► Equity market valuations are broadly reasonable adjusted for the cyclical low in earnings and

potential for revival going forward.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► We remain bullish on equities from a medium to long term perspective.

► Investors are suggested to have their asset allocation plan based on one's risk appetite and future goals in life.

► Expect lower interest rates in the second half of FY25.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year duration and 3-5-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

► Investors should add duration with every rise in yields, as yield upside limited.

► Mix of 10-year duration and 3-5-year duration assets are best strategies to invest in the current macro environment.

► Credits continue to remain attractive from a risk reward perspective give the improving macro fundamentals.

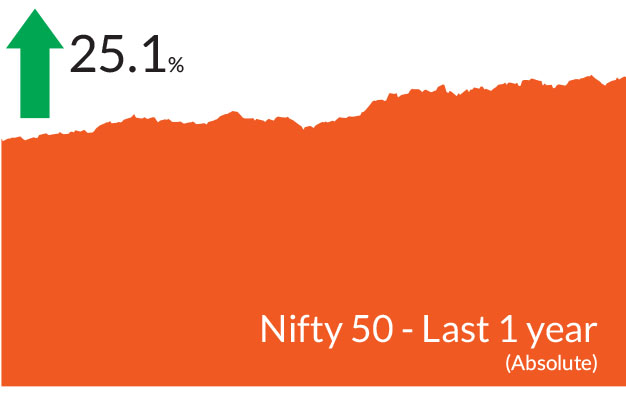

Indian equities faced bouts of volatility through the month but ended in

the positive territory. The S&P BSE Sensex and the NIFTY 50 ended

1.1% and 1.2% higher respectively. After a sharp correction in March,

mid-caps and small caps surged and outperformed the frontline indices.

The NIFTY Midcap 100 ended the month higher 5.8% while NIFTY

Small cap 100 ended up 11.4%. Market volatility was marginally higher

compared to the previous month while the advance decline line was up

37% in April. The month saw Foreign Portfolio Investors (FPIs)

withdraw to the tune of US$1 bn while domestic institutional investors

remained strong with inflows of US$5.3 bn.

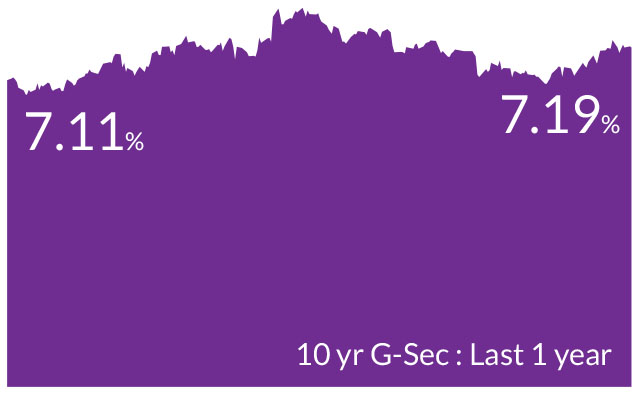

Bond markets globally experienced volatility, influenced by stronger than expected US data and rising geo political tensions. As a result, the yields on US Treasuries rose significantly, closing the month 48 bps higher at 4.68%. Indian government bond yields too mirrored the moves of US Treasuries and rose 14 bps to 7.20%. Foreign Portfolio Investors (FPI) flows were net sellers of government bonds in April to the tune of US$1.3 bn over the month and year to date, cumulative debt inflows amounted to US$5.4 bn.

In its April monetary policy meeting, the Fed retained a status quo on interest rates and refrained from mentioning about change in dot plots, but announced plans to reduce the pace of balance sheet drawdowns by US$ 35bn starting 1 June 2024. The central bank still expects the next move to be rate cuts, but as of now, rates can remain unchanged for long. The Fed's comments led markets to believe that its ultra-hawkish stance has been tamed to a cautious one.

In the Eurozone, economic growth appears to have reached its bottom and is poised for an upswing, as suggested by GDP and PMI figures. Although inflation is on a downward trajectory, core services inflation remains somewhat high. Despite this, there is still anticipation for a potential rate cut in the near term. On a separate note, the Reserve Bank of India (RBI) maintained its interest rates during the April policy meeting, adopting a vigilant stance regarding inflation.

