|

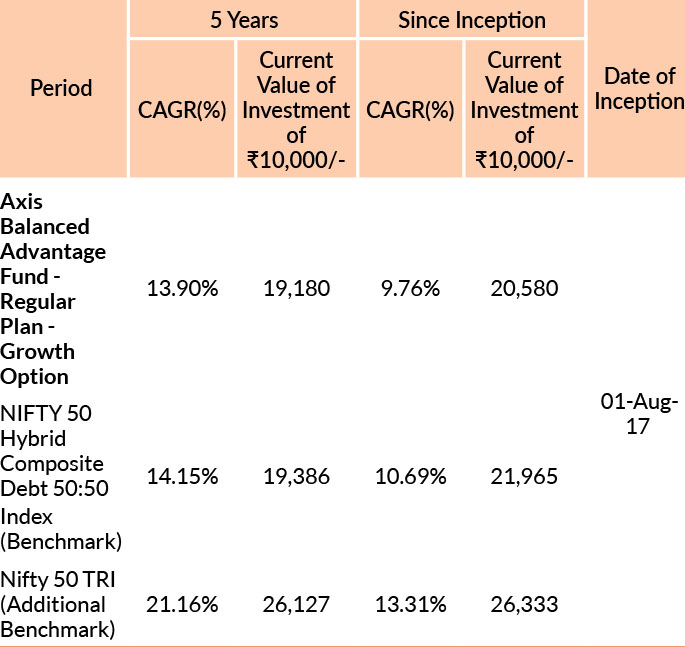

DATE OF ALLOTMENT | 1st August 2017 |

|

MONTHLY AVERAGE | 2,840.32Cr. |

| AS ON 30th April, 2025 | 2,935.36Cr. | |

|

BENCHMARK | NIFTY 50 Hybrid Composite Debt 50:50 Index |

| MARKET CAP^^ | |

| Large Cap: | 87.49% | |

| Mid Cap: | 6.63% | |

| Small Cap: | 5.88% | |

| ^^Market caps are defined as per SEBI regulations as below: a. Large Cap: 1st -100th company in terms of full market capitalization. b. Mid Cap: 101st -250th company in terms of full market capitalization. c. Small Cap: 251st company onwards in terms of full market capitalization. | ||

| STATISTICAL MEASURES | (3 YEARS) |

| Standard Deviation | 8.16% | |

| Beta | 1.07 | |

| Sharpe Ratio** | 1.00 | |

| Computed for the 3-yr period ended Mar 28, 2025. Based on month-end NAV. **Risk-free rate assumed to be 6% (MIBOR as on 30-04-2025) - Source: www.fimmda.org |

||

|

Residual Maturity@* | 13.35 years |

| Modified Duration@* | 5.75 years | |

| Macaulay Duration@* | 5.99 years | |

| Annualised Portfolio YTM* | 6.99% | |

|

*in case of semi annual YTM, it will be annualised *As per AMFI Best Practices Guidelines Circular No. 88 / 2020 -21-Additional Disclosures in Monthly Factsheets. @ Based on debt portfolio only. For instruments with put/call option, the put/call date has been taken as the maturity date. This should not be taken as an indication of the returns that maybe generated by the fund and the securities bought by the fund may or may not be held till their respective maturities. The calculation is based on the invested corpus of the debt portfolio. | ||

|

FUND MANAGER | |

| Mr. Jayesh

Sundar Work experience: 21 years.He has been managing this fund since 28th September 2023 | ||

| Mr. Devang Shah Work experience: 19 years.He has been managing this fund since 5th April 2024 | ||

| Mr. Hardik Shah Work experience: 15 years.He has been managing this fund since 31st January 2022 | ||

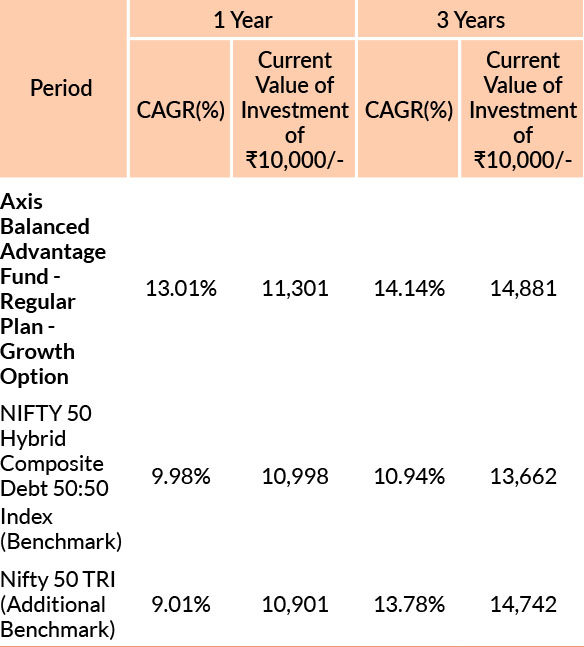

Past performance may or may not be sustained in future. Different plans have different expense structure. Jayesh Sundar is managing the scheme since 28th September 2023 and he manages 8 schemes of Axis Mutual Fund & Devang Shah is managing the scheme since 5th April 2024 and he manages 22 schemes of Axis Mutual Fund & Hardik Shah is managing the scheme since 31st January 2022 and he manages 18 schemes of Axis Mutual Fund . Please refer to annexure for performance of all schemes managed by the fund managers. Returns greater than 1 year period are compounded annualised (CAGR). Face Value per unit : ₹10.

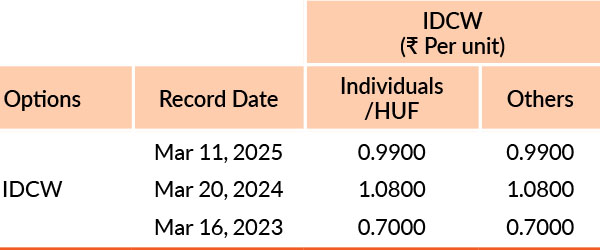

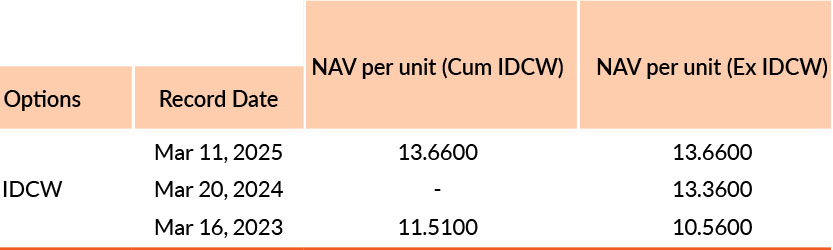

Pursuant to payment of Distribution (of Income & Capital), the NAV of the above stated IDCW options of the scheme/plan would fall to the extent of payout and statutory levy, if any. Past performance may or may not be sustained in future. Facevalue of units is ₹ 10. IDCW means Income Distribution cum Capital Withdrawal.

Entry Load :NA

Exit Load : If redeemed / switched-out within 12 months from the date of allotment,For 10% of investments: Nil.For remaining investments: 1%.If redeemed / switched - out after 12

months from the date of allotment: NIL.

Please click here for NAV, TER, Riskometer & Statutory Details.