► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Start of a shallow rate cycle post February cuts.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-5-year corporate bonds are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year maturity and 1-5-year corporate bonds are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

March was a month of RRR - Rise, Recover and Return of foreign

inflows albeit to a small extent. Earlier in the month, investor sentiment

remained cautious due to lingering concerns about the potential impact

of the tariffs by the US and their consequences globally. However,

sentiment improved after the US Federal Reserve indicated two rate

cuts this year.

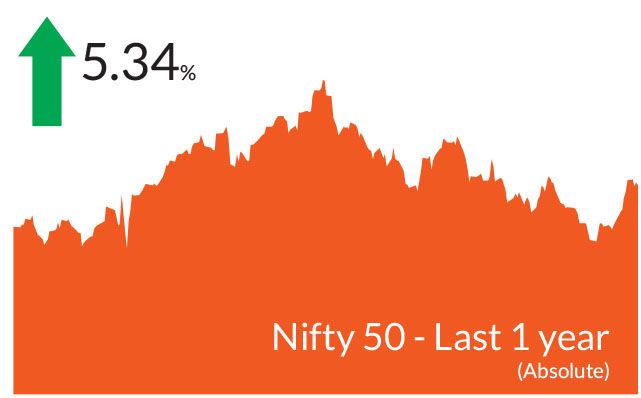

Consequently, after five months of negative returns, Indian equities ended March higher. The BSE Sensex and Nifty 50 closed 5.7% and 6.2% higher, while the NSE Midcap 100 advanced by 7.7% and the NSE Smallcap 100 by 9.3%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in March but the extent of outflows reduced to US$0.4 bn. In fact, the last 5-6 sessions saw good inflows primarily on account of attractive valuations, an appreciation in the rupee and somewhat strong macro environment. In contrast, DIIs bought equities worth US$ 4.3bn. With this the total outflows by FPIs in FY25 stand at US$13.4 bn while the total inflows by DIIs add upto US$71.6 bn.

After a fall in February, US Treasury yields ended flat in March amid concerns over the impending US slowdown as a result of the tariffs implemented by the US. In India, the 10-year government bond yields fell 13 basis points given liquidity infusion by the central bank, receding inflation numbers and expectations of interest rate cuts.

Meanwhile, FY25 ended with a banking liquidity surplus of Rs 894 billion due to a notable liquidity infusion of Rs 3.2 trillion, along with government spending and recent FPI inflows.

Inflation falls below 4% : Headline inflation fell to 3.6% in February from 4.3% in January 2024, led by a faster than expected moderation in food prices especially vegetables with the onset of winter months. Core inflation continues to remain below 4% for over 12 months. We anticipate headline inflation to remain low due to good rabi and kharif crop harvests and lower vegetable prices.

Rupee appreciates in March : The rupee appreciated approx. 2.4% in March vis a vis the US dollar on account of foreign inflows in the latter part of March and a weaker dollar itself which lost ground against most currencies. We expect the rupee to stabilize in the near term.

US treasury yields unchanged in March : While yields fell from mid February, March turned out to be relatively flat. Investors maintained a cautious stance towards the reciprocal tariffs being implemented and the invariable slowdown that the US could face.

Tariffs imposed on Indian exports could marginally slow growth : Reciprocal tariffs were announced by the US government across countries with tariff on India being 26% which means all goods entering the US will now attract a minimum 26% levy effective April 9, 2025. The impact on India's exports may be muted in near-term but global growth and trade slowdown will be negative for India over the medium-term.

Consequently, after five months of negative returns, Indian equities ended March higher. The BSE Sensex and Nifty 50 closed 5.7% and 6.2% higher, while the NSE Midcap 100 advanced by 7.7% and the NSE Smallcap 100 by 9.3%. Foreign Portfolio Investors (FPIs) continued with their cautious stance in March but the extent of outflows reduced to US$0.4 bn. In fact, the last 5-6 sessions saw good inflows primarily on account of attractive valuations, an appreciation in the rupee and somewhat strong macro environment. In contrast, DIIs bought equities worth US$ 4.3bn. With this the total outflows by FPIs in FY25 stand at US$13.4 bn while the total inflows by DIIs add upto US$71.6 bn.

After a fall in February, US Treasury yields ended flat in March amid concerns over the impending US slowdown as a result of the tariffs implemented by the US. In India, the 10-year government bond yields fell 13 basis points given liquidity infusion by the central bank, receding inflation numbers and expectations of interest rate cuts.

Key Market Events

RBI infuses liquidity, could lower rates : The central bank is infusing liquidity into the system by way of open market operations (OMOs) worth Rs 80,000 cr. This will be carried out in four tranches of Rs 20,000 crore each, on April 3, April 8, April 22 and April 29. This would take cumulative OMO purchases by the RBI in 2025 to INR 3,300bn. Earlier in March, it conducted OMO purchases of government securities worth Rs 1 lakh crore in two tranches of Rs 50,000 crore each. The central bank also held a dollar-rupee buy/sell swap auction of $10 billion for 36 months. All eyes are towards the monetary policy on April 9, wherein the Reserve Bank of India is expected to lower interest rates by 25 basis points.Meanwhile, FY25 ended with a banking liquidity surplus of Rs 894 billion due to a notable liquidity infusion of Rs 3.2 trillion, along with government spending and recent FPI inflows.