In Japan, with the cessation of negative interest rates and yield curve control, attention has shifted to the timing and magnitude of potential rate hikes. Meanwhile, recent data from China has validated the impact of supply-side incentives, indicating stronger GDP growth coupled with increased deflationary pressures. Additionally, the GDP deflator has continued its negative trend for the fourth consecutive quarter.

► Inflationary pressures gradually declining: CPI moderated to 4.9% in March at 5.1% in February while core CPI declined further to 3.3%. This was led by a slowdown in prices across the board, for both core goods and services, from the previous month's levels. Going forward, a normal monsoon could lead to a downward trajectory in inflation in the second half of 2024.

► Increasing geopolitics drives crude prices higher: Escalating tensions between Israel and Iran which increased in the past few weeks dampened investor sentiments. Overall, commodities saw a significant uptick in prices especially Crude and precious metals due to increasing geopolitical risks. Brent crude crossed $91 in April but ended the month at US$ 87.86. Nonetheless, an inventory overhang led to a notable fall in prices to ~US$ 82.

Bond markets globally experienced volatility, influenced by stronger than expected US data and rising geo political tensions. As a result, the yields on US Treasuries rose significantly, closing the month 48 bps higher at 4.68%. Indian government bond yields too mirrored the moves of US Treasuries and rose 14 bps to 7.20%. Foreign Portfolio Investors (FPI) flows were net sellers of government bonds in April to the tune of US$1.3 bn over the month and year to date, cumulative debt inflows amounted to US$5.4 bn.

Key Market Events

► Shifting interest rate expectations: The macroeconomic indicators from the US have shown robust performance, particularly in retail sales and employment numbers in February-March. Concurrently, headline inflation experienced an uptick, reaching 3.5% over the month. This led to a significant increase in the yields of US Treasuries, as the possibility of interest rate reductions by June has diminished due to the Federal Reserve's (Fed) statements. Though the Fed acknowledged "lack of further progress towards its 2% inflation goal in the recent months," market implied expectations for at least one Fed rate cut this year remained intact. Initially, the markets had anticipated 5 to 6 rate cuts by the Fed at the start of the year.In its April monetary policy meeting, the Fed retained a status quo on interest rates and refrained from mentioning about change in dot plots, but announced plans to reduce the pace of balance sheet drawdowns by US$ 35bn starting 1 June 2024. The central bank still expects the next move to be rate cuts, but as of now, rates can remain unchanged for long. The Fed's comments led markets to believe that its ultra-hawkish stance has been tamed to a cautious one.

In the Eurozone, economic growth appears to have reached its bottom and is poised for an upswing, as suggested by GDP and PMI figures. Although inflation is on a downward trajectory, core services inflation remains somewhat high. Despite this, there is still anticipation for a potential rate cut in the near term. On a separate note, the Reserve Bank of India (RBI) maintained its interest rates during the April policy meeting, adopting a vigilant stance regarding inflation.

In Japan, with the cessation of negative interest rates and yield curve control, attention has shifted to the timing and magnitude of potential rate hikes. Meanwhile, recent data from China has validated the impact of supply-side incentives, indicating stronger GDP growth coupled with increased deflationary pressures. Additionally, the GDP deflator has continued its negative trend for the fourth consecutive quarter.

► Inflationary pressures gradually declining: CPI moderated to 4.9% in March at 5.1% in February while core CPI declined further to 3.3%. This was led by a slowdown in prices across the board, for both core goods and services, from the previous month's levels. Going forward, a normal monsoon could lead to a downward trajectory in inflation in the second half of 2024.

► Increasing geopolitics drives crude prices higher: Escalating tensions between Israel and Iran which increased in the past few weeks dampened investor sentiments. Overall, commodities saw a significant uptick in prices especially Crude and precious metals due to increasing geopolitical risks. Brent crude crossed $91 in April but ended the month at US$ 87.86. Nonetheless, an inventory overhang led to a notable fall in prices to ~US$ 82.

Market View

Equity MarketsThe earnings season has been lukewarm so far and the mid and small caps witnessed earnings downgrades compared to their large cap counterparts. This season did not witness any major recovery in consumer staples, and growth in the IT sector has been modest. In addition, sluggish export demand and slow B2B execution due to the elections are all expected to keep the earnings tepid in the near future. However, forward guidance is suggestive of improving demand in select B2C sectors due to a positive impact of heat wave in certain categories and a base effect. The K-shaped trajectory continues. B2B segment, especially capital goods are witnessing election related slowdown.

