► Markets do remain overvalued across the investment part of the economy and we may see

normalisation in some of these segments.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Rate cycle on a pause for the next few policies.

► Yield upside limited; investors should add duration with every rise in yields.

► Mix of 8-10 yr Gsecs and short term 1-5-year corporate bonds are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

► Yield upside limited; investors should add duration with every rise in yields.

► Mix of 8-10 yr Gsecs and short term 1-5-year corporate bonds are best strategies to invest in the current macro environment.

► Selective Credits continue to remain attractive from a risk reward perspective given the improving macro fundamentals.

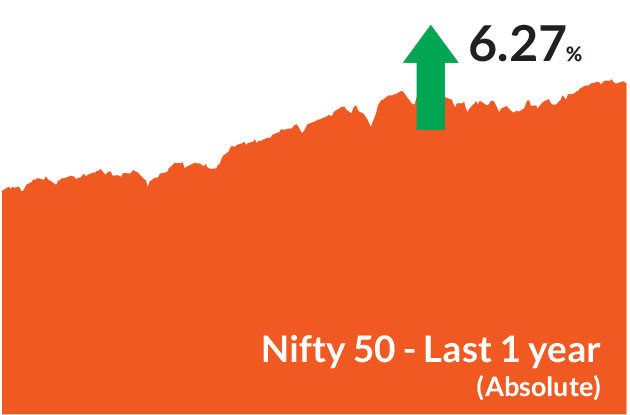

Indian equities maintained their strong momentum in June, despite

experiencing bouts of volatility. The month was characterized by

geopolitical conflicts between Israel and Iran, which eventually led to a

ceasefire. This resolution of conflict contributed to gains in equities

globally. Consequently, the BSE Sensex and Nifty 50 closed 2.6% and

3.1% higher, while the NSE Midcap 100 advanced by 4% and the NSE

Smallcap 100 by 6.7%, outperforming the large caps. Almost all sectors

ended in the green, except FMCG. Globally too, equities ended higher

with the US equities advancing 5%. US equities touched record highs

after falling in March and early April then recovering across May and

June.

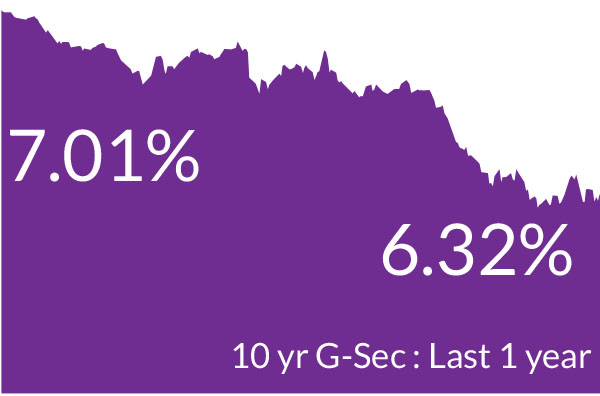

The month saw geopolitical conflicts in Israel Iran that led to investors opting for safer havens such as bonds and gold. Overall, 10 year Treasuries ended 17 bps lower at 4.23%. In India, the 10-year government bond yields ended 3 basis points higher at 6.32% given abundant banking liquidity and receding inflation.

Inflation falls further : Headline inflation fell to 2.8% in May from 3.1% in April, led by a faster than expected moderation in food prices especially vegetables. The IMD's forecast of an above-normal monsoon is likely to support the crop harvests, which, in addition to the healthy buffer stocks, is likely to ensure that food prices remain benign. We expect headline inflation to remain near 3% or below over the next few months driven by benign food prices and due to favourable outlook for crop production. Crude oil prices rose sharply and witnessed an equally sharp reversal following the de-escalation in geopolitical tensions.

Macro data mixed : May industrial production growth slowed to 1.2% vs 2.6% in the previous month. Growth was subdued due to sluggish growth in Mining and Electricity sector which contracted by 0.1% and 5.8% respectively. Manufacturing grew by 2.6% in May. Meanwhile, India's current account surplus of 1.3% of GDP in Q4FY25 was the strongest seen in any fourth quarter since FY09. The usual seasonal pickup was bolstered by services-exports, lower dividend outflow, and front-loading of goods-exports pre-US tariffs.

