|

(An Open-Ended Equity Linked Savings Scheme With A Statutory Lock In Of 3 Years And Tax Benefit) |

|

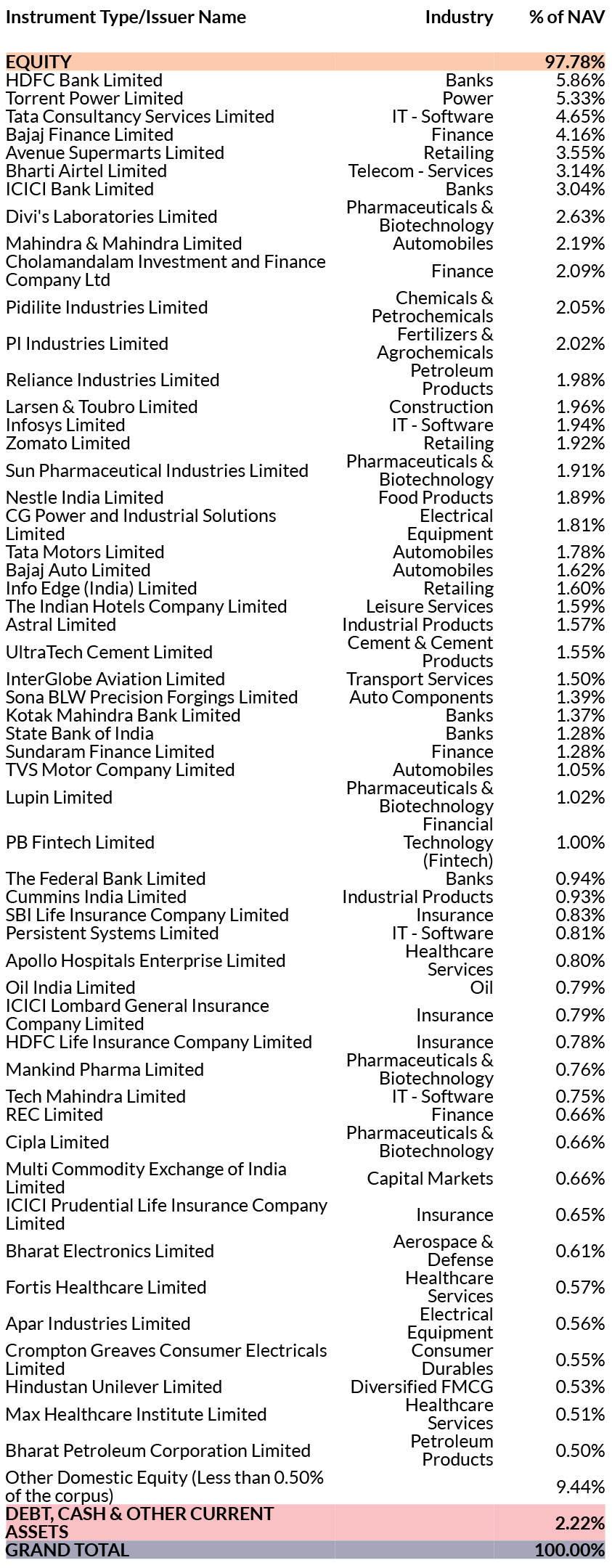

DATE OF ALLOTMENT | 29th December 2009 |

|

MONTHLY AVERAGE | 37,595.95Cr. |

| AS ON 31st August, 2024 | 38,422.94Cr. | |

|

BENCHMARK | Nifty 500 TRI |

|

STATISTICAL MEASURES | (3 YEARS) |

| Standard Deviation | 15.16% | |

| Beta | 1.03 | |

| Sharpe Ratio** | 0.17 | |

| **Risk-free rate assumed to be 6.8% (MIBOR as on 31-08-2024) - Source: www.fimmda.org Computed for the 3-yr period ended August 31, 2024. Based on month-end NAV. | ||

|

PORTFOLIO TURNOVER (1 YEAR) | 0.50 times |

| FUND MANAGER | |

| Mr. Shreyash Devalkar | ||

| Work experience: 20 years.He has been managing this fund since 4th August 2023 | ||

| Mr. Ashish Naik | ||

| Work experience: 16 years.He has been managing this fund since 3rd August 2023 | ||

