Markets do remain overvalued across the

investment part of the economy and we may

see normalisation in some of these segments.

We remain bullish on equities

from a medium to long term

perspective.

Investors are suggested to have their

asset allocation plan based on one's risk

appetite and future goals in life.

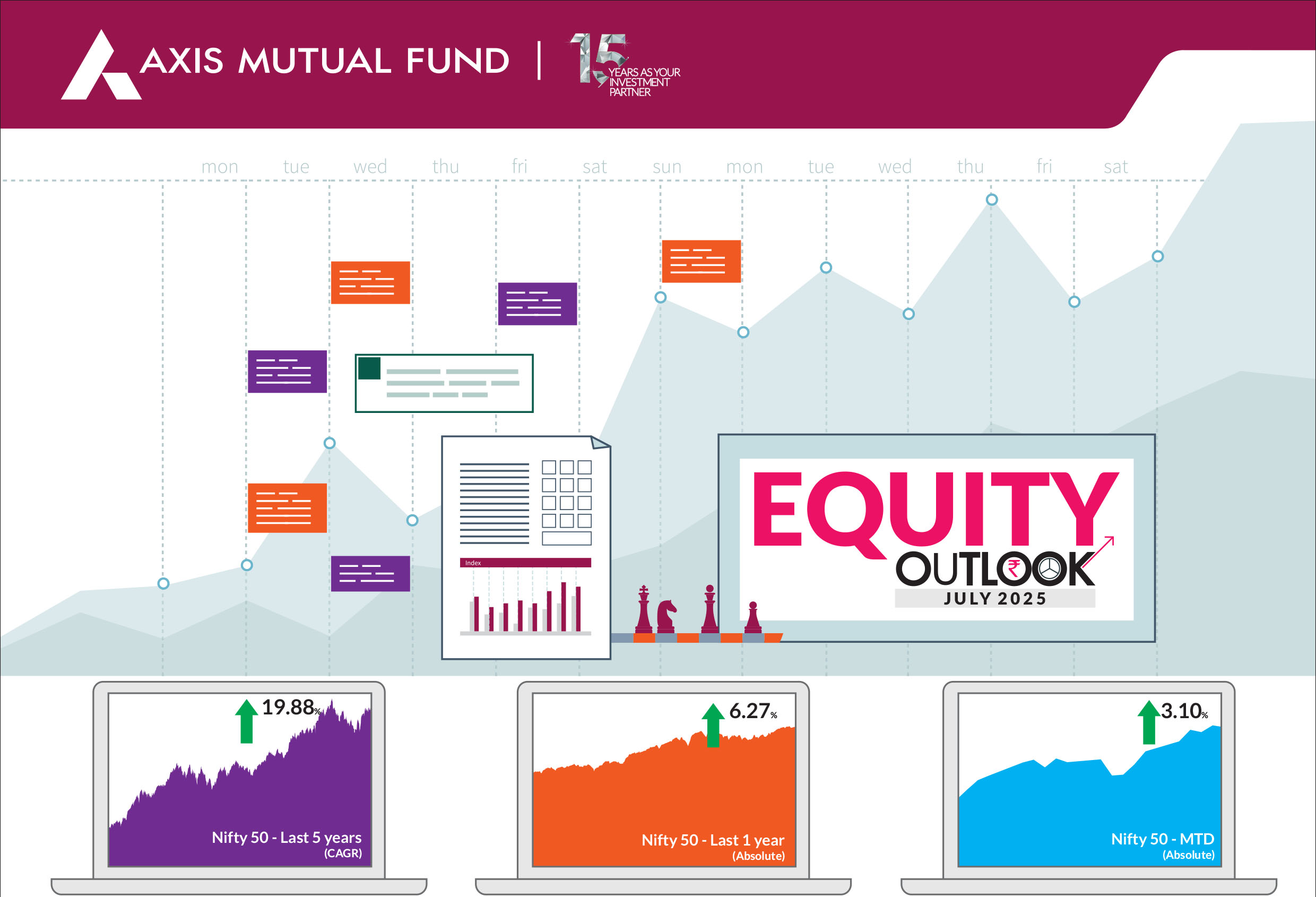

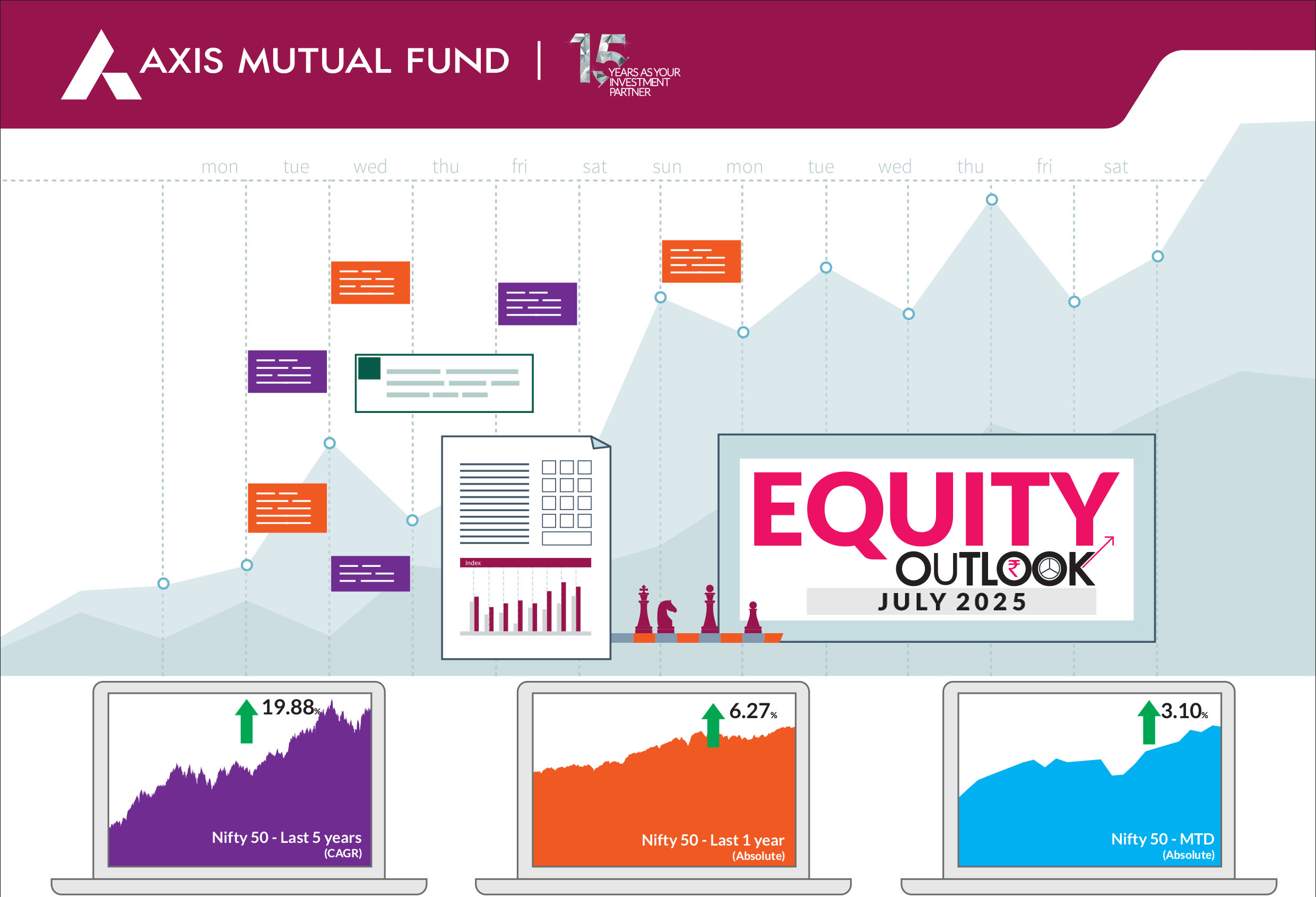

Indian equities maintained their strong momentum in June, despite experiencing bouts of volatility. The month was characterized by geopolitical conflicts between Israel and Iran, which eventually led to a ceasefire. This resolution of conflict contributed to gains in equities globally. Consequently, the BSE Sensex and Nifty 50 closed 2.6% and 3.1% higher, while the NSE Midcap 100 advanced by 4% and the NSE Smallcap 100 by 6.7%, outperforming the large caps. Almost all sectors ended in the green, except FMCG. Globally too, equities ended higher with the US equities advancing 5%. US equities touched record highs after falling in March and early April then recovering across May and June. |

As in May, promoter and strategic shareholder stake sales continued unabated in June - emerging as a notable supply source. This was prompted by the sharp rebound from the lows and higher valuations triggering equity supply to the tune of US$18bn of which approx. 75% was driven by promoter and PE exits. FY26 has already seen 56 IPO filings in ~3-months, and an estimated supply pipeline of US$60-80bn is expected in the remaining 9MFY26. This equates to roughly 2 years of SIP inflows at current level of US$ 3 bn/per month). |

