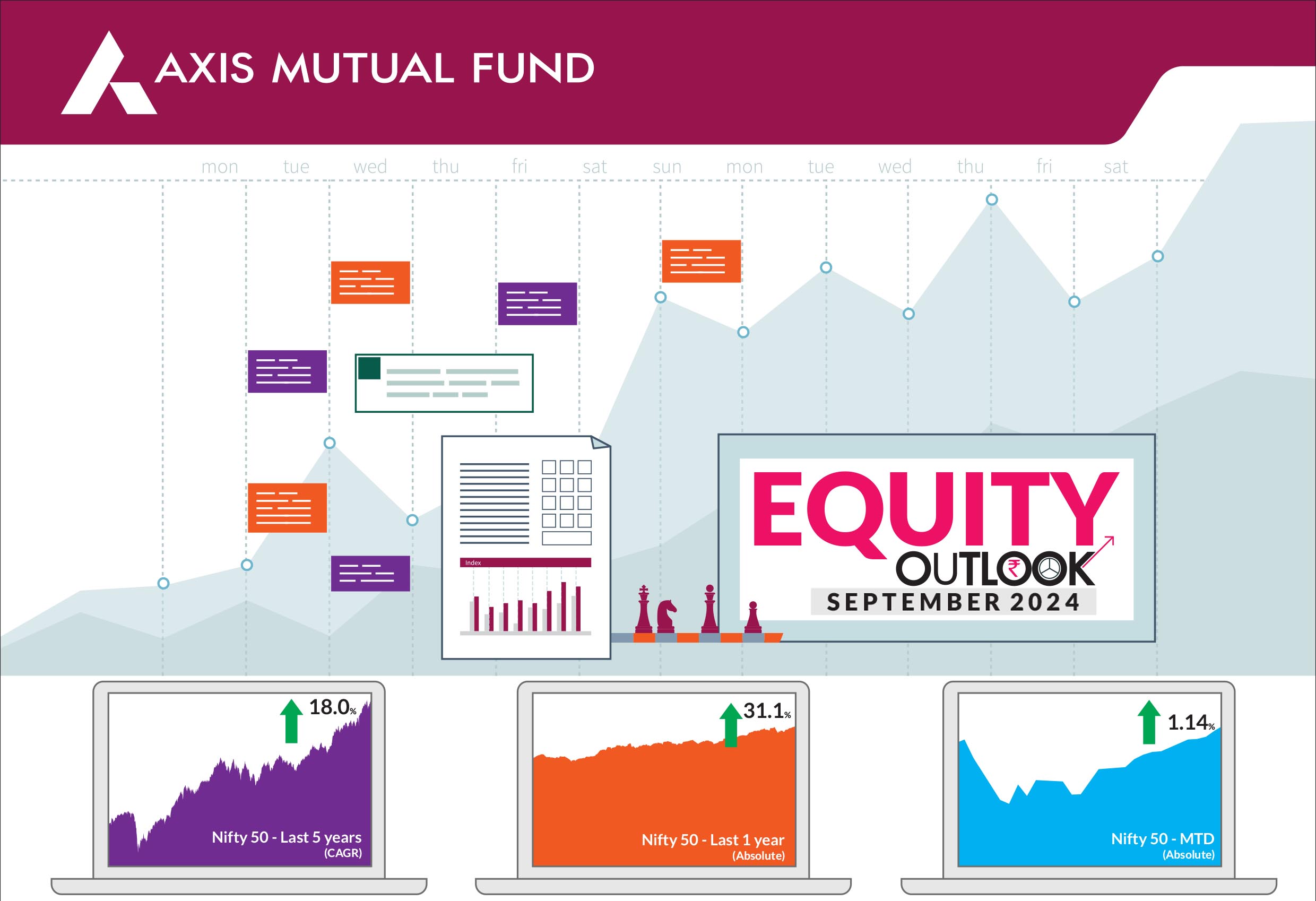

Indian equites ended August higher with most of the gains coming in 12 consecutive trading sessions. Initially, equities were buffeted by the unwinding of yen carry trades as a result of the interest rate hike by the Bank of Japan. In addition, slowing macro data in the US suggesting a slowdown impacted markets. Nonetheless, markets regained their footing later on better data and expectations of lower interest rates by the US Federal Reserve. Consequently, the BSE Sensex and the NIFTY 50 ended the month at all time highs and ended 0.8% and 1.1% up respectively. Both the mid-caps and small caps gained during the month but underperformed the large caps. The NIFTY Midcap 100 ended the month higher 0.5% while NIFTY Small Cap 100 ended 0.9% up. The number of stocks trading above their respective 200- day moving averages was little changed at 94%. The advance-decline line was up 2% in August while volatility was down. |

Following the earnings upgrades seen in the last few quarters, we have seen cuts come across all forward estimates after the first quarter earnings. Earnings growth itself remained weak this quarter, with overall revenue growing at just 8%, despite weak base quarter as well. EBIT growth slowed to +4%. PAT growth was close to zero. Weak earnings of oil and gas companies tempered overall earnings growth, while auto, telecom, real estate and telecom reported improved earnings. |

The important events for the Indian markets have passed. The likely triggers going forward will be global cues such as interest rate cuts by the US Federal Reserve in its September monetary policy, the outcome of presidential elections in November and geopolitical risks. Interest rate cuts in the US could result in FPI inflows in emerging markets and India could be one of the beneficiaries. However, Indian markets do remain relatively expensive with the Nifty EPS for FY25 currently at 20x. We may see normalisation in some of the segments where the run-up has been particularly sharp. In addition, equity supply has also picked up with stake sales by promoters, PE and large pipeline of IPOs. We believe that any declines are likely opportunities to increase exposure to equities and investors should stay invested at all times based on investor goals, investment horizon and risk profile with a long-term view. India remains one of the fastest growing economies globally. Macros remain strong with an easing inflation cycle, progress of monsoons and robust economic growth. GDP growth moderated to 6.7% yoy in Q1FY25, compared to 7.8% in the previous quarter due to base effects. Growth for the quarter was led by a recovery in private consumption which rose to a seven-quarter high of 7.4% yoy, while gross fixed capital formation came in at 7.5% yoy, above the previous quarter's level. Government consumption remained weak as spending was restricted in view of general elections. We have been highlighting since many months, that we see a recovery in rural consumption and many indicators have been suggestive of the same. - increasing FMCG volumes, improving two-wheeler sales, favourable monsoon trends, and kharif sowing, moderating inflation; and management commentary from FMCG firms. Furthermore, with the beginning of the festive season, we expect demand to be broad based. The trend of premiumisation continues, benefiting various segments within consumer discretionary. Automobiles, real estate, and high-end retail have all experienced growth. The housing sector is witnessing increased absorption across India, and with the government's emphasis on affordable housing, building materials and related industries are poised to benefit. This ties in well with our recently concluded NFO on Axis Consumption Fund. Meanwhile, the GDP data also suggested private investments is showing signs of revival with improving investment intentions, increasing order books, and supporting the robust trend in public and household capital expenditure. This coupled with multiple enablers such as deleveraged corporate balance sheets, healthy profitability, rising domestic demand, and increasing capacity utilization bodes well for the capex cycle. Accordingly, we are overweight on infrastructure, manufacturing, utilities and transport. We also maintain a bias to holdings in sectors that can benefit from government policies such as defense and power but underweight the export-oriented segment, due to slowing global growth. |

Source: Bloomberg, Axis MF Research.