► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect lower interest rates in the second half of Fy25.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-3-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-3-year maturity assets are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

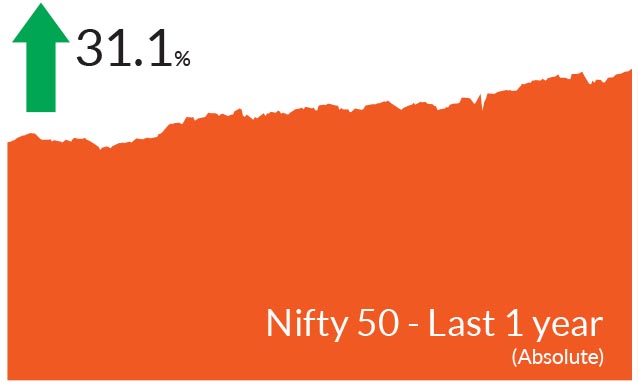

Indian equites ended August higher with most of the gains coming in 12

consecutive trading sessions. Initially, equities declined due to the

unwinding of yen carry trades as a result of the interest rate hike by the

Bank of Japan. In addition, slowing macro data in the US suggesting a

slowdown impacted markets. Nonetheless, markets regained their

footing later on better data and expectations of lower interest rates by

the US Federal Reserve. Consequently, the BSE Sensex and the NIFTY

50 ended the month at all time highs and ended 0.8% and 1.1% up

respectively. Both the mid-caps and small caps gained during the month

but underperformed the large caps. The NIFTY Midcap 100 ended the

month higher 0.5% while NIFTY Small Cap 100 ended 0.9% up. The

number of stocks trading above their respective 200- day moving

averages was little changed at 94%. The advance-decline line was up 2%

in August while volatility was down.

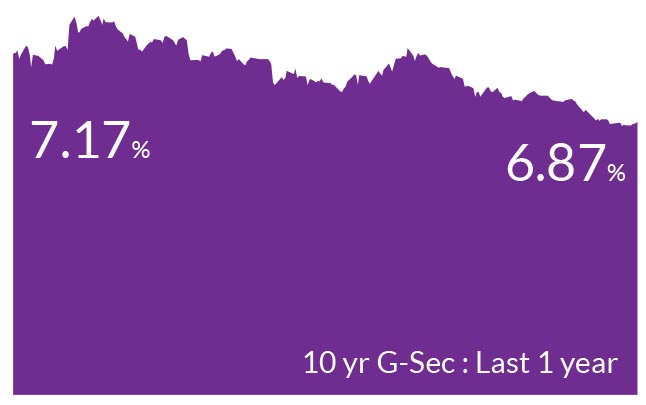

Overall, the month was favourable for Indian Bonds buoyed by a significant rise in US unemployment data, which led to fears of a slowdown and increased recession risks in the US. Expectations of lower inflation and rate cuts in the US from September led to a rally of 6 bps in the 10-year bond yields, ending at 6.87% while the swaps yields ended lower by 20 bps over the month. Foreign Portfolio Investors (FPI) flows was positive in August and stood at US$2.1 bn over the month. Year to date, cumulative debt inflows amounted to US$13.1bn. US bond yields priced in aggressive rate cuts and ended 13 bps lower at 3.90%.

► GDP growth softens due to base effects : As widely expected, GDP growth moderated to 6.7% yoy in June 2024, compared to 7.8% in the previous quarter due to base effects. Growth for the quarter was led by a recovery in private consumption which rose to a seven-quarter high of 7.4% YoY, while gross fixed capital formation came in at 7.5% yoy, above the previous quarter's level. Government consumption remained weak as spending was restricted in view of general elections. Net exports contributed positively, with growth in exports surpassing imports. Meanwhile, GVA for the quarter rose to 6.8% vs 6.3% in the previous quarter. GVA growth outpaced GDP growth as net indirect taxes declined in the current quarter. In terms of sectors, manufacturing activity slowed; construction and electricity, gas & water supply improved. Both services and agricultural growth gained momentum. Within consumption, rural demand is picking up, as suggested by 1) rural FMCG volumes 2) improvement in twowheeler sales; 3) favourable monsoon trends and kharif sowing, 4) moderating inflation; and 5) earnings commentary from FMCG firms.

► Inflationary pressures ease : Headline inflation declined from 5.1% in June to 3.5% in July, mainly driven by favorable base effects. Core inflation continued to remain low at~3.4%. Going forward, headline inflation for month of August too could remain at 3.5% due to a fall in vegetable prices. Geopolitical tensions, particularly in the Middle East have increased which led to volatility in crude prices; yet crude ended 2.4% lower. Weaker China macro data and fears of global growth slowdown led to lower commodity prices. We will be watchful of these developments and how they impact inflation which we believe may not be material.

► Banking liquidity in surplus : Banking liquidity continued to remain in surplus while the overnight funding rate stayed low which helped keep money market curve yields in check. We believe that once festive season starts from September, banking liquidity would turn in to deficit zone and we might see some volatility in money market yields due to pick up in credit growth and higher deposit supply.

Overall, the month was favourable for Indian Bonds buoyed by a significant rise in US unemployment data, which led to fears of a slowdown and increased recession risks in the US. Expectations of lower inflation and rate cuts in the US from September led to a rally of 6 bps in the 10-year bond yields, ending at 6.87% while the swaps yields ended lower by 20 bps over the month. Foreign Portfolio Investors (FPI) flows was positive in August and stood at US$2.1 bn over the month. Year to date, cumulative debt inflows amounted to US$13.1bn. US bond yields priced in aggressive rate cuts and ended 13 bps lower at 3.90%.

