► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect a 25 bps rate cut in December policy.

► Yield upside limited; investors should add short term bonds with every rise in yields.

► Short term 2-5-year corporate bonds, tactical mix of 8-10 yr Gsecs and income plus arbitrage are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Yield upside limited; investors should add short term bonds with every rise in yields.

► Short term 2-5-year corporate bonds, tactical mix of 8-10 yr Gsecs and income plus arbitrage are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

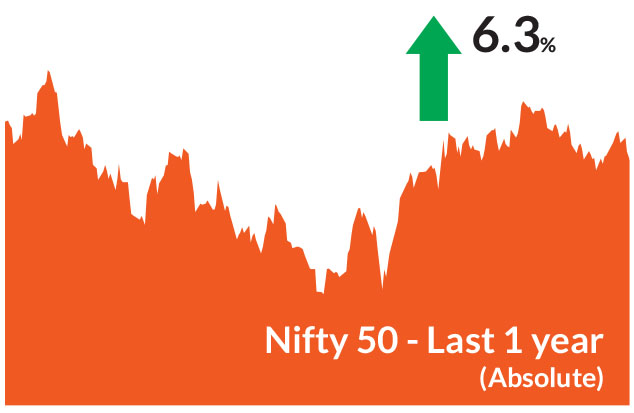

Indian equities ended the month higher supported by strong festive

demand, easing global trade tensions and better than expected earnings so

far. At its highest level in October, the Nifty 50 was around 150 odd points

away from its all time highs. The BSE Sensex and Nifty 50 ended the month

with gains of 4.6% and 4.5%, respectively. The mid and small-cap indices

outperformed, with the NSE Midcap 100 rising by 5.8% and NSE Smallcap

100 gaining by 4.7%. At a sector level, realty, IT and oil & gas indices ended

higher in a month where all sectors delivered positive returns.

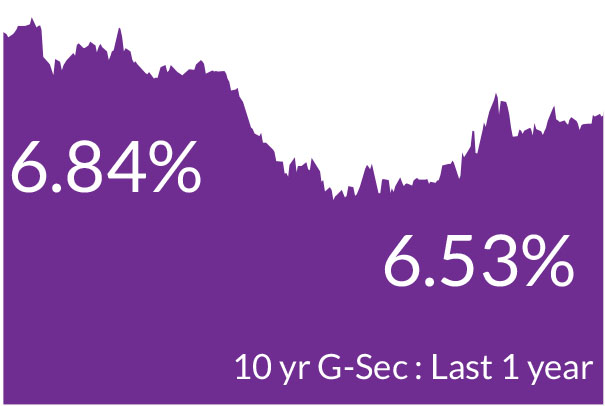

Bond yields traded in a narrow range over the month with the 10-year benchmark government bond yield declining 4 basis points to end at 6.53%. US Treasury yields edged lower, with the 10-year yield ending the month at 4.07%, following interest rate cuts by the US Federal Reserve (Fed).

Lenders are benefiting from cyclical recovery, digital adoption, and wellcontained credit costs. Banks delivered a broadly in-line quarter, with most banks reporting modest credit growth, modestly higher-than-expected NIMs and broadly stable asset quality and large banks seeing signs of stabilization in their unsecured book. Downstream oil players are supported by firm refining margins, stable marketing economics, and softer crude prices, which enhance cash flow and dividend visibility. In consumer tech, festive demand, disciplined unit economics, and operating leverage continue to drive structural growth. IT services companies witnessed some stabilization in growth in 2QFY26, while margins held up broadly. However, IT services companies maintained a cautious outlook, given continued headwinds of a challenging macro environment and growing disruption risks.

Overall, the tone of results and management commentary reinforces confidence in India's mid-cycle expansion story.

Trade negotiations impasse : Progress on the India-US trade deal has renewed optimism around export diversification and supply-chain realignment in India's favor, particularly in electronics, pharmaceuticals, and engineering goods. A successful conclusion could unlock greater market access for Indian exporters, reduce tariff-related uncertainties, and encourage global firms to deepen manufacturing and sourcing partnerships with India across high-value sectors.

