•

Yield curve flat - Duration plays

can be played in the 2-4 year

segment.

• Peaking interest rates imply

capital gains opportunities

now become focal point of

active fund management.

•

Spreads between G-Sec/AAA

& SDL/AAA have seen some

widening.

•

Credits continue to remain

attractive from a risk reward

perspective give the improving

macro fundamentals.

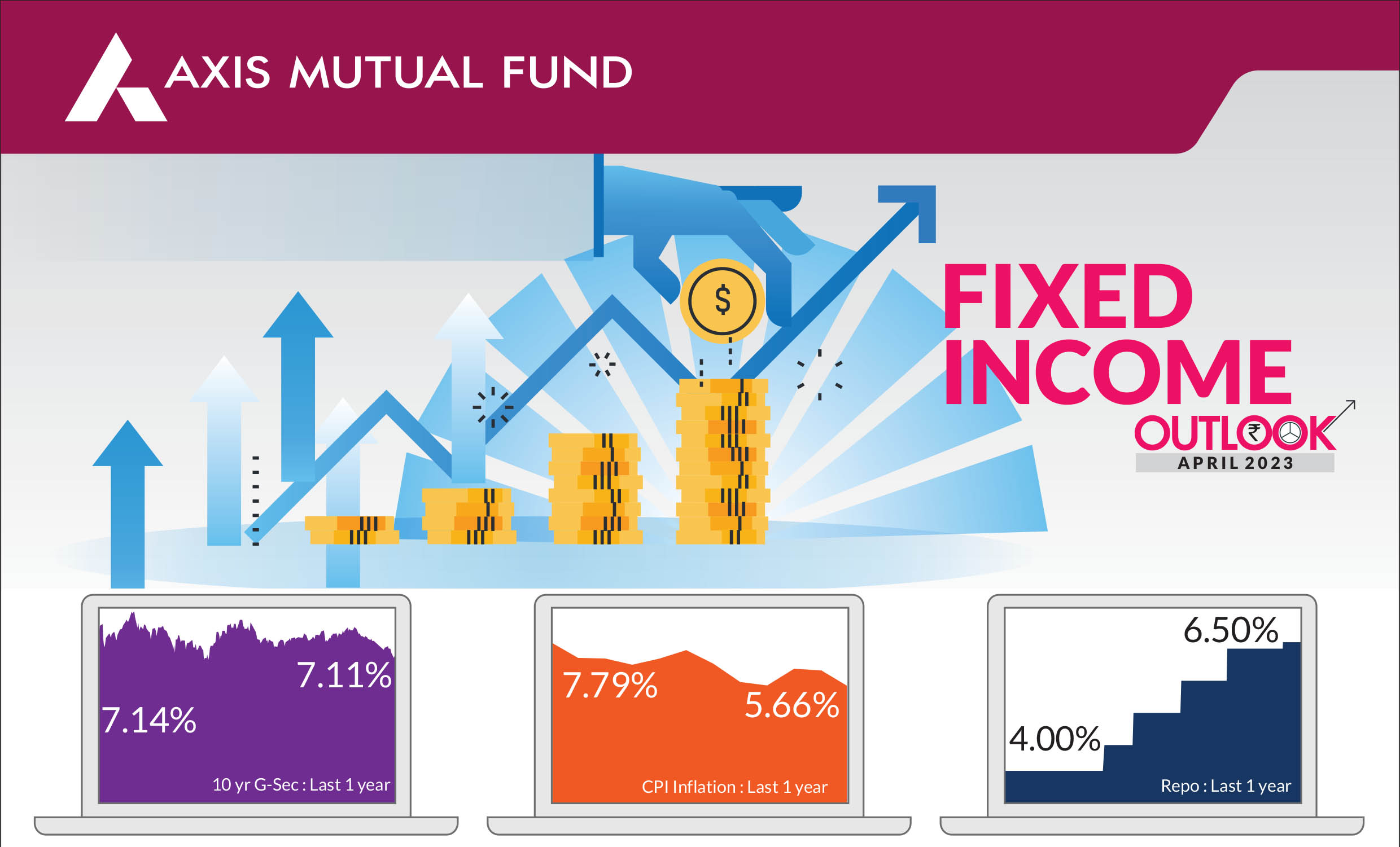

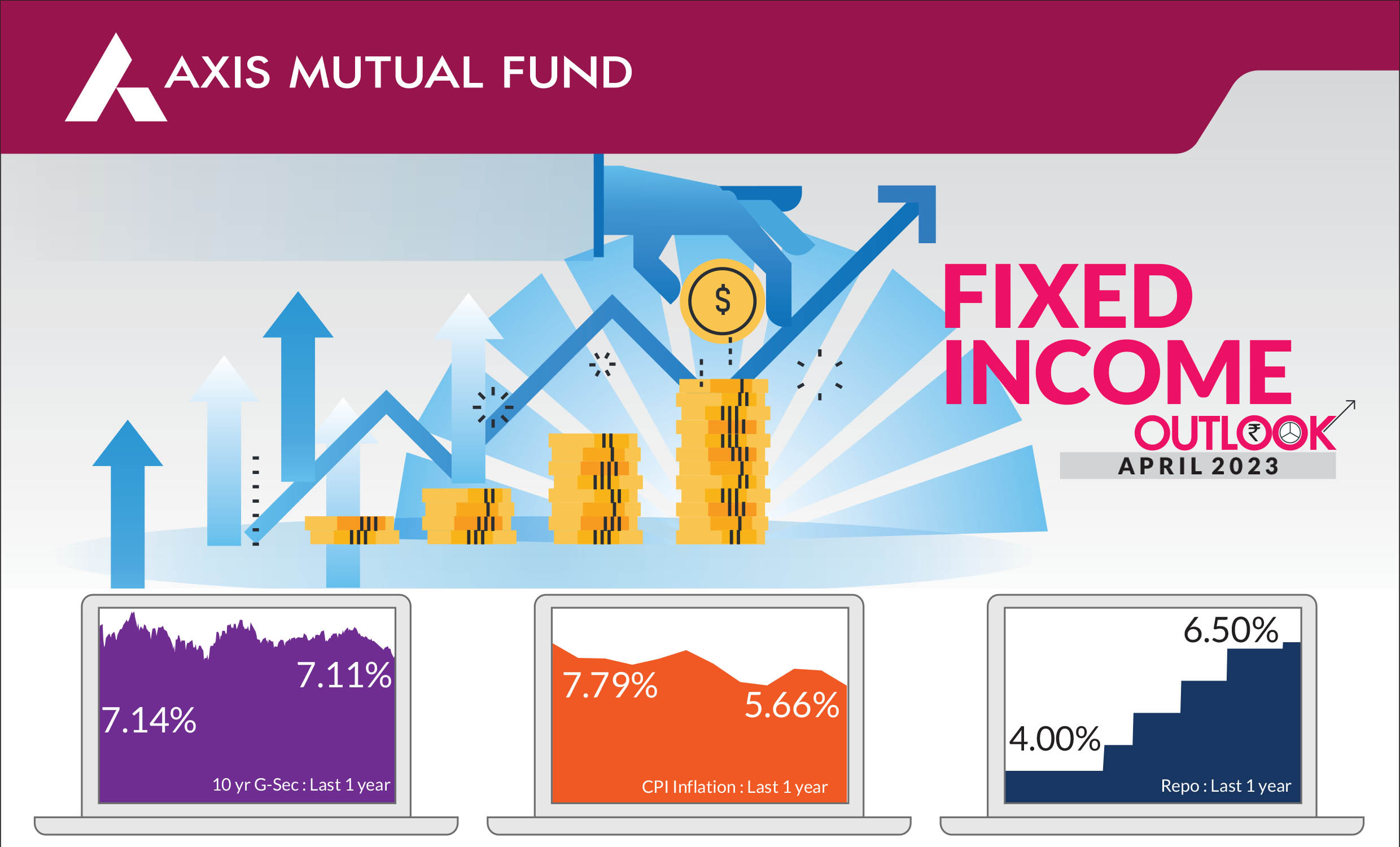

► Bond Yields cool - Benchmark 10 Year G-Sec drops to 7.11%: Cooling inflation, RBI pausing rate hikes and a stable macroeconomic

environment cooled bond yields across the curve.

Money market rates saw yields drop by 11bps while 3-year AAA

corporate bonds saw yields soften ~20bps. Long tenor SDLs and GSecs

also saw yields soften 15-20bps.

► Inflation Softens, Commodities

& INR stable: Inflation trajectory

in India has seen a gradual fall aided by softer commodity prices and monetary

policy. March WPI inflation moderated sharply to 1.3% (February: 3.9%).

Improvements in the external sector have also meant the INR has remained

stable over the last 3 months. The INR stood firm at 81.78/USD. The 3 in

unison provide much needed comfort for policy makers given the strong

domestic macro environment.

► GST collections at new life high - Economic activity buoyant: GST collection

for April (reflecting activity in March) came in at an all-time high of Rs 1.87

lakh cr, PMI manufacturing rose to a 4-month high of 57.2 in April. On the

consumption side services PMI accelerated to 62 in April, the highest since

Jun-10, with the upturn driven by a pick-up in new business growth and

favorable market conditions. Air passenger traffic gained pace in sequential

terms and remained steady in YoY terms. Strength from all quarters of the

economy indicate a high degree of positivity in the economy.