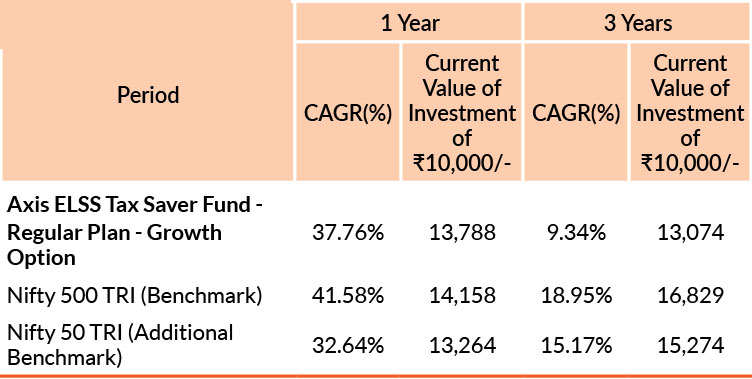

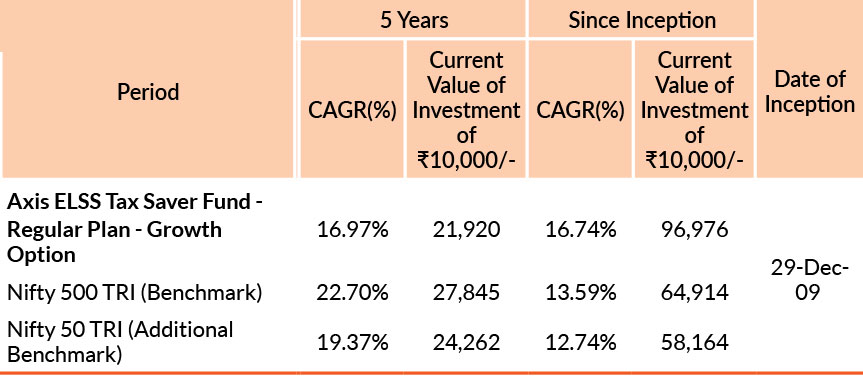

Past performance may or may not be sustained in future.Different plans have different expense structure. Shreyash Devalkar is managing the scheme since 4th August 2023 and he manages 9 schemes of Axis Mutual Fund & Ashish Naik is managing the scheme since 3rd August 2023 and he manages 18 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund manager. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹ 10.

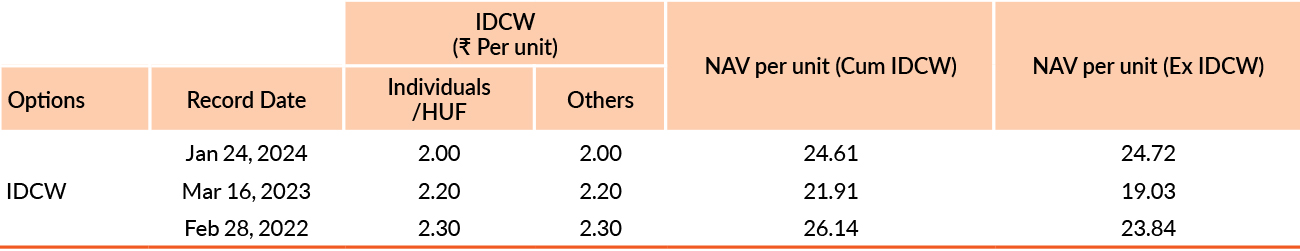

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future.

Face value of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load : NA

Exit Load : NIL

Please click here for NAV, TER, Riskometer & Statutory Details.