RBI could lower rates in December : While the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) kept the policy repo rate unchanged at 5.5% in its October meeting, expectations are for an interest rate cut in December given lower inflation.

Bond yields traded in a narrow range over the month with the 10-year benchmark government bond yield declining 4 basis points to end at 6.53%. US Treasury yields edged lower, with the 10-year yield ending the month at 4.07%, following interest rate cuts by the US Federal Reserve (Fed).

Key Market Events

Better than expected earnings : 95 companies in BSE200 have reported results for Q2FY26 so far, accounting for 55% of BSE200 market cap. By sector, IT services, bank, NBFC, and staples are mostly out with their numbers, but many companies in auto, telecom, healthcare, NBFC, and chemicals are yet to report. For reported companies, Q2 sales growth picked up to +8.1% YoY vs 5.2% in Q1. Ex-energy/metals, growth was better at 9.8% YoY, though lower than 9.0% in Q1. All sectors have reported YoY growth in sales so far, led by consumer discretionary, auto and cement.Lenders are benefiting from cyclical recovery, digital adoption, and wellcontained credit costs. Banks delivered a broadly in-line quarter, with most banks reporting modest credit growth, modestly higher-than-expected NIMs and broadly stable asset quality and large banks seeing signs of stabilization in their unsecured book. Downstream oil players are supported by firm refining margins, stable marketing economics, and softer crude prices, which enhance cash flow and dividend visibility. In consumer tech, festive demand, disciplined unit economics, and operating leverage continue to drive structural growth. IT services companies witnessed some stabilization in growth in 2QFY26, while margins held up broadly. However, IT services companies maintained a cautious outlook, given continued headwinds of a challenging macro environment and growing disruption risks.

Overall, the tone of results and management commentary reinforces confidence in India's mid-cycle expansion story.

Trade negotiations impasse : Progress on the India-US trade deal has renewed optimism around export diversification and supply-chain realignment in India's favor, particularly in electronics, pharmaceuticals, and engineering goods. A successful conclusion could unlock greater market access for Indian exporters, reduce tariff-related uncertainties, and encourage global firms to deepen manufacturing and sourcing partnerships with India across high-value sectors.

RBI could lower rates in December : While the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) kept the policy repo rate unchanged at 5.5% in its October meeting, expectations are for an interest rate cut in December given lower inflation.

Equity Market View:

The earnings season has exceeded expectations so far, indicating that the earnings cycle may be approaching a bottom. Festive demand for discretionary products has been strong, though its sustainability in the coming months remains a key monitorable. As we near the end of 2025, the primary macro concern continues to be the unresolved impasse over a favorable trade agreement for India.Against this backdrop, we maintain an overweight stance on consumption. The robust festive demand underscores the positive impact of GST rationalization. If macro tailwinds continue to flow through to end consumers, India's consumption cycle could reset meaningfully. Companies across consumer durables and automobiles have reported strong festiveseason sales.

We also remain constructive on other consumer discretionary plays-especially in retail, hospitality, and travel & tourism-which are poised to gain from strengthening domestic momentum.

Debt Market View:

The Fed's rate cut was very much on the expected lines, but the future guidance was on the hawkish side. We believe that the Fed will again lower rates and this is not the end of rate cycle. Given the current situation in the US, we see weakening economic indicators particularly the unemployment data.In India, market expectations for an interest rate cut have increased, a view that we had shared earlier as well. Uncertainty around tariffs and expectations of a softer inflation trajectory-partly due to anticipated GST rate rationalization-have created room for an additional rate cut in the current easing cycle. Should the tariff impasse persist, an additional 25 bps cut could materialize in February.

With 100 bps of repo rate cuts already delivered, we believe the majority of the RBI's rate easing is now behind us. We believe that the best of the duration play is behind us. Given that inflation expectations remain well within the central bank's target range, we foresee a "lower for longer" interest rate environment.

Source: Bloomberg, Axis MF Research.