•

Expect a 25 bps rate cut in

December policy.

• Yield upside limited; investors

should add short term bonds

with every rise in yields.

•

Short term 2-5-year corporate bonds,

tactical mix of 8-10 yr Gsecs and income

plus arbitrage are best strategies to invest

in the current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

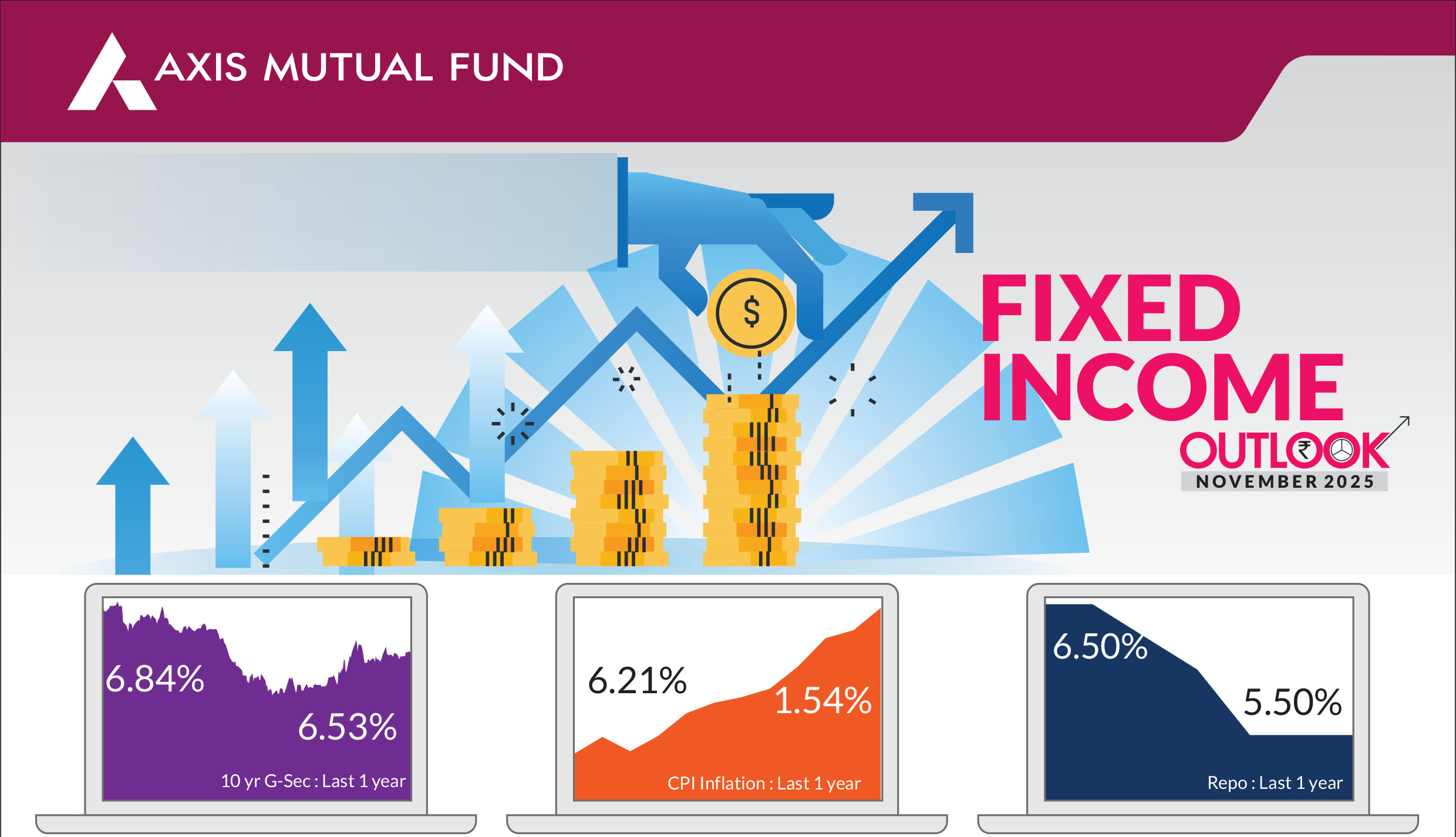

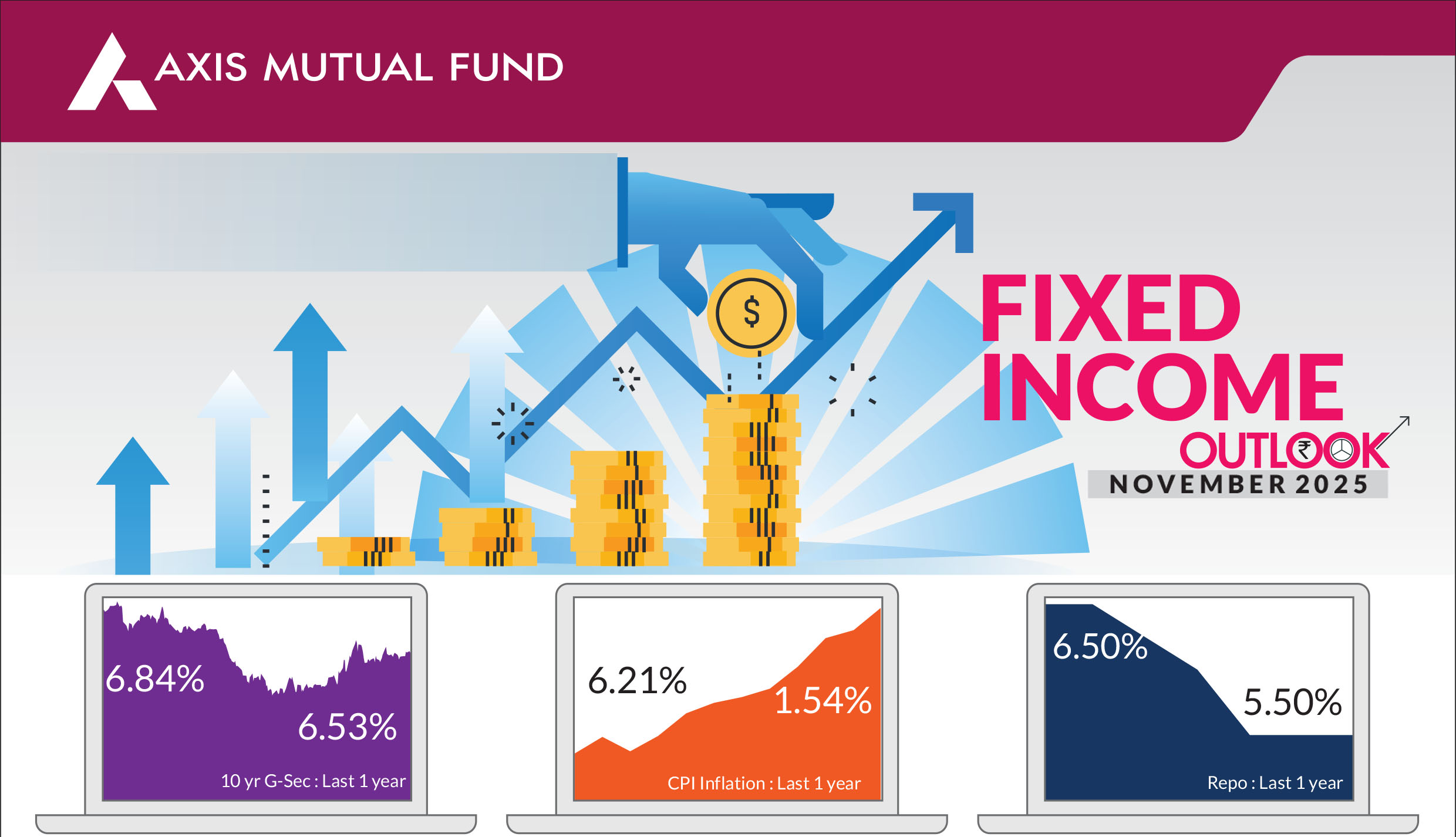

Bond yields traded in a narrow range over the month with the 10-year benchmark government bond yield rising 4 basis points to end at 6.57%. In contrast, US Treasury yields edged lower, with the 10-year yield ending the month at 4.15%, following interest rate cuts by the US Federal Reserve (Fed).

