Equity market valuations are broadly reasonable

adjusted for the cyclical low in earnings and

potential for revival going forward.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

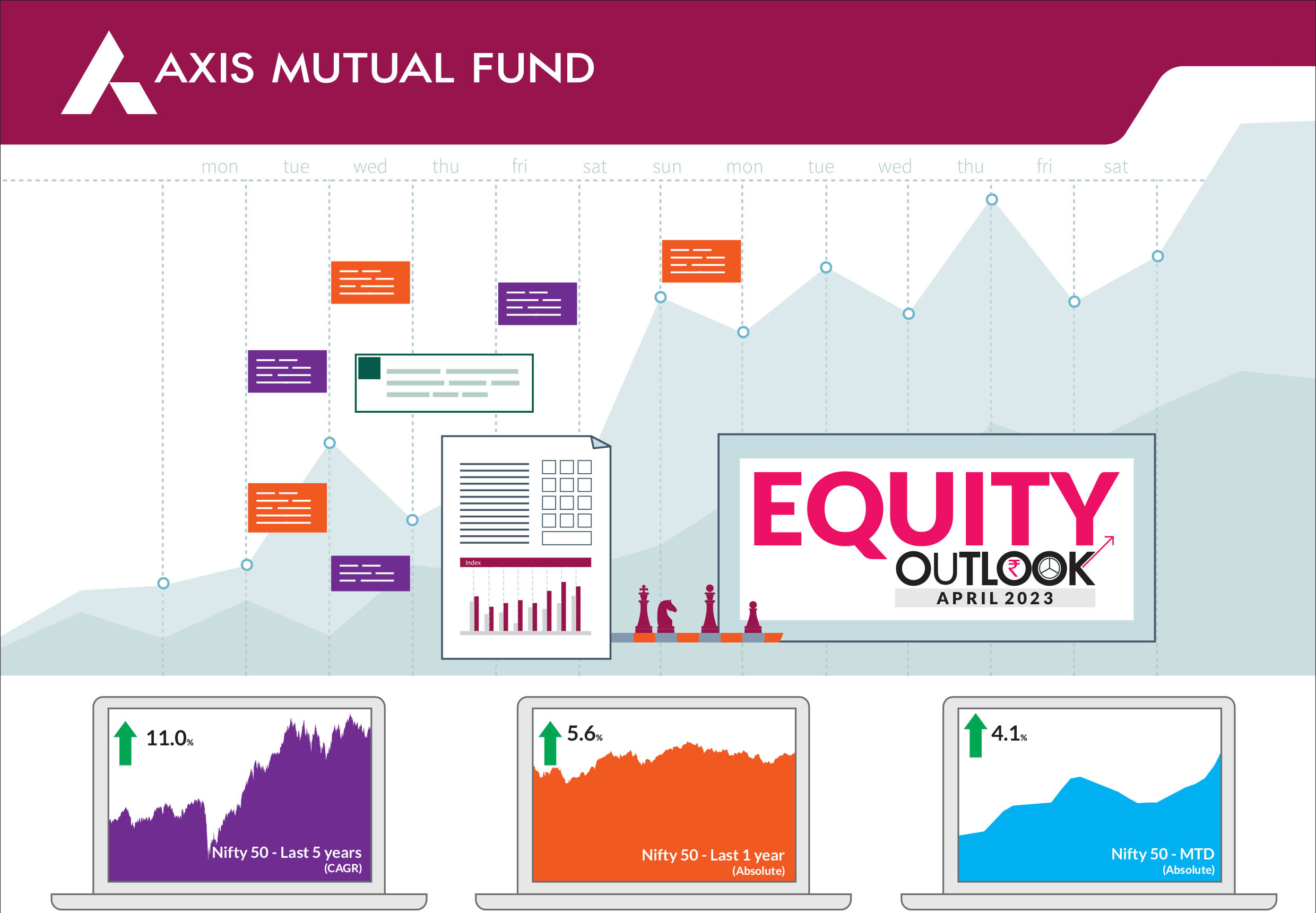

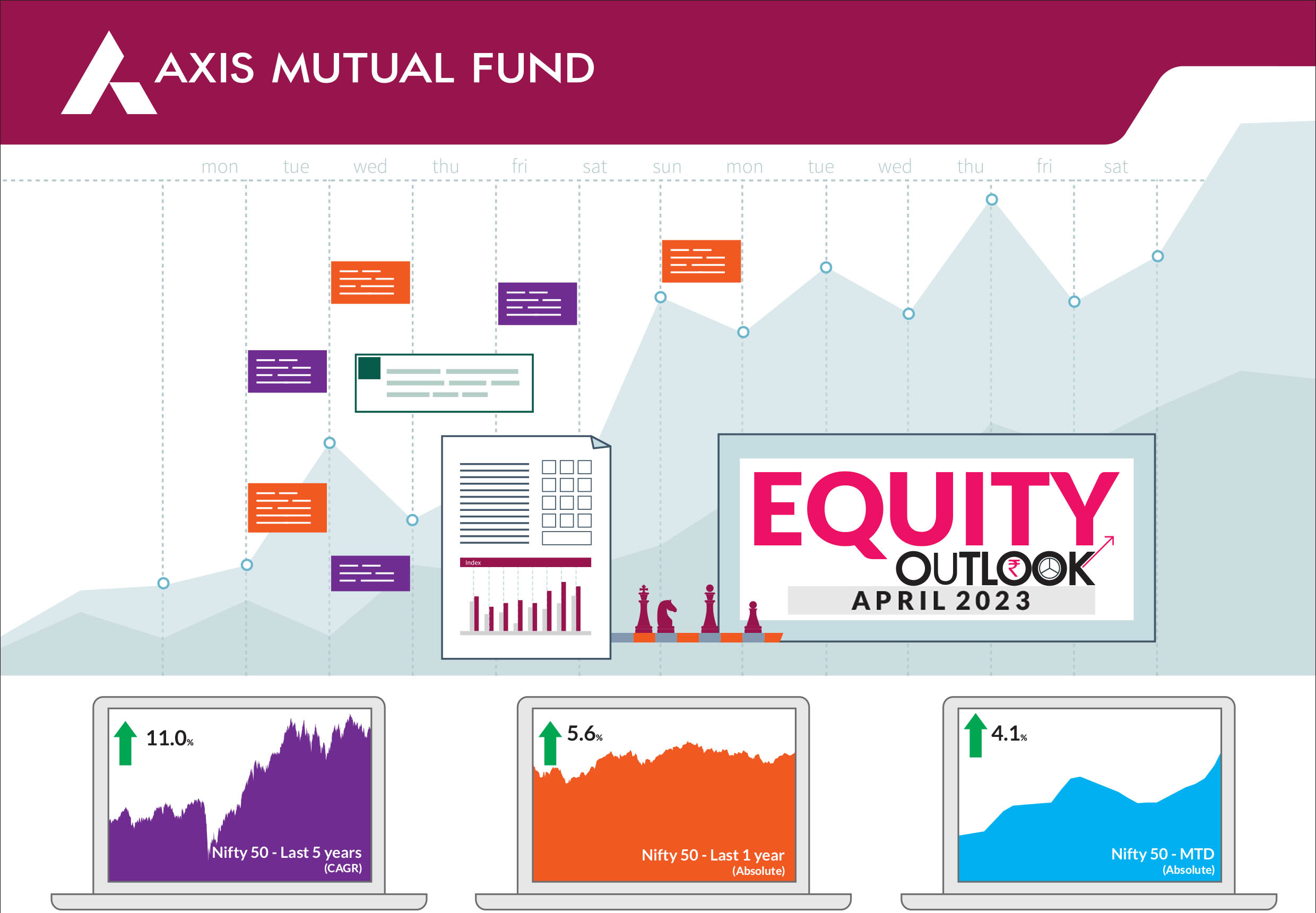

Indian markets staged a strong recovery last month, as markets digested full year earnings & sentiment turned favourable. S&P BSE Sensex & NIFTY 50 ended the month up 3.6% & 4.1% respectively. NIFTY Midcap 100 & NIFTY Small cap 100 outperformed their large cap peers, up 5.9% & 7.4% respectively. FPI's continued adding to Indian equities with a net purchase of Rs 11,600 Cr for the month of April 2023. |

|

Earnings season commenced on a mixed note with cyclical sectors like banking, industrials and auto delivering numbers largely in line with market estimates. IT as a sector has lagged consensus estimates hampered by the weakening global environments and client pressures. The markets have been quick to digest earnings. Companies that have failed to live up to expectations have seen share prices re-price eliminating any premia/froth in trading valuations. Growth indicators for companies have seen a unique period of extremes over the last 2 years. The shocks of Covid resulting in a collapse of demand and supply metrics and the subsequent recovery in both legs created an artificial extreme growth environment. The recent results and the management commentary have highlighted tempering growth expectations across the economy & corporate earnings. High frequency indicators like credit growth and auto sales are reflective of this trend. Incrementally we believe growth is likely to be seen in pockets rather than 'across the board' and active investing in growth & quality will be key to alpha creation. The divergence in market performance between momentum and quality has been reversing rather swiftly on a relative basis. Many of these names today trade at attractive valuations in contrast to the rest of the market. This coupled with buoyancy on the economic front bode well for investors looking to build a highly quality centric portfolio. We continue to reiterate, companies where earnings trajectory has remained consistent are likely to return as winners of 2023. Currently, our portfolios favour large caps where companies continue to deliver on growth metrics. Corporate earnings of our portfolio companies continue to give us confidence in the strength of our portfolio companies. From a risk perspective, in the current context, given rising uncertainties our attempt remains to minimize betas in our portfolios. The markets have kept 'quality' away from the limelight for over 18 months, making valuations of these companies relatively cheap both from a historical context and a relative market context. While we remain cautious of external headwinds, strong discretionary demand and stable government policies give us confidence that our portfolios are likely to weather the ongoing challenges. |

Source: Bloomberg, Axis MF Research.