Rupee little changed in June : Rupee stayed unchanged through the month against the US dollar. However, the US dollar lost ground against most currencies in June and on a year to date basis, was 8% down.

US treasury yields move lower : The yields on US Treasuries fell 17 bps over the month ending at 4.23% as geopolitical stresses eased. Meanwhile the US Federal Reserve has indicated that it is taking a patient approach bt a rate cut could be on the horizon based on incoming data.

The month saw geopolitical conflicts in Israel Iran that led to investors opting for safer havens such as bonds and gold. Overall, 10 year Treasuries ended 17 bps lower at 4.23%. In India, the 10-year government bond yields ended 3 basis points higher at 6.32% given abundant banking liquidity and receding inflation.

Key Market Events

Banking liquidity in surplus : Banking liquidity remains in surplus prompting the Reserve Bank of India (RBI) to conduct a seven day VRRR auction to the tune of Rs 84,975 cr. The higher surplus liquidity in the banking system is forcing overnight rates in the market to trade below the Standing Deposit Facility (SDF), which the central bank wants to align it with the repo rate. Overall, the yield curve has steepened since the monetary policy action in early June.Inflation falls further : Headline inflation fell to 2.8% in May from 3.1% in April, led by a faster than expected moderation in food prices especially vegetables. The IMD's forecast of an above-normal monsoon is likely to support the crop harvests, which, in addition to the healthy buffer stocks, is likely to ensure that food prices remain benign. We expect headline inflation to remain near 3% or below over the next few months driven by benign food prices and due to favourable outlook for crop production. Crude oil prices rose sharply and witnessed an equally sharp reversal following the de-escalation in geopolitical tensions.

Macro data mixed : May industrial production growth slowed to 1.2% vs 2.6% in the previous month. Growth was subdued due to sluggish growth in Mining and Electricity sector which contracted by 0.1% and 5.8% respectively. Manufacturing grew by 2.6% in May. Meanwhile, India's current account surplus of 1.3% of GDP in Q4FY25 was the strongest seen in any fourth quarter since FY09. The usual seasonal pickup was bolstered by services-exports, lower dividend outflow, and front-loading of goods-exports pre-US tariffs.

Rupee little changed in June : Rupee stayed unchanged through the month against the US dollar. However, the US dollar lost ground against most currencies in June and on a year to date basis, was 8% down.

US treasury yields move lower : The yields on US Treasuries fell 17 bps over the month ending at 4.23% as geopolitical stresses eased. Meanwhile the US Federal Reserve has indicated that it is taking a patient approach bt a rate cut could be on the horizon based on incoming data.

Equity Market View:

From their lows, all indices have risen notably - the Nifty 50 by 15.6%, the Nifty Midcap 100 by 25% and Nifty Smallcap 100 by 30%. The large caps have outperformed the mid and small caps in the first half of the year - the Nifty 50 is up 8%, the Nifty Midcap 100 4.4% and the Nifty Small Cap 100 is up 1.6%.Valuations, however, are not cheap, given the sharp run and are trading at least one standard deviation above long-term averages. Across categories - both investment and consumption - stocks trade at higher valuations. However, as compared to global economies, India is one of the worst performing countries. In US dollar terms after US and China. (India +8%, US 6%, China +6%, Korea +40%, Germany +36%, Mexico and Brazil +31% each).

Meanwhile, economic indicators are showing some signs of improvement but not out of the woods completely and recent positives are not yet fully factored in. GDP growth has recovered, system liquidity is now back to historical levels and should improve further with the CRR cut. RBI frontloaded rate cuts with the 50bps of cuts in June. FPIs are getting positive on emerging markets and the base will start becoming favourable.

Even as the 9 July tariff deadline is near the corner, there are increasing signs that it is a soft marker and perhaps could be extended. This sense of market dread has lifted somewhat allowing investors to be optimistic on the tariff scenario. We currently assume that extreme scenarios are unlikely at this point and the downside in the market may have already been captured. However, whenever the tariffs are implemented, countries may face a slowdown to varying degrees and most companies impacted by tariffs could likely pass on the increasing costs to consumers. India remains relatively insulated from the impact of these tariffs given that we are largely a domestic based consumption economy.