► IMD Forecasts a normal monsoon: According to the preliminary forecast for the 2023 monsoon season (June to September), IMD anticipates the southwest monsoon rainfall for the country as a whole is likely to be 96% of the Long Period Average (LPA). Markets were factoring concerns of an impending el Niño event that causes drier conditions and lower rainfall in India. Agriculture & allied activities constitute ~18.2% of GDP. The growth in the sector is influenced by the monsoon as 51% of the cropped area is monsoon dependent.

► US Fed Commentary - Hint of pessimism, Incremental action will be data dependent: The US fed raised rates yet again (500 bps rate hikes since March 2022) to its highest levels since 2007 even as the regional banking crises claimed another banking victim (First Republic Bank). Despite the fear of a near term recession, the US Fed believes the economy and the banking sector are stable. We believe, rates across the world are likely at peaks and the world economy might encounter a period of extended 'rate pauses' till policy makers confirm an inflation cool-off.

► IMD Forecasts a normal monsoon: According to the preliminary forecast for the 2023 monsoon season (June to September), IMD anticipates the southwest monsoon rainfall for the country as a whole is likely to be 96% of the Long Period Average (LPA). Markets were factoring concerns of an impending el Niño event that causes drier conditions and lower rainfall in India. Agriculture & allied activities constitute ~18.2% of GDP. The growth in the sector is influenced by the monsoon as 51% of the cropped area is monsoon dependent.

► US Fed Commentary - Hint of pessimism, Incremental action will be data dependent: The US fed raised rates yet again (500 bps rate hikes since March 2022) to its highest levels since 2007 even as the regional banking crises claimed another banking victim (First Republic Bank). Despite the fear of a near term recession, the US Fed believes the economy and the banking sector are stable. We believe, rates across the world are likely at peaks and the world economy might encounter a period of extended 'rate pauses' till policy makers confirm an inflation cool-off.

Markets have seen an expected fall in rates as is the seasonal nature of bonds

during the FY crossing. The large inflow into mutual fund schemes in the last days

of FY 23 and the subsequent bond buying in April has also been a trigger for yields

across asset types to cool. Our call to add duration in Q4 FY 2023 achieved twin

objectives of locking in elevated rates (For target maturity fund investors) and

capitalizing gains on the duration play in actively managed portfolios.

Growth has returned to its central place in RBI's framework. With inflation projected to fall below 6%, and no mention of the 4% official target of inflation, it appears that RBI is comfortable with its projection of inflation in the coming year. Average inflation is projected at 5.2%. GDP growth was marginally marked up to 6.5% for FY24. The impact of the 290 bps of tightening over the last year is now expected to affect the real economy. The clear emphasis seems to be support for growth unless inflation again surprises above 6% consistently.

Lastly the RBI is mindful of the large government borrowing programmer this year. With this in mind, the RBI also indicated that it would be agile in liquidity management. We are now close to a neutral liquidity position - and at the current pace of outflows (currency and reserve demand), the liquidity demand from the RBI is likely to be close to 4 lakh crores. A part of this can be filled by forex flows if the currency is stable and financial conditions globally are easy. However, it is likely that the RBI will need to respond to liquidity needs through open market operations later this year.

The current curve continues to remain flat with everything in corporate bonds beyond 1 year up to 15 years is available @7.0 -7.25% range. Falling CPI, weaker growth and strong investor demand would keep yields under check despite high G-Sec supply next year. We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. Actively managed portfolios with mid/moderate duration mandates offer compelling investment solutions as compared to traditional savings instruments given that both assets have parity in tax treatment.

Growth has returned to its central place in RBI's framework. With inflation projected to fall below 6%, and no mention of the 4% official target of inflation, it appears that RBI is comfortable with its projection of inflation in the coming year. Average inflation is projected at 5.2%. GDP growth was marginally marked up to 6.5% for FY24. The impact of the 290 bps of tightening over the last year is now expected to affect the real economy. The clear emphasis seems to be support for growth unless inflation again surprises above 6% consistently.

Lastly the RBI is mindful of the large government borrowing programmer this year. With this in mind, the RBI also indicated that it would be agile in liquidity management. We are now close to a neutral liquidity position - and at the current pace of outflows (currency and reserve demand), the liquidity demand from the RBI is likely to be close to 4 lakh crores. A part of this can be filled by forex flows if the currency is stable and financial conditions globally are easy. However, it is likely that the RBI will need to respond to liquidity needs through open market operations later this year.

The current curve continues to remain flat with everything in corporate bonds beyond 1 year up to 15 years is available @7.0 -7.25% range. Falling CPI, weaker growth and strong investor demand would keep yields under check despite high G-Sec supply next year. We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. Actively managed portfolios with mid/moderate duration mandates offer compelling investment solutions as compared to traditional savings instruments given that both assets have parity in tax treatment.

Source: Bloomberg, Axis MF Research.