|

(An open ended fund of fund investing in ETFs wherein the underlying investments comprise of US treasury securities across duration) |

|

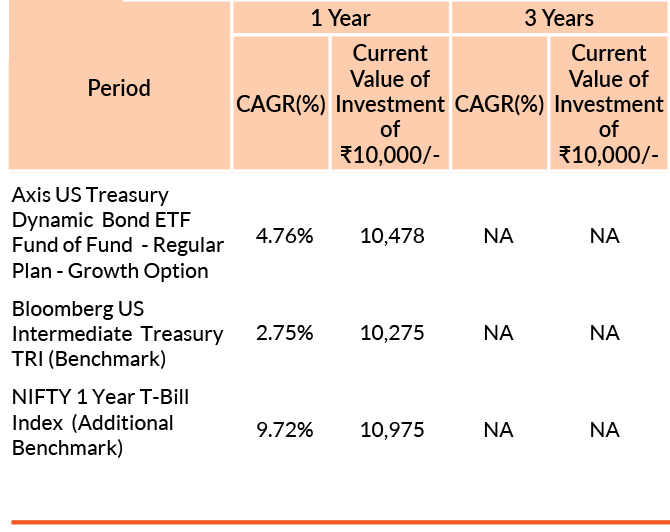

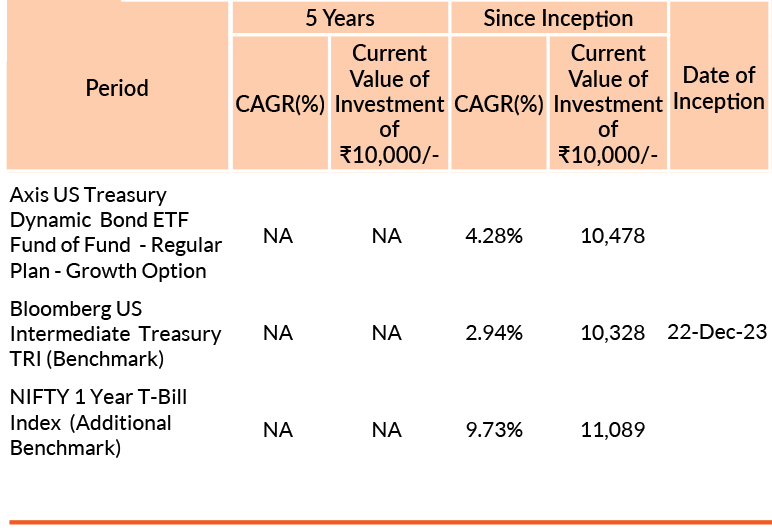

DATE OF ALLOTMENT | 22nd December 2023 |

|

MONTHLY AVERAGE | 61.86 Cr. |

| AS ON 31st January, 2025 | 60.60 Cr. | |

| RESIDUAL MATURITY | 8.65 years | MODIFIED DURATION* | 7.19 years | Annualised Portfolio YTM * | 4.48% |

| *in case of semi annual YTM, it will be annualised | ||

|

BENCHMARK | Bloomberg US Intermediate Treasury TRI |

| FUND MANAGER | |

| Ms. Krishnaa N (for Foreign Securities) [AXISGEA,AXISGCE,AXISGIF,AXISNFOF,AXISEQF,AXISF25,AXISMCF, AXISMLF,AXISGOF,AXISSCF,AXISSSF,AXISQUA,AXISVAL,AXISRDP,AXISRCP, AXISRAP,AXISESG,AXISTDB] Work experience: 4 years. She has been managing this fund since 1st March 2024 | ||

Past performance may or may not be sustained in future. Different plans have different expense structure. Krishnaa N is managing the scheme since 1st March2024 and she manages 23 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager.Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

Entry Load :NA

Exit Load :If redeemed / switched-out within 1 month from the date of allotment: 0.25%

If redeemed/switched-out after 1 month from the date of allotment: Nil

Please click here for NAV, TER, Riskometer & Statutory Details.