Our overall positioning broadly remains unchanged. We are overweight the financial sector, particularly NBFCs. We also maintain an overweight position in the pharmaceutical segment, although we have slightly reduced our exposure in light of the uncertainty regarding tariffs and pricing issues in the US. We maintain an overweight in the consumer discretionary segment through retailers, hotels, travel and tourism. We believe that the discretionary segment is well positioned to benefit from strengthening domestic momentum and lower interest rates coupled with lower tax rates may likely provide consumption a fillip. We have reduced our overweight in automobiles in the last few months and remain underweight information technology. Renewable capex, manufacturers and power transmission/distribution companies, defense are the other themes we favour and we have increased our exposure to defense in the last few months.

Debt Market View:

After the larger-than-expected repo rate cut, shift to "neutral stance' from 'accommodative' and unexpected CRR cut, markets remain in neutral. Liquidity remains abundant and we do not anticipate further cuts in the next 3-6 months. Recently, the central bank conducted a 7 day VRRR to remove the volatility in the overnight /operative rates. As mentioned earlier, the higher surplus liquidity in the banking system forced overnight rates in the market to trade below the Standing Deposit Facility (SDF).Furthermore, we anticipate that maintaining sustained liquidity of 1% of NDTL or higher coupled with slow credit growth will lead to a rally in short end of the fixed income curve and result in a steeper yield curve. Consequently, we expect 1-5-year corporate bonds to rally and outperform long bonds on a risk reward perspective. Additionally, we foresee a limited rally in government bonds going forward, as we expect a shallow rate cut cycle and incremental OMO purchases to be limited to Rs 1-1.5 trillion.

As we have been indicating, a significant part of the bond market rally is behind us and expect macro indicators like GDP, CPI to remain soft for FY26. Consequently, there is nothing that can lead to significant upside in yields. Historically we have witnessed a 100-125 basis points bond rally in an easing cycle. We have already seen yields lower by 70-75 bps over last 12 months. Hence we expect limited rally from hereon. Once there is a resolution on US tariffs, and if they are significantly rolled back, the rally in India bond markets will likely be done. This is because clarity will emerge on CPI, and one will be able to gauge the impact on growth and start pricing terminal rate cut. Given the surplus liquidity, we expect the short bonds to outperform longer duration.

On the global front, while the tariff uncertainty has come down, countries are using the cool off period to negotiate. Whle the Fed has remained shy of lowering rates in last few months, we do expect two rate cuts this year. The US will see its growth slowing down and indicators like a weak labour market could be an indication. Meanwhile, tariffs could lower growth and this could mean rate cut cycle of 75-100 bps.

Risks to our view: The risks to our view at this point are as below

1) Currency risk

2) Trade wars

Strategy - We have been maintaining a higher duration across all our funds and guiding the rally in bonds since March 2024. We have already witnessed more than 80 bps of rally in 10-year bonds since early 2024. Although positive demand-supply dynamics for government bonds and expected rate cuts will continue to keep bond markets happy, from hereon we expect a limited rally in the next 3-6 months. Directionally we see yields for the 10-year Gsec to trade in a range of 6%-6.40% in the next 6 months. Corporate bond yield for AAA rated firms for notes due in 3-10 years will trade in a band of 6.50% and 6.75%; effectively we have 50-100 bps of incremental gains in this segment.

We anticipate that the RBI will maintain its emphasis on ensuring positive system liquidity going forward. Due to favourable demand supply dynamics and OMOs, we continue to have a higher bias towards government bonds in our duration funds.

We have been adding 1-5 year corporate bonds to the portfolio as we expect surplus banking liquidity, lower supply of corporate bonds/ CDs due to slowdown and delay in implementation of LCR guidelines and attractive spreads and valuations. Incrementally short bonds can outperform long bonds from risk risk-reward perspective due to a shallow rate cut cycle, lower OMO purchases in the second half of the year and a shift in focus to Govt Debt to GDP targets.

Source: Bloomberg, Axis MF Research.