Despite the volatility, key benchmark indices have touched all time highs or remain closer to the highs. The market movements seen in the last few months suggest that although consolidation could continue in the near term, investors can utilise these corrections to increase exposure to equities. A word of advice is to focus on the long term and shut out any noises in the near term. Valuations in India remain expensive relative to Asian peers. Robust macro indicators at almost all levels, lower levels of inflation, expectations of falling interest rates later in the year, increased industrial activity and the fall in twin deficits (both current account and fiscal) have led to increased optimism and an extended goldilocks scenario.

Elections are underway and the final outcome on June 4 will set the tone for the markets. Markets have priced in expectations for the incumbent party to continue and policy continuity remains the key. Meanwhile, India's long term growth story remains intact with our country being one of the fastest growing economies globally. With India's GDP growth projected at a robust 7% for FY25E, the RBI has enough policy room to hold rates at 6.5%. Headline inflation is on its way down and a normal monsoon will help bring down price pressures. High frequency indicators such as PMIs, GST collections, rail freight and domestic passenger growth remain encouraging compared with the historical standards.

Construction cycle is already underway with rise in government infrastructure related spending and a revival in real estate. Rising private capex should further accelerate the capex cycle. Corporate balance sheets and banks are in great shape laying the foundation for a vigorous private capex cycle. We expect that the market trends will be shaped by positive cyclical trends, and sectors driven by capital expenditures like infrastructure, locally-focused manufacturing, and utilities are poised to gain. Our investment strategies are aligned with this outlook, and we have a higher allocation in these areas. Additionally, we hold a positive view and have an overweight in the consumer discretionary sector, especially in the automotive and real estate industries. Our portfolio also includes investments in sectors such as energy, defense, and transport, which stand to benefit from government policies. With firms seeking funds for growth and new ventures, we expect a surge in credit demand, which is expected to enhance the banking sector's results. In the pharmaceutical industry, we anticipate the favorable pricing conditions to persist and intensify. Conversely, we have reduced our holdings in the export-oriented segment, attributing this to the decline in global economic growth.

Debt Markets

The US economy has surpassed expectations on economic growth and signs of a slowdown have been deferred. Inflation has been choppy but gradually heading lower. Even though macros are robust, they have taken a back seat and expectations of interest rate cuts by the Fed have shifted to end of year in light of rising geopolitical threats and the runup in crude prices. Accordingly, we believe that the central banks globally and in India will exercise cautions before lowering interest rates. In line with our view, the RBI upheld interest rates in early April and we expect this stance to continue. Oil prices remain a risk against the backdrop of geopolitical conflicts and if oil prices remain under control, inflation could head further lower over the course of the year.

Overall, India is in an extended goldilocks against a backdrop of moderating inflation, higher economic growth and strong external account (falling fiscal and current account deficit and a stable rupee). We remain constructive on rates due to positive demand supply dynamics especially for Indian government bonds due to their inclusion in JP Morgan / Bloomberg Indices. Furthermore, the operative rate has shifted from 6.75% to 6.5% due to ease in banking liquidity and this has led to rally in short term bond yields.

The fixed income curve is pricing in no rate cuts till March 2025. We have retained our long duration stance across our portfolios within the respective scheme mandates. We do expect the 10-year bond yields to trade in a narrow range of 7.10-7.25% in the near term and to soften to 6.75% over the next few quarters. Investors need to be patient on the rate cut cycle which could be delayed to the second half of FY25.

From a strategy perspective, while the overall call is to play a falling interest rate cycle over the next 6-12 months, markets are likely to see sporadic rate movements. In the current scenario, investors should use the rise in yields to build in duration across their portfolios. With positive demand supply outlook for bonds and improved liquidity stance of RBI, investors could use this opportunity to invest in short to medium term funds with tactical allocation to gilt funds. We maintain a higher allocation to corporate bonds and SDL's due to lower issuance and perceived change in RBI's liquidity stance.

Source: Bloomberg, Axis MF Research.