|

(An open ended fund of fund investing in ETFs wherein the underlying investments comprise of US treasury securities across duration) |

|

DATE OF ALLOTMENT | 22nd December 2023 |

|

MONTHLY AVERAGE | 59.09Cr. |

| AS ON 28th February, 2025 | 60.15Cr. | |

| RESIDUAL MATURITY | 8.15 years | MODIFIED DURATION* | 6.83 years | Annualised Portfolio YTM * | 4.29% |

| *in case of semi annual YTM, it will be annualised | ||

|

BENCHMARK | Bloomberg US Intermediate Treasury TRI |

| FUND MANAGER | |

| Ms. Krishnaa N (for Foreign Securities) Work experience: 4 years. She has been managing this fund since 1st March 2024 | ||

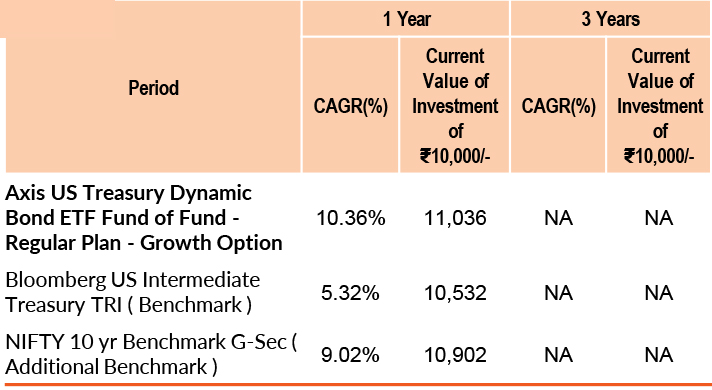

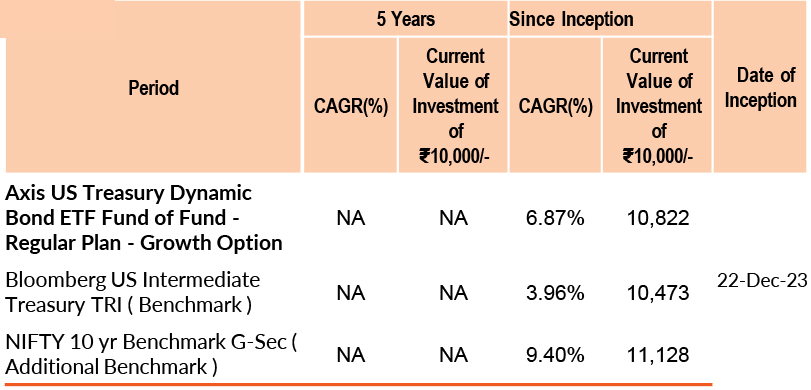

Past performance may or may not be sustained in future. Different plans have different expense structure. Krishnaa N is managing the scheme since 1st March 2024 and she manages 23 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager.Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

Entry Load :NA

Exit Load :If redeemed / switched-out within 1 month from the date of allotment: 0.25%

If redeemed/switched-out after 1 month from the date of allotment: Nil

Please click here for NAV, TER, Riskometer & Statutory Details.