Key Market Events

►Global interest rates heading lower : At the annual Jackson Hole symposium in last week of August, Fed Chair Jerome Powell said "the time has come for policy to adjust," thereby boosting debt and equities alike globally. Fed futures are now pricing in 100 bps cut till Dec 2024 and a total of 225 bps by end of 2025. In Europe, slowing wage growth will prompt the European Central Bank to further lower interest rates while in the UK, the Bank of England lowered rates by 25 bps to 5%. Meanwhile, the Reserve Bank of India (RBI) held interest rates steady but maintained a cautious outlook. In contrast, the Bank of Japan surprisingly hiked the policy rate from a range of 0.0-0.1% to 0.25% at its July monetary policy meeting to curb the yen's fall against the US dollar.► GDP growth softens due to base effects : As widely expected, GDP growth moderated to 6.7% yoy in June 2024, compared to 7.8% in the previous quarter due to base effects. Growth for the quarter was led by a recovery in private consumption which rose to a seven-quarter high of 7.4% YoY, while gross fixed capital formation came in at 7.5% yoy, above the previous quarter's level. Government consumption remained weak as spending was restricted in view of general elections. Net exports contributed positively, with growth in exports surpassing imports. Meanwhile, GVA for the quarter rose to 6.8% vs 6.3% in the previous quarter. GVA growth outpaced GDP growth as net indirect taxes declined in the current quarter. In terms of sectors, manufacturing activity slowed; construction and electricity, gas & water supply improved. Both services and agricultural growth gained momentum. Within consumption, rural demand is picking up, as suggested by 1) rural FMCG volumes 2) improvement in twowheeler sales; 3) favourable monsoon trends and kharif sowing, 4) moderating inflation; and 5) earnings commentary from FMCG firms.

► Inflationary pressures ease : Headline inflation declined from 5.1% in June to 3.5% in July, mainly driven by favorable base effects. Core inflation continued to remain low at~3.4%. Going forward, headline inflation for month of August too could remain at 3.5% due to a fall in vegetable prices. Geopolitical tensions, particularly in the Middle East have increased which led to volatility in crude prices; yet crude ended 2.4% lower. Weaker China macro data and fears of global growth slowdown led to lower commodity prices. We will be watchful of these developments and how they impact inflation which we believe may not be material.

► Banking liquidity in surplus : Banking liquidity continued to remain in surplus while the overnight funding rate stayed low which helped keep money market curve yields in check. We believe that once festive season starts from September, banking liquidity would turn in to deficit zone and we might see some volatility in money market yields due to pick up in credit growth and higher deposit supply.

Market View

Equity MarketsThe important events for the Indian markets have passed. The likely triggers going forward will be global cues such as interest rate cuts by the US Federal Reserve in its September monetary policy, the outcome of presidential elections in November and geopolitical risks. Interest rate cuts in the US could result in FPI inflows in emerging markets and India could be one of the beneficiaries. However, Indian markets do remain relatively expensive with the Nifty EPS for FY25 currently at 20x. We may see normalisation in some of the segments where the runup has been particularly sharp. In addition, equity supply has also picked up with stake sales by promoters, PE and large pipeline of IPOs. We believe that any declines are likely opportunities to increase exposure to equities and investors should stay invested at all times based on investor goals, investment horizon and risk profile with a long-term view. India remains one of the fastest growing economies globally. Macros remain strong with an easing inflation cycle, progress of monsoons and robust economic growth.

We have been highlighting since many months, that we see a recovery in rural consumption and many indicators have been suggestive of the same as already mentioned above. The trend of premiumisation continues, benefiting various segments within consumer discretionary. Automobiles, real estate, and high-end retail have all experienced growth. The housing sector is witnessing increased absorption across India, and with the government's emphasis on affordable housing, building materials and related industries are poised to benefit.

Debt Markets

Over the last two months, US yields have rallied by more than 60 bps due to expectations of rate cuts by the Fed. The Fed chair almost confirmed a September rate cut in his Jackson Hole meeting. The key questions are the extent and speed of these rate cuts. We anticipate that the US central bank would be cautious and guided by data. Hence we do not expect more than 75 bps cut till Dec 2024. US bond markets could likely continue to trade in a range of 3.65-4.10% following rate cuts but high US fiscal deficits will likely prevent a massive rally in US yields

Back home, in its August policy meeting, the RBI maintained a status quo stance on rates with a cautious approach. The policy's impact on our bond markets was minimal. Our headline inflation figures were lower, and we believe a significant fall in vegetable prices will result in the August CPI to be ~3.5%. The CPI average for the second quarter will be substantially lower than RBI expectations (~4% v/s 4.4% RBI projections)

Our core view on bonds remains constructive driven by lower-thanexpected inflation (in India) in the second quarter, Fed rate cuts and favourable demand supply dynamics for bonds. We believe that if the Fed reduces rates September and monsoon is normal, there is a strong likelihood that the RBI will shift to a neutral policy stance in the October or December monetary policy meeting. Given the strong economic growth and rising geopolitical risks we expect the RBI to be cautious and not aggressive in cutting rates. We expect 50 bps of rate cut in this cycle in next 6-12 months. Consequently, we continue to maintain higher duration and larger allocation to government bonds across all our funds.

From a strategy perspective, we have maintained an overweight duration stance within the respective scheme mandates with a higher allocation to Government bonds. Accordingly, investors should continue to hold duration across their portfolios. Investors would need to be patient for a further rally as actual rate cuts in India would be delayed to the second half of FY 25. They could use this opportunity to invest in Short to Medium term funds with tactical allocation to gilt funds against a backdrop of lower inflation, favorable demand supply dynamics for government bonds and continued flows from FPIs.

Source: Bloomberg, Axis MF Research.