RBI could lower rates in December :

While the

Monetary Policy Committee (MPC) of the

Reserve Bank of India (RBI) kept the policy

repo rate unchanged at 5.5% in its October

meeting, expectations are for an interest rate

cut in December given lower inflation.

Banking liquidity in surplus : After staying in surplus since the end of March

2025, banking system liquidity has fluctuated between surplus and deficit

over the past two weeks in October, affecting bond market sentiment.

Liquidity has remained in surplus since the end of March 2025 and is

expected to remain comfortable till January 2026 aided by drawdown of

government cash balance and infusion of ~INR 2 trillion by the remaining 75

bps of CRR cuts.

Inflation falls to below 2% : Headline inflation eased to 1.54% in September vs 2.07% in August supported by a favourable base effect and continued moderation in food prices. Core inflation was higher at 4.5% vs 4.15% driven mainly by sharply higher gold prices.

US treasury yields fall : The yields on US Treasuries fell 7 bps with the 10 year yield closing at 4.07%. The Fed lowered its interest rate by 25 bps for the second time this year but indicated a rate cut in December seems unlikely.

Inflation falls to below 2% : Headline inflation eased to 1.54% in September vs 2.07% in August supported by a favourable base effect and continued moderation in food prices. Core inflation was higher at 4.5% vs 4.15% driven mainly by sharply higher gold prices.

US treasury yields fall : The yields on US Treasuries fell 7 bps with the 10 year yield closing at 4.07%. The Fed lowered its interest rate by 25 bps for the second time this year but indicated a rate cut in December seems unlikely.

Market view

The Fed's rate cut was very much on the expected lines, but the future guidance was on the hawkish side. We believe that the Fed will again lower rates and this is not the end of rate cycle. Given the current situation in the US, we see weakening economic indicators particularly the unemployment data.In India, market expectations for an interest rate cut have increased, a view that we had shared earlier as well. Uncertainty around tariffs and expectations of a softer inflation trajectory-partly due to anticipated GST rate rationalization-have created room for an additional rate cut in the current easing cycle. Should the tariff impasse persist, an additional 25 bps cut could materialize in February.

With 100 bps of repo rate cuts already delivered, we believe the majority of the RBI's rate easing is now behind us. We believe that the best of the duration play is behind us. Given that inflation expectations remain well within the central bank's target range, we foresee a "lower for longer" interest rate environment.

Looking ahead, with limited scope for further aggressive rate cuts, we expect the RBI to maintain its accommodative liquidity stance (+1% NDTL). This should continue to support the shorter end of the yield curve. From a medium-term perspective, we favor accrual strategies over duration plays. We expect 10yr GSec to trade in a range of 6.30-6.65% for the remaining part of the financial year.

Fiscal concerns on the back of GST cuts coupled with worries on end of ratecut cycle, led to an increase in the yields over the past few weeks. However in the near term, markets will be guided by lower inflation, pressures on growth, likely OMOs during Jan-Mar 2026 and possibility of inclusion in Bloomberg indices, which may provide a tactical opportunity for long bond investing.

Risks to our view: The risks to our view at this point are as below

1) Currency

2) Growth shocks globally and in India

Strategy - We have gradually reduced duration in our portfolios since February 2025 transitioning from long duration strategies to accrual-based strategies.

We have been focused on the short term 2-5 year corporate bonds in the portfolio as we expect surplus banking liquidity, lower supply of corporate bonds/ CDs due to slowdown and delay in implementation of LCR guidelines and attractive spreads and valuations. Incrementally short bonds can outperform long bonds from risk-reward perspective due to a shallow rate cut cycle, lower OMO purchases in the second half of the year and a shift in focus to Govt Debt to GDP targets.

What should investors do?

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.