Inflation falls below 4% : Headline inflation fell to 3.6% in February from 4.3% in January 2024, led by a faster than expected moderation in food prices especially vegetables with the onset of winter months. Core inflation continues to remain below 4% for over 12 months. We anticipate headline inflation to remain low due to good rabi and kharif crop harvests and lower vegetable prices.

Rupee appreciates in March : The rupee appreciated approx. 2.4% in March vis a vis the US dollar on account of foreign inflows in the latter part of March and a weaker dollar itself which lost ground against most currencies. We expect the rupee to stabilize in the near term.

US treasury yields unchanged in March : While yields fell from mid February, March turned out to be relatively flat. Investors maintained a cautious stance towards the reciprocal tariffs being implemented and the invariable slowdown that the US could face.

Tariffs imposed on Indian exports could marginally slow growth : Reciprocal tariffs were announced by the US government across countries with tariff on India being 26% which means all goods entering the US will now attract a minimum 26% levy effective April 9, 2025. The impact on India's exports may be muted in near-term but global growth and trade slowdown will be negative for India over the medium-term.

Equity Market View:

Tariff war and uncertainty related to it could be a key trigger for global and Indian markets. In particular, reciprocal tariffs have been announced across countries with tariff on India being 26% which means all goods entering the US will now attract a minimum 26% levy effective April 5, 2025. The impact on India's exports may be muted in near-term but global growth and trade slowdown will be negative for India over the medium-term. Sectors such as chemicals, electronics, gems and jewelry, etc. face a relatively larger increase in tariffs while pharmaceuticals have been kept out of the ambit of tariffs. India's export to the US is dominated by textiles (furnishings and apparels), gems and jewelry (diamonds), pharmaceutical products (medicaments), electronics (mobile phones). Earlier, at an aggregate level, the difference between India imposed and US imposed tariff rates ranged between 6-10% for major exports. After the reciprocal tariffs, most sectors (except pharma and energy) will uniformly face tariff rates at 26%. The steeper additional tariffs impact major US trading partners, with the European Union facing a 20% and China a 34% in addition to the existing 20%. Other key partners include South Korea at 25%, Japan at 24% and Vietman at a steep 46%. These reciprocal tariffs are only half the rate that other countries impose on US products and this leaves room for negotiation.Last month, we spoke about how the market correction (15-25% for various indices) has brought Nifty valuations closer to their one-year forward PE average. Following the underperformance, the India premium has also adjusted and is now much closer to the average compared to other emerging markets. We believe that markets may remain rangebound in the near term and the lingering effect of tariffs may continue to dominate market sentiment.

In terms of sectors, we have been increasing exposure to financials, particularly NBFCs and pharma, we remain overweight the consumer discretionary segment through retailers, hotels, travel and tourism and have reduced our overweight in automobiles and remain underweight information technology. Renewable capex, manufacturers and power transmission/distribution companies, defense are the other themes we favour.

If one views India's long term growth story, the fundamentals are supported by: 1) strong macro stability, characterized by improving terms of trade, a declining primary deficit, and declining inflation 2) annual earnings growth in the mid- to high-teens over the next 3-5 years, driven by an emerging private capital expenditure cycle, the releveraging of corporate balance sheets, and a structural increase in discretionary consumption.

Debt Market View:

We expect an overall shallow interest rate cut cycle of 25-50 bps in next 6-12 months with 25 bps coming up in the April monetary policy meeting and a long pause thereafter. As mentioned earlier, the central bank proactively managed liquidity infusion to anchor the overnight rates to the policy rates. Despite rate cut and slew of liquidity measures, short end CDs and 3-5 year corporate bond yields have hardened and spreads have widened due to higher supply. OMO purchases and measured supply in Govt bonds have led G-Sec yields to rally by 5-10 bps. We believe that the liquidity infusion has been more than sufficient to ensure Core liquidity remains in surplus in near term. Core/durable liquidity has shifted from a deficit of INR 1 trillion in Dec to a surplus of INR 1.5 trillion by March 25 and is expected to be above INR 2.5 trillion by Sept 2025. Announcement of RBI dividend by June 2025 of INR 2.5 trillion would be another big boost to core / durable liquidity and hence we believe core/ durable liquidity to remain in surplus from April 2025 for H1 FY 2025-26. Positive liquidity augurs well for short end of the curve and we expect the curve to get steeper over the next 6 months as compared to flat/invert yield curve.In the US, we believe rate cuts could be to the tune of 50-75 basis points. Growth is indeed slowing down as seen by the weaker data such as GDP growth, lower inflation and other macros. The tariff measures implemented by the US on its top trading partners will hurt growth over the medium term.

Source: Bloomberg, Axis MF Research.