From their lows, all indices have risen notably - the Nifty 50 by 15.6%, the Nifty Midcap 100 by 25% and Nifty Smallcap 100 by 30%. The large caps have outperformed the mid and small caps in the first half of the year - the Nifty 50 is up 8%, the Nifty Midcap 100 4.4% and the Nifty Small Cap 100 is up 1.6%. Valuations, however, are not cheap, given the sharp run and are trading at least one standard deviation above long-term averages. Across categories - both investment and consumption - stocks trade at higher valuations. However, as compared to global economies, India is one of the worst performing countries in US dollar terms after US and China. (India +8%, US 6%, China +6%, Korea +40%, Germany +36%, Mexico and Brazil +31% each). Meanwhile, economic indicators are showing some signs of improvement but not out of the woods completely and recent positives are not yet fully factored in. GDP growth has recovered, system liquidity is now back to historical levels and should improve further with the CRR cut. RBI frontloaded rate cuts with the 50bps of cuts in June. FPIs are getting positive on emerging markets and the base will start becoming favourable. Even as the 9 July tariff deadline is near the corner, there are increasing signs that it is a soft marker and perhaps could be extended. This sense of market dread has lifted somewhat allowing investors to be optimistic on the tariff scenario. We currently assume that extreme scenarios are unlikely at this point and the downside in the market may have already been captured. However, whenever the tariffs are implemented, countries may face a slowdown to varying degrees and most companies impacted by tariffs could likely pass on the increasing costs to consumers. India remains relatively insulated from the impact of these tariffs given that we are largely a domestic based consumption economy. Our overall positioning broadly remains unchanged. We are overweight the financial sector, particularly NBFCs. We also maintain an overweight position in the pharmaceutical segment, although we have slightly reduced our exposure in light of the uncertainty regarding tariffs and pricing issues in the US. We maintain an overweight in the consumer discretionary segment through retailers, hotels, travel and tourism. We believe that the discretionary segment is well positioned to benefit from strengthening domestic momentum and lower interest rates coupled with lower tax rates may likely provide consumption a fillip. We have reduced our overweight in automobiles in the last few months and remain underweight information technology. Renewable capex, manufacturers and power transmission/distribution companies, defense are the other themes we favour and we have increased our exposure to defense in the last few months. Notwithstanding expectations of lower growth in the short to medium term, India's long term growth story is supported by: 1) strong macro stability, characterized by improving terms of trade, a declining primary deficit, and declining inflation 2) annual earnings growth in the mid- to high-teens over the next 3-5 years, driven by an emerging private capital expenditure cycle, the re-leveraging of corporate balance sheets, and a structural increase in discretionary consumption. |

Source: Bloomberg, Axis MF Research.