|

(NSE Scrip Code: AXISGOLD, BSE Scrip Code: 533570) |

|

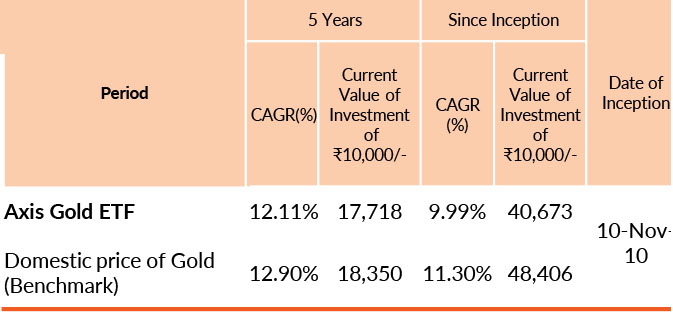

DATE OF ALLOTMENT | 10th November 2010 |

|

MONTHLY AVERAGE | 1,912.56Cr. |

| AS ON 31st July, 2025 | 1,955.47Cr. | |

|

BENCHMARK | Domestic Price Of Gold |

|

iNAV | AXISGOINAV |

|

EXCHANGE SYMBOL/SCRIP CODE | AXISGOLD, 533570 |

|

TRACKING ERROR | 0.21% (As compared to Domestic Price of Gold) (As compared to NIFTY 50 TRI) |

|

FUND MANAGER | |

| Mr. Aditya Pagaria Work experience: 17 years.He has been managing this fund since 1st June 2024 | ||

| Mr. Pratik Tibrewal Work experience: 14 years.He has been managing this fund since 1st February 2025 | ||

|

CREATION UNIT~ | 1,00,000 UNITS |

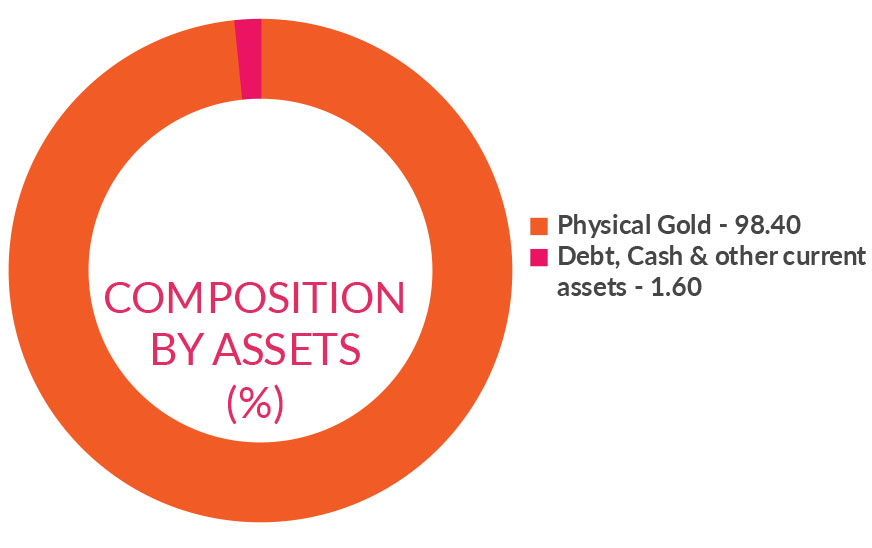

| Instrument Type/ Issuer Name | % OF NAV |

| PHYSICAL GOLD | 98.40% |

| Gold | 98.40% |

| DEBT, CASH & OTHER CURRENT ASSETS | 1.60% |

| GRAND TOTAL | 100.00% |

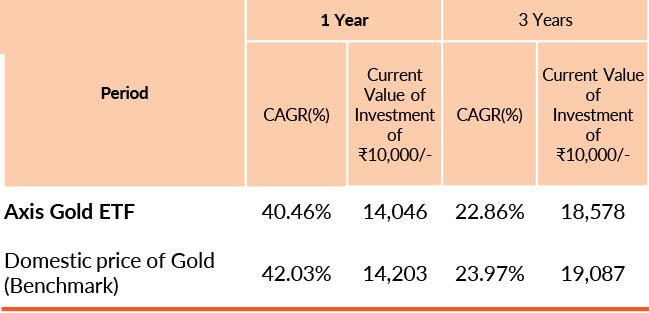

Past performance may or may not be sustained in future. Different plans have different expense structure. Aditya Pagaria is managing the scheme since 1st June 2024 and he manages 21

schemes of Axis Mutual Fund & Pratik Tibrewal is managing the scheme since 1st February 2025 and he manages 5 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager.Returns greater than 1 year period are

compounded annualised (CAGR). Face Value per unit : ₹ 1~.

~w.e.f from July 24th 2020

Entry Load : NA

Exit Load : Nil

Annualised tracking error is calculated based on daily rolling returns for the last 12

months.

Please click here for NAV,

TER,

Riskometer &